The updated securities industry report for the first 9 months of 2024, recently released by VIS Rating, said that the number of overdue bonds and bond repurchase commitments has gradually decreased, helping to reduce asset risks for securities companies.

Overdue bonds of securities companies gradually decrease, margin debt increases risk

The updated securities industry report for the first 9 months of 2024, recently released by VIS Rating, said that the number of overdue bonds and bond repurchase commitments has gradually decreased, helping to reduce asset risks for securities companies.

According to VIS Rating, large securities companies (SCs) led the industry's profit growth thanks to income from margin lending and investment, supported by large capital increases. The industry's return on average assets (ROAA) increased from 4.3% in 2023 to 4.9% in the first 9 months of 2024, with large SCs outperforming their peers in terms of profit from margin lending and fixed-income investments.

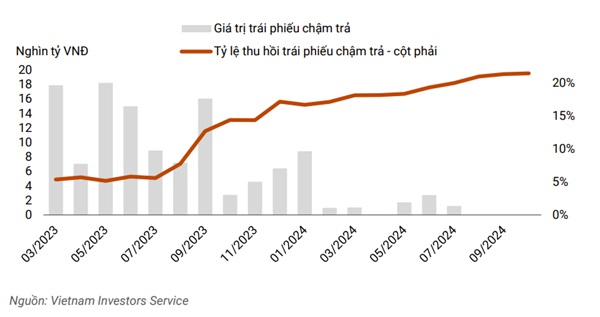

Notably, the number of overdue bonds and bond repurchase commitments has gradually decreased, helping to reduce asset risks for securities companies. Overdue bonds in the third quarter are no longer significant compared to the value of about VND 8,000 billion in January 2024, or the peak of about VND 18,000 billion in overdue bonds in May 2023. Liquidity remains stable despite companies increasing short-term borrowing to expand margin lending.

|

| The value of overdue bonds in the third quarter of 2024 is no longer significant compared to the peak of VND 18,000 billion in value in May 2023. |

The sector’s asset risk is gradually decreasing, thanks to the reduction of delinquent bonds and bond buyback commitments. Tan Viet Securities Joint Stock Company (TVSI) has reduced its bond buyback commitment by about 30% in 9M 2024, after issuers in the energy and real estate sectors have completed previously late principal and interest payments.

More than 20% of securities companies in the analysis report have high risk appetite due to investing in many corporate bonds. Asset risks from these investments have gradually decreased compared to the previous year thanks to the gradual decrease in the rate of overdue bonds and the improvement in the recovery rate of overdue bonds.

Meanwhile, margin loans to large clients continue to increase in Q3/2024, increasing the risk for securities companies if they are forced to sell off collateral during a stock market downturn, as happened in Q4/2022. It is expected that capital increases by securities companies affiliated with banks and large domestic securities companies will strengthen risk buffers and boost growth.

Large-scale securities companies recorded strong growth in margin loan balance with higher lending interest rates than peers, thanks to their large capital scale and extensive customer network.

|

| Large-scale securities companies record strong growth in margin loan balance. |

In addition, these companies often have the largest fixed income portfolios in the industry, and benefit from improved corporate bond market conditions with increased returns from bond investments and custody service fees (e.g. TCBS, VPBANKS, VND).

In contrast, ROAA of mid-sized securities companies (e.g. SHS, BSI, VDS) decreased by 2% compared to the previous quarter, mainly due to the decrease in the value of equity investments.

Margin lending growth of mid-sized securities companies is also slower than that of large companies due to capital and customer network limitations. Overall, VIS Rating expects more than half of the 251 companies to meet their full-year profit targets. The industry's ROAA for the full year of 2024 will improve by 50-70 basis points compared to the previous year, reaching 4.8%-5%2 .

Leverage in the industry remains low, thanks to large capital raisings. Strong capital raising by domestic securities companies (VIX, VND, MBS) in Q3 2024 has strengthened risk buffers and kept the industry leverage ratio low at around 230%.

ACB Securities Company (ACBS) is also proposed to continue to increase capital and gradually play a more important role in the parent bank's business strategy. For Ho Chi Minh City Securities Company (HSC), the new capital increase will support business expansion and maintain the margin lending ratio below the prescribed limit of 200% of equity.

Along with further capital mobilization from domestic companies (SSI, SHS, VCI), it is expected that the industry leverage ratio will decrease in the coming quarters.

Overall, only 10% of companies have high leverage due to limitations in raising capital or having many commitments to buy back bonds from customers. Liquidity risks from increasing short-term debt of some foreign-invested companies and companies affiliated with banks are still well controlled.

For example, bank-affiliated securities companies (CTS, ORS) have access to credit lines from domestic banks, while foreign-invested companies (MASVN, KIS) benefit from support from their parent companies.

In addition, liquid assets such as cash and certificates of deposit (CD) of these companies also account for about 15-30% of total assets. The refinancing risk from loans to institutional and individual customers has gradually decreased for Techcom Securities Corporation (TCBS), thanks to the four-fold increase in long-term bond issuance last year.

Overall, 30% of the companies have strong liquidity profiles, mostly bank-affiliated securities companies that benefit from recent capital raises and are less dependent on short-term debt to finance core investments.

VIS Rating's report is based on data covering the 30 largest securities companies by assets, accounting for about 90% of the industry's total assets.

Source: https://baodautu.vn/trai-phieu-cham-tra-cua-cong-ty-chung-khoan-giam-dan-du-no-ky-quy-tang-rui-ro-d230539.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

![[Photo] National Assembly Chairman successfully concludes official visit to Uzbekistan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/9/8a520935176a424b87ce28aedcab6ee9)

![[Infographic] Approval of election results for Chairman of Dong Thap Provincial People's Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/9/b195c37b840e4fb298dde9d519fad2c8)

Comment (0)