The Prime Minister emphasized that the law must aim to promote administrative procedure reform, avoid the mechanism of asking and giving, reduce inconvenience for people and businesses, and not create an environment for corruption and negativity.

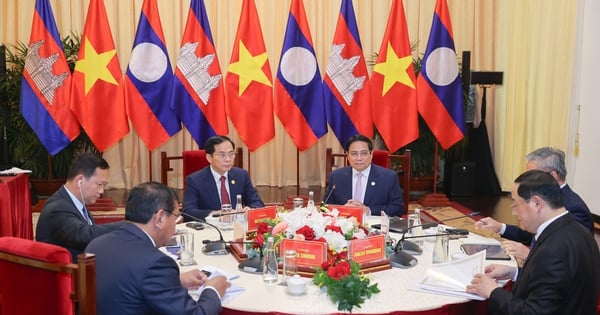

On the evening of August 16, Prime Minister Pham Minh Chinh, Head of the Steering Committee for reviewing and handling difficulties in the system of legal documents, chaired a meeting of the Government Standing Committee with ministries and branches to discuss the development of a draft law to amend a number of contents of laws in the fields of finance and budget.

Attending the meeting were Deputy Prime Ministers: Tran Hong Ha, Tran Luu Quang, Le Thanh Long; leaders of ministries, branches and relevant agencies of the Government.

At the meeting, the Government Standing Committee heard a report on the proposal to develop a Law amending a number of articles of the following laws: State Budget Law; Law on Management and Use of Public Assets; Law on National Reserves; Law on Accounting; Law on Independent Auditing; Law on Securities; Law on Tax Administration.

Delegates discussed and gave opinions on the necessity of developing laws, procedures, documents and policy contents of this law.

Concluding the meeting, Prime Minister Pham Minh Chinh emphasized that building and perfecting institutions and laws is one of the three strategic breakthroughs identified by the Party and State. Along with reviewing and building the Law, when problems arise in practice, they must be promptly amended and supplemented.

Agreeing to build a law to amend and supplement 7 laws in the financial sector to handle legal problems, Prime Minister Pham Minh Chinh requested to review and amend extremely basic and urgent contents, serving the goal of stabilizing the macro economy, controlling inflation, promoting growth, and ensuring major balances of the economy.

Along with strengthening state management through policies, processes, standards and inspection and supervision tools, the law must aim to promote administrative procedure reform, avoid the mechanism of asking and giving, reduce inconvenience for people and businesses; not create an environment for corruption and negativity; remove difficulties for businesses in production and business activities; promote decentralization, delegation of authority, resource allocation, remove obstacles, mobilize all resources, open up development; successfully implement the goals set by the 13th National Party Congress.

The Prime Minister directed to review and carefully evaluate the shortcomings, clarify the regulations that need to be amended and supplemented, ensure to increase decentralization for local handling, remove difficulties and obstacles in the authority to decide on budget revenue and expenditure, disbursement of public investment; increase revenue, reduce costs, reduce waste... in the State Budget Law; clarify the criteria, bases, and flexible principles to handle urgent issues stipulated in the Law on National Reserves; review to further decentralize the consideration and decision on handling of public assets under the authority and ensure consistency in the application of the law in the Law on Management and Use of Public Assets, both ensuring management and mobilizing resources for development.

The Prime Minister directed a specific assessment of the Accounting Law to remove obstacles and create a legal framework so that officials can feel secure and not be afraid of making mistakes. Review specific provisions of the Auditing Law to ensure a legal basis to enhance the capacity of auditing enterprises to operate effectively; prevent financial risks of enterprises, especially complex and large-scale economic transactions; contribute to improving the competitiveness of enterprises and increasing the confidence of domestic and foreign investors.

The Securities Law must remove obstacles for development, but must also prevent and handle violations, especially fraudulent acts, taking advantage of legal loopholes to commit fraud and profiteering in the market...

Regarding the Law on Tax Administration, the Prime Minister requested to continue reviewing and ensuring the thorough resolution of difficulties in tax administration procedures in the direction of simplifying tax administrative procedures, creating favorable conditions for enterprises, organizations and individuals, especially in tax refund procedures, deductions, and handling of late payment; strengthening post-audit mechanisms, preventing fraud and tax evasion to ensure against tax losses for the state budget.

Prime Minister Pham Minh Chinh requested leaders of ministries and branches to continue to carefully review and contribute opinions in accordance with the set objectives, subjects and scope; assign the Ministry of Finance to complete the dossier proposing the drafting of laws in accordance with the provisions of the Law on Promulgation of Legal Documents, submit to the Government for consideration and decision to submit to the 15th National Assembly at the 8th session in October 2024, ensuring the roadmap, progress and quality.

During the construction process, it is necessary to closely coordinate with the agencies of the National Assembly. If any problems or difficulties arise, promptly report to the competent authorities for consideration and comments./.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)