In the Vietnamese market, there are very few cases where bondholders recover their investments through liquidation of collateral, instead, they choose debt restructuring.

Very few bondholders recover their capital through liquidation of collateral.

In the Vietnamese market, there are very few cases where bondholders recover their investments through liquidation of collateral, instead, they choose debt restructuring.

Enhancing transparency in the bond market

In a recent analysis report, VIS Rating stated that key changes in the revised Securities Law will limit high-risk investment activities and improve market behavior, benefiting bondholders.

The amendments to the law bind the obligations of bond issuers and intermediaries in the corporate bond market, specify the authority of the regulatory agency to intervene in the market, introduce new requirements for public bond issuance and classify individual bonds in which individual investors can invest.

Specifically, in the responsibility section Regarding the legal responsibilities of issuers and intermediaries regarding issuance documents and periodic information disclosures, the new law has added provisions on the responsibilities of individuals and organizations involved in preparing issuance documents and reports in all activities on the securities market. This includes both public and private issuance activities. At the same time, it clarifies the role of bond issuance consultancy organizations in reviewing and checking the accuracy, honesty and completeness of information in the issuance documents.

Compared to the current law, the new amendments clearly define the roles and responsibilities of each party involved in public and private bond issuance, including the advisory unit, auditor, and credit rating unit. The new law stipulates that these units must comply with all applicable laws and regulations and provide services honestly and responsibly. In addition, the State Securities Commission will have the right to enforce the law against any violations that may harm investors, such as when issuers fail to disclose necessary information to investors.

Under various regulations implemented in the past two years, bond issuance dossiers must include a list of detailed information that must be disclosed to investors. On November 6, 2024, the Ministry of Finance revised the information disclosure form to include more financial information that must be publicly disclosed. The new Securities Law continues to orient the requirements to improve market transparency and protect investors' interests.

Prevent high-risk investment activities of individual investors

In addition to increasing information transparency, credit rating agencies assess that the new law will prevent high-risk investment activities by individual investors.

Regarding the conditions for privately issued bonds to be distributed to individual investors, the new law has added that professional institutional investors are allowed to buy and sell individual bonds; professional individual investors are only allowed to buy individual bonds with credit ratings and collateral or payment guarantees from credit institutions. This helps create an additional layer of protection for investors when bonds are late in payment.

Regarding the conditions for issuing bonds to the public, the new law also adds that the issuing organization must meet additional Government regulations on bondholder representatives, debt ratios, issuance value on equity and credit ratings.

As a result, high-risk companies will be restricted from issuing bonds to the public; issuers will have to comply with stricter criteria, such as debt-to-equity ratios, bondholder representative requirements, and regulatory credit ratings. Second, for private placements, private bonds will no longer be distributed and sold to individual investors unless they are considered professional investors and the bonds are rated and must be guaranteed by a bank or have collateral.

VIS Rating estimates that professional individuals will have invested in more than 40% of private placements issued in 2024. Credit ratings can provide new information to help investors better understand their risks. Bank payment guarantees can mitigate the risk of loss in the event of default.

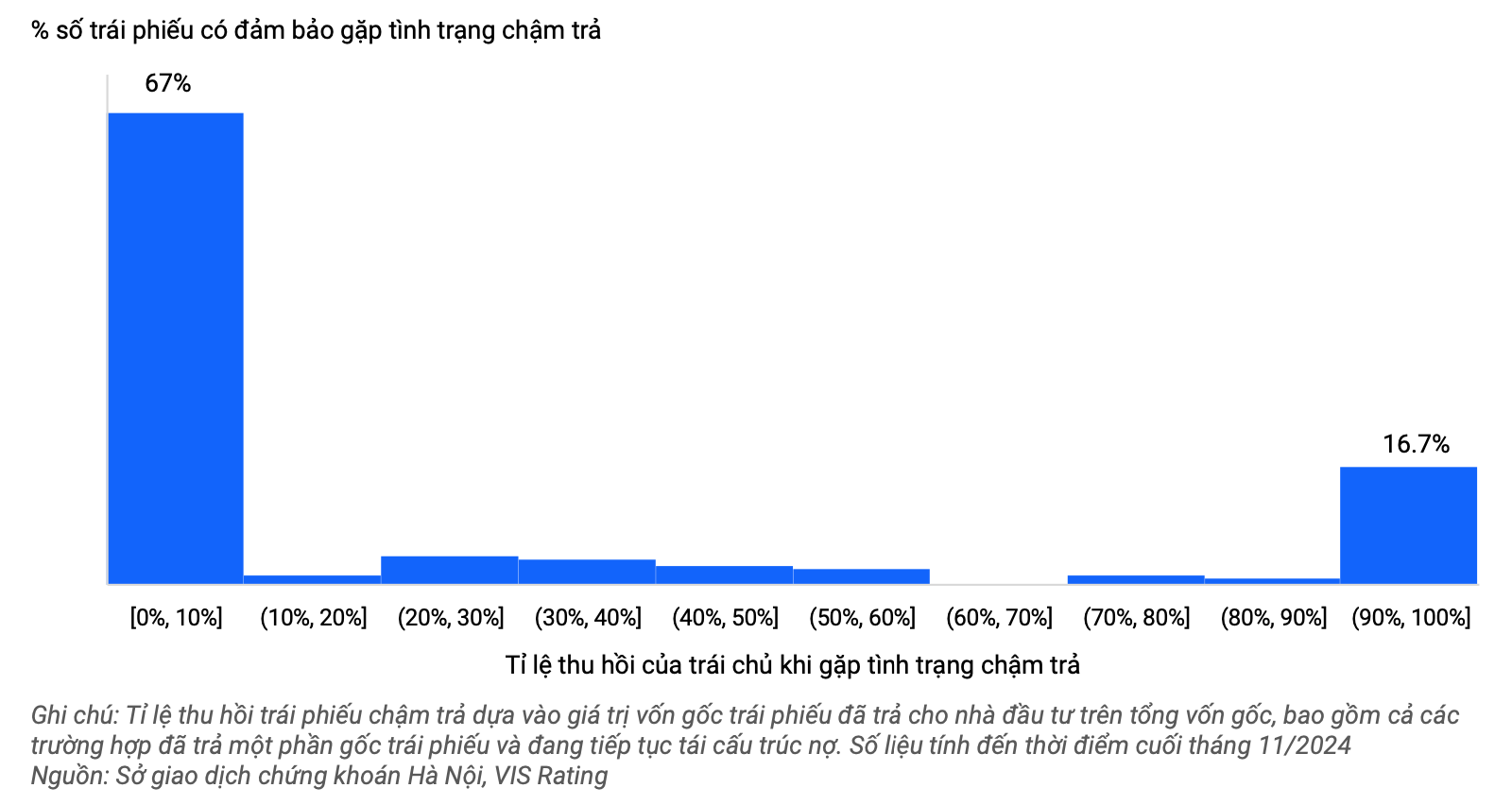

In the Vietnamese market, there are very few cases where bondholders have recovered their investments through liquidation of collateral. According to the rating agency’s research, the legal process to liquidate assets and repay debts to creditors is often lengthy. In fact, most bondholders of secured bonds facing payment delays in the 2022-2024 period have chosen debt restructuring, i.e., extending payment, instead of liquidating collateral, mainly in the form of stocks and real estate-related assets.

|

Most of the secured bonds facing late principal/interest payments in the 2022-2024 period currently have a recovery rate of less than 10%. |

Bondholders need to evaluate the legality, liquidity and value of the collateral in the event of a bond default and determine whether the collateral can provide adequate credit enhancement as intended.

"The new law will take effect in January 2025. The emphasis on investor protection and sustainable growth of the corporate bond market in the new law is expected to promote improved market confidence and more vibrant issuance activities in 2025.

The Government also plans to soon issue detailed regulations on public bond issuance to specify the provisions in the new Law. The revised regulations include mandatory credit rating requirements for enterprises or bonds issued to the public and debt ratios below specific thresholds," VIS Rating said.

Source: https://baodautu.vn/rat-it-trai-chu-thu-hoi-duoc-von-nho-thanh-ly-tai-san-the-chap-d232370.html

![[Photo] Ho Chi Minh City Youth Take Action for a Cleaner Environment](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762233574890_550816358-1108586934787014-6430522970717297480-n-1-jpg.webp)

![[Photo] The road connecting Dong Nai with Ho Chi Minh City is still unfinished after 5 years of construction.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762241675985_ndo_br_dji-20251104104418-0635-d-resize-1295-jpg.webp)

![[Photo] Ca Mau "struggling" to cope with the highest tide of the year, forecast to exceed alert level 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762235371445_ndo_br_trieu-cuong-2-6486-jpg.webp)

![[Photo] Panorama of the Patriotic Emulation Congress of Nhan Dan Newspaper for the period 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762252775462_ndo_br_dhthiduayeuncbaond-6125-jpg.webp)

Comment (0)