VN-Index increased by 26.8 points, surpassing the 1,180 point threshold

Mr. Dinh Quang Hinh, Head of Market Strategy Department, VnDirect Securities Analysis Division, said that the stock market was more positive than expected in the week of January 15-19 thanks to supportive information from the National Assembly.

The National Assembly's approval of two important and long-awaited bills, the Land Law (amended) and the Law on Credit Institutions (amended), was a catalyst for the market's uptrend.

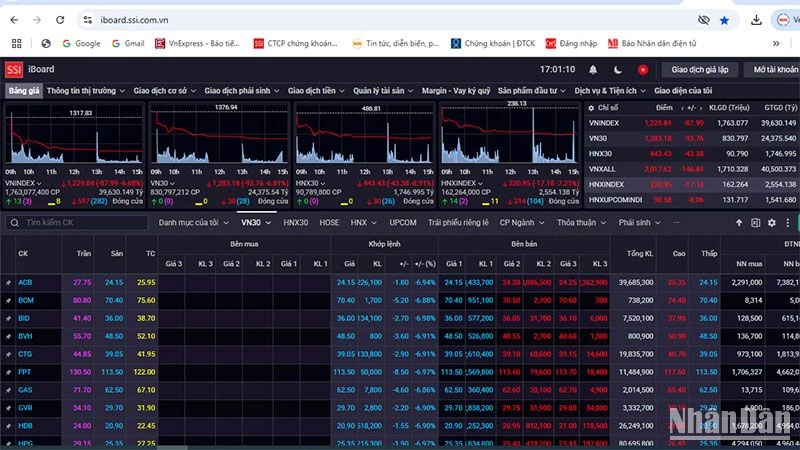

The stock market had an impressive trading week as listed companies began announcing their fourth quarter business results and the extraordinary National Assembly session provided positive supporting information.

After a temporary break, banking stocks attracted cash flow again, helping the VN-Index continue to increase and end the weekend session (January 19) at its highest level since the beginning of 2024.

Green returned to most stocks in the banking group. Some codes surpassed or reached historical peaks, such as BID of BIDV Bank, ACB of Asia Commercial Bank, LPB of LPBank...

It can be seen that the banking group is the most positive highlight, reinforcing the trend of large cash flows participating, thereby affecting many other industry groups at the end of the week such as consumption (+1.1%), industrial real estate (+1%)...

At the end of the week, the VN-Index increased by 2.2% compared to the previous week to 1,181.5 points. Meanwhile, the HNX-Index decreased slightly by 0.4% to 229.48 points and the Upcom-Index increased by 0.6% to 87.46 points.

In addition, BIDV shares increased by 8.4%; Vietcombank (VCB) increased by 4.4%. Vinhomes (VHM) of billionaire Pham Nhat Vuong recovered by 4.2%, while Mobile World (MWG) attracted quite a lot of cash flow (including foreign investors) and increased by 9.9%.

On the other hand, SHB Bank of Mr. Do Quang Hien decreased by 1.2%, SeABank (SSB) of Ms. Nguyen Thi Nga decreased by 1.5%. BVH shares of Bao Viet Group decreased by 1.3%, also putting pressure on the general index of the market.

Another downside is that liquidity has not exploded. The matched volume is still 10.8% lower than the 20-session average. The transaction value on the three exchanges decreased by nearly 29% compared to last week, down to VND15,868 billion/session.

During the week of January 15-19, investors also recorded the return of foreign investors, with a net purchase of VND454 billion, after a year of strong selling.

Will the real estate group recover?

Mr. Dinh Quang Hinh said that last week, the banking stocks continued to extend their upward momentum, led by state-owned banks such as BID, CTG and VCB. Cash flow also had a more positive spread when the upward momentum appeared in other stock groups, such as retail, steel and real estate. This was a bright spot compared to the previous trading week.

At the same time, foreign investors have also been continuously net buying in recent sessions. Overall, the market's upward momentum has not shown any signs of reversing. In addition, the picture of Q4/2023 business results is gradually being revealed with bright colors that will help cash flow maintain its heat and rotate between stock groups to maintain the market's upward momentum.

In a recently published report, experts Hoang Huy and Nguyen Hoang Minh from Maybank Securities (MSVN) forecast that Vietnam's economy will recover steadily throughout 2024, with the focus on consumption recovery thanks to strong export growth, more stable household finances and the gradual revival of the real estate market.

According to Maybank Securities, this is a supporting factor for the stock market. This securities company has proposed two scenarios for the VN-Index with potential increases of 11% and 26%, respectively, based on profit growth of 19.8% and the opportunity for Vietnam to be upgraded to an emerging market, which is an important transition to achieve a positive scenario.

MSVN bets on cyclical sectors, especially those related to consumption, raising its view on the real estate sector from "negative" to "neutral".

According to Kien Thiet Securities (CSI), the strong resistance level of 1,200-1,210 points is near ahead, but with the strong breakthrough momentum of the banking group, there is a high possibility that VN-Index will test the above resistance level in the sessions of the new week.

However, according to CSI, observing the order matching volume as well as the number of industry groups that increased in price last week (9/21 industry groups increased, mainly large cash flows concentrated in banks and large-cap stocks), it can be seen that the upward momentum is only concentrated and has not spread to many industry groups. Therefore, there is a high possibility that strong fluctuations will occur when VN-Index approaches the above resistance zone.

CSI also recommends taking profits when VN-Index approaches the above resistance zone and limiting buying in the upcoming increasing sessions.

Globally, the global economy is still in trouble as geopolitical tensions escalate and interest rates remain high. 2024 is expected to be a volatile year. However, the US economy is expected to only experience a mild recession, not too severe.

In the last session of the week on January 19, the US broad stock index increased by more than 1.2% to an all-time record high: 4,839.81 points.

Source

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Infographic] Government bond market March 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/e13239cdbcfd4968abc836c201204c43)

Comment (0)