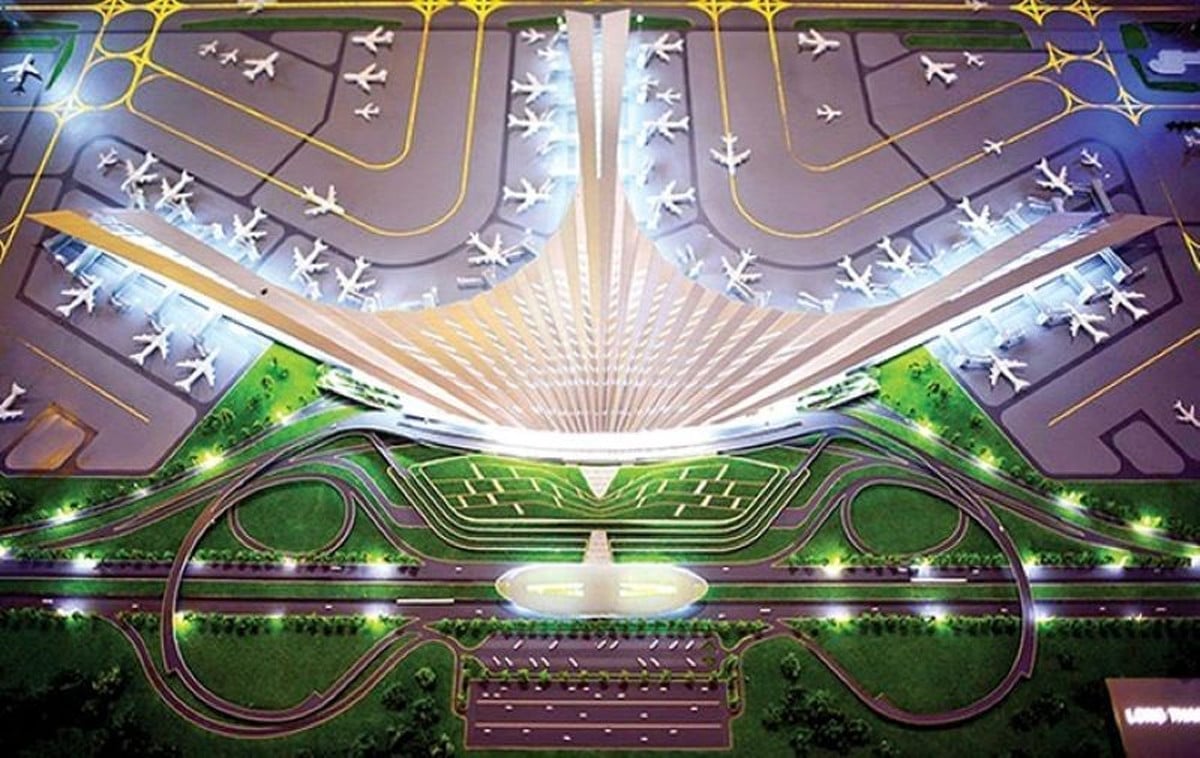

After nearly 2 months of bidding, on August 1, Vietnam Airports Corporation (ACV) - the investor of Long Thanh Airport project announced that Vietur consortium had surpassed 2 other competitors and became the only consortium that met all technical requirements in package 5.10 of Long Thanh Airport project (the largest package, worth more than 35,200 billion VND) and will continue to bid to evaluate financial capacity.

VNDirect believes that Vietur has a great chance of winning this bid, creating a premise to help the Long Thanh Airport project meet the schedule set by the Prime Minister (starting construction in August 2023).

The Vietur consortium consists of 10 members, led by the Turkish ICISTAS Industrial and Commercial-Construction Group. This consortium includes 3 enterprises in the ecosystem of Mr. Nguyen Ba Duong - former Chairman of the Board of Directors of Coteccons - namely: Newtecons, Ricons and SOL E&C.

Besides, there are also Vietnam Construction and Import-Export Corporation - Vinaconex (VCG); Hanoi Construction Corporation (HAN); Construction Corporation No. 1 - JSC (CC1); Phuc Hung Holdings Construction JSC (PHC)...

Some conditions on the financial capacity of the joint venture must be met, including: the participating contractor's counterpart capital is 3,224 billion VND; the contractor's net asset value in the most recent fiscal year compared to the time of bidding must be positive; the average revenue of the 5 most recent fiscal years (excluding VAT) has a minimum value of 19,800 billion VND.

These criteria are not too big of an obstacle for the Vietur joint venture.

However, not every business in the group is in good financial health.

Construction Number 1: Cash, Assets Decline

Construction Corporation No. 1 (CC1) is a long-standing enterprise specializing in the construction of civil, industrial, infrastructure and energy projects in Vietnam.

Despite its long history of operation, CC1 has a rather modest scale with a charter capital of nearly VND 3,290 billion. Its financial health and business situation have been on a downward trend recently.

According to the financial report for the second quarter of 2023, Construction Corporation No. 1 recorded a decrease of nearly VND 1,170 billion in total assets compared to the beginning of the year to VND 14,415 billion. Of which, cash and cash equivalents at CC1 decreased rapidly from over VND 1,639 billion to VND 897 billion, equivalent to a decrease of 55% in 6 months. Of which, bank deposits were VND 320 billion, compared to over VND 1,200 billion at the beginning of the year.

Equity also decreased from VND4,162 billion at the beginning of the year to nearly VND4,053 billion.

Revenue in the first 6 months of 2023 decreased by nearly 36% compared to the same period to 1,782 billion VND. In the second quarter alone, CC1's revenue decreased by 22% to nearly 1,237 billion VND.

In the second quarter, CC1 reported a loss of more than VND 2.5 billion, compared to a profit of nearly VND 13.3 billion in the same period last year. Accumulated in the first 6 months of 2023, profit decreased more than 5.1 times to only nearly VND 5.8 billion.

As of the end of June 2023, CC1 recorded receivables of up to VND8,085 billion (VND6,906 billion in short-term receivables), accounting for 56% of total assets. This enterprise recorded construction in progress costs at VND2,497 billion, up from VND2,118 billion at the beginning of the year.

Explaining the business results of the period, CC1 said that production and business activities in the second quarter of 2023 decreased compared to the same period due to the general difficulties in the construction industry.

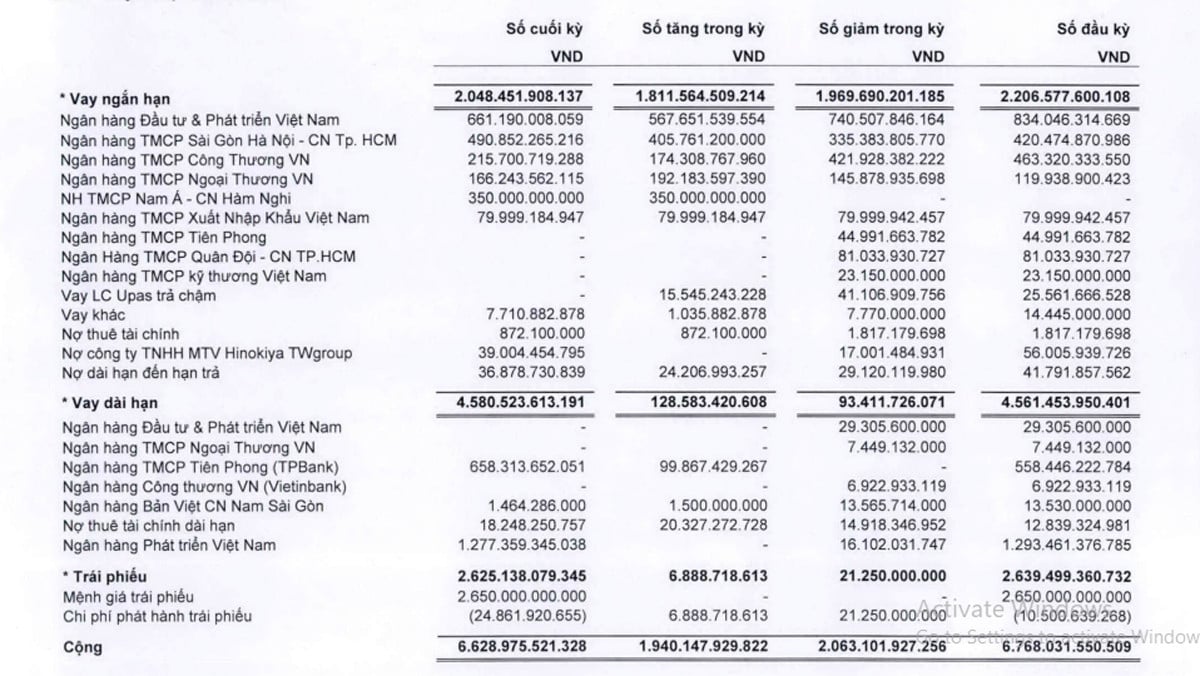

Big debt

While depositing only a few hundred billion VND in the bank, CC1 has large short-term and long-term loans and financial leasing debts, totaling more than 6,628 billion VND, of which 2,048 billion VND is short-term. In which, mainly 3 bond lots worth 2,650 billion VND with an interest rate of 10%/year; long-term financial leasing debt of more than 1,277 billion VND with the Vietnam Development Bank; loans from TPBank, BIDV, SHB, Vietinbank, NamABank, Vietcombank...

Short-term bank loans bear interest rates from 6.3% to 13.4% per year. Long-term bank loans bear interest rates from 8.6% to 10.9% per year.

In 6 months, CC1 had to spend more than 189 billion VND to pay interest expenses, equivalent to an average of more than 1 billion VND/day. In the second quarter of 2023 alone, CC1 had to pay more than 125 billion VND in interest, compared to 103.8 billion VND in the same period last year. This means CC1 had to pay nearly 1.4 billion VND/day in interest in the second quarter. This is also the reason why CC1 lost more than 2.5 billion VND.

Despite the loss-making business results in the second quarter, CC1 shares nearly doubled in the past 3 months to above VND20,100/share.

Construction Corporation No. 1 was established in 1979 and IPO in 2016. As of the end of 2022, the company has only one major shareholder, Chairman of the Board of Directors Nguyen Van Huan, holding more than 11% of charter capital and Mr. Tran Tan Phat holding nearly 4.5%.

CCI has many outstanding construction projects such as: Nghi Son Refinery, Sao Mai Cement Plant (Holcim), Dung Quat Refinery, Tri An Hydropower Plant, Thac Mo Hydropower Plant, Phu My Thermal Power Plant, Nghi Son 1 Thermal Power Plant, Thu Thiem Bridge, Ho Chi Minh City Urban Railway - Line 1, Da Nang - Quang Ngai Expressway, SP-SSA International Container Port, King Crown Infinity Urban Area, Dream City Hung Yen...

Source

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

![[Photo] Quang Binh: Bright yellow vermicelli flowers in Le Thuy village](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/80efad70a1d8452581981f8bdccabc9d)

Comment (0)