According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material commodity market in yesterday's trading session (November 21).

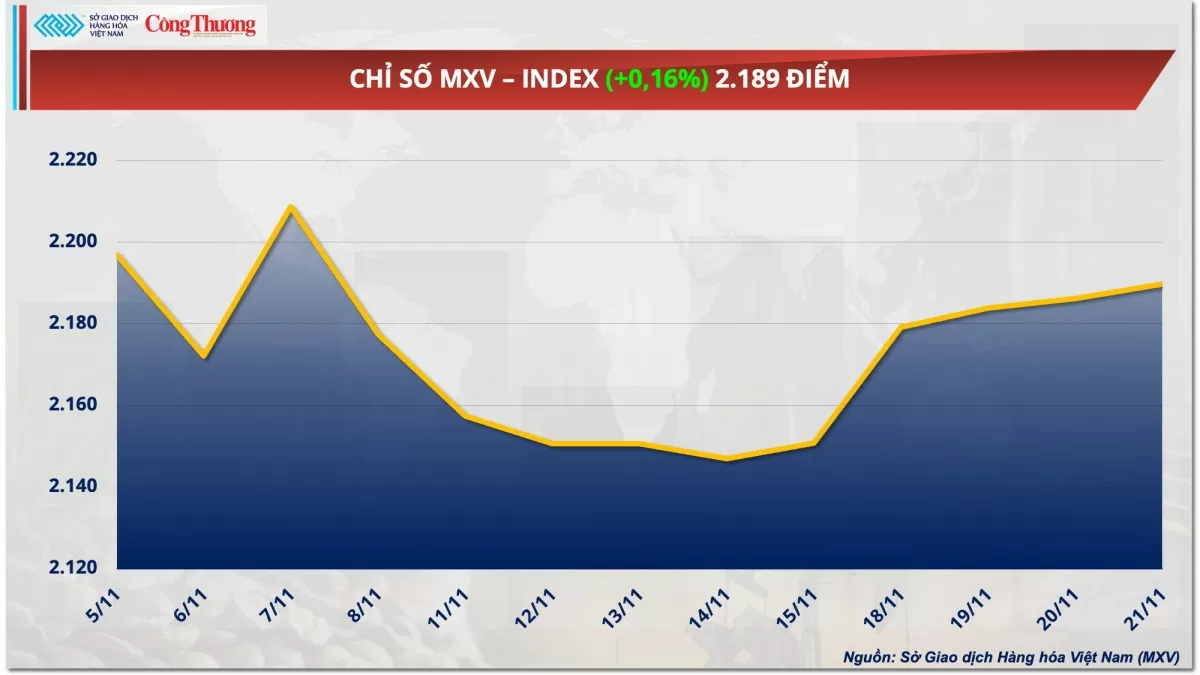

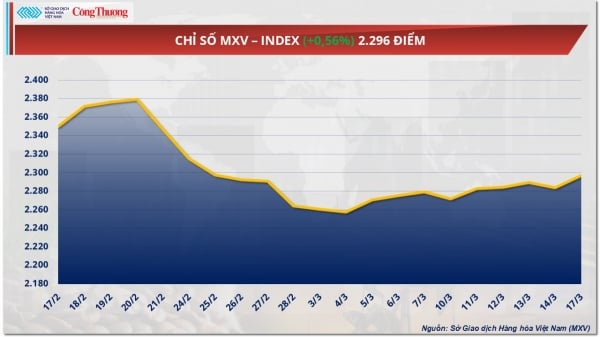

Closing, the MXV-Index increased by 0.16% to 2,189 points, extending the streak of 5 consecutive sessions of increase. Notably, all 5 energy group commodities increased in price in the context of more complicated geopolitical tensions.

|

| MXV-Index |

Concerns about the risk of supply tension, crude oil prices increase sharply

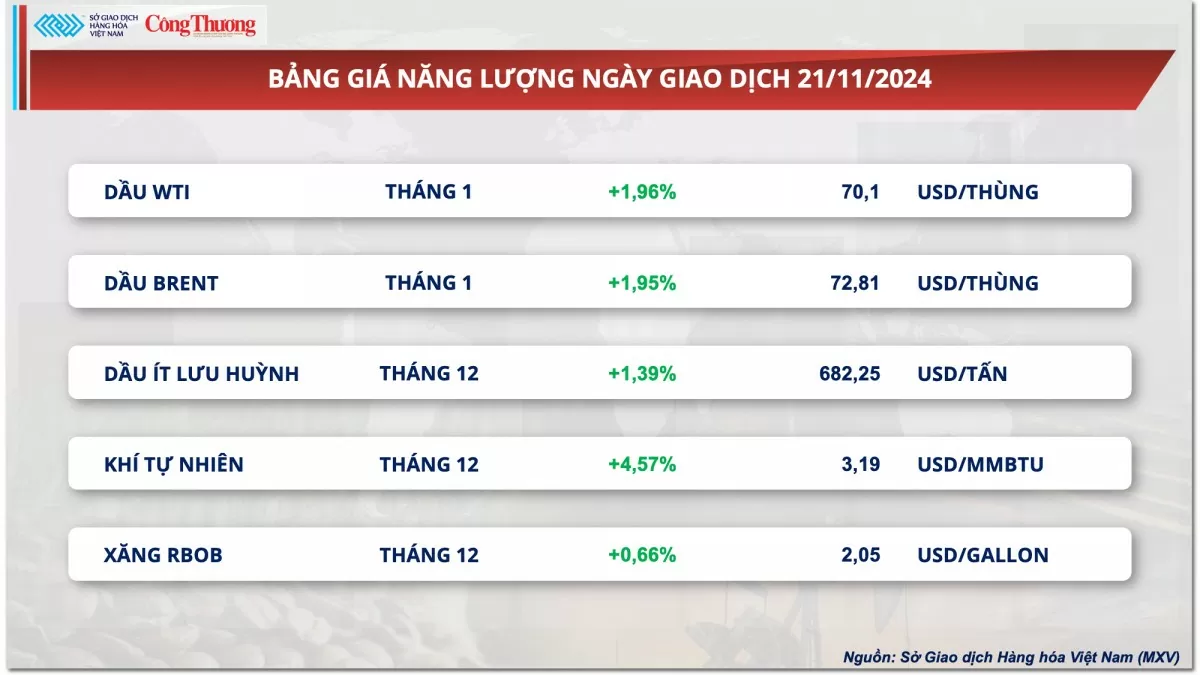

Crude oil prices returned to an upward trend in the trading session on November 21, after experiencing a prolonged correction in the previous two sessions. With the war situation in Ukraine showing signs of dangerous escalation, buying power dominated this commodity for most of yesterday's session and helped prices return to the threshold of 70 USD/barrel.

Specifically, WTI crude oil price increased nearly 2% to 70.1 USD/barrel. Brent crude oil price also increased nearly 2% to more than 74 USD/barrel.

|

| Energy price list |

A long-range missile attack between Russia and Ukraine has escalated the war to a dangerous new level, threatening to disrupt the flow of crude from the world's second-largest exporter and support oil prices.

In addition, the market is also paying attention to the December policy meeting of OPEC+. Analysts assess that OPEC+ will face many difficulties in the meeting early next month, when it has to choose between increasing production in the context of weak demand, or continuing to maintain the production quota despite many members wanting to produce more oil.

A slowdown in global oil demand growth, led by China, threatens to weaken prices if OPEC+ loosens its output policy. However, some member states such as the United Arab Emirates have expressed frustration at having to cut production for a long time, affecting their budget balances.

Sugar market continues to face downward pressure

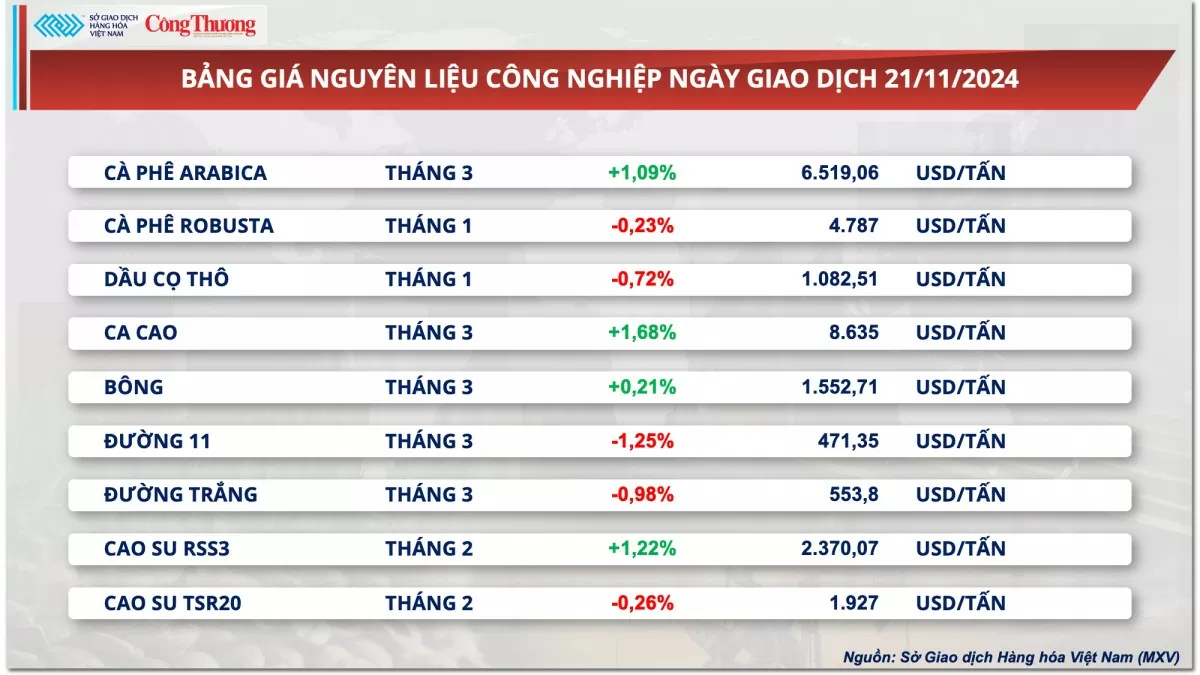

The sugar market continued to face downward pressure as sugar No. 11 lost more than 1% in yesterday's session, the third consecutive decline this week. This development reflected the market's reaction to improved supply information from the latest report of the International Sugar Organization (ISO).

|

| Industrial raw material price list |

Accordingly, the ISO has cut its forecast for the global sugar deficit in the 2024-2025 season to 2.51 million tonnes, down about 1 million tonnes from its previous forecast. At the same time, the organization also revised its estimate for the global sugar supply-demand balance in the 2023-2024 season from a deficit of 200,000 tonnes to a surplus of 1.31 million tonnes. The ISO explained that this change is mainly due to lower consumption, with global consumption in the 2023-2024 season being revised from 181.5 million tonnes to just over 180 million tonnes.

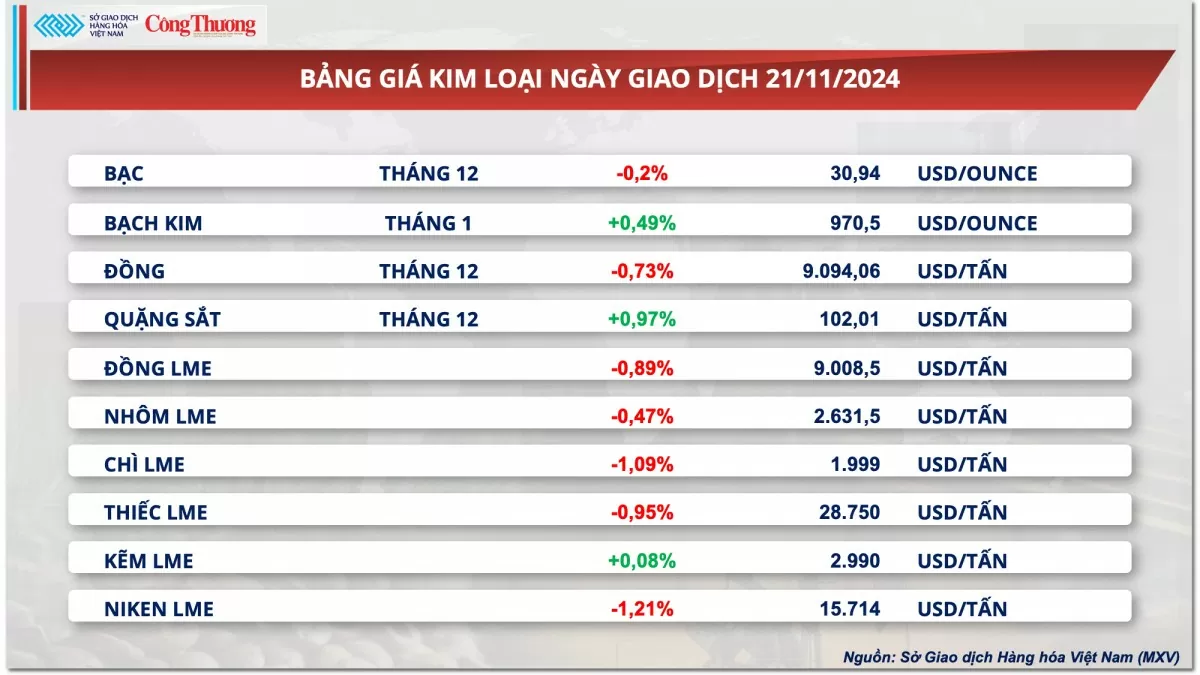

Prices of some other goods

|

| Metal price list |

|

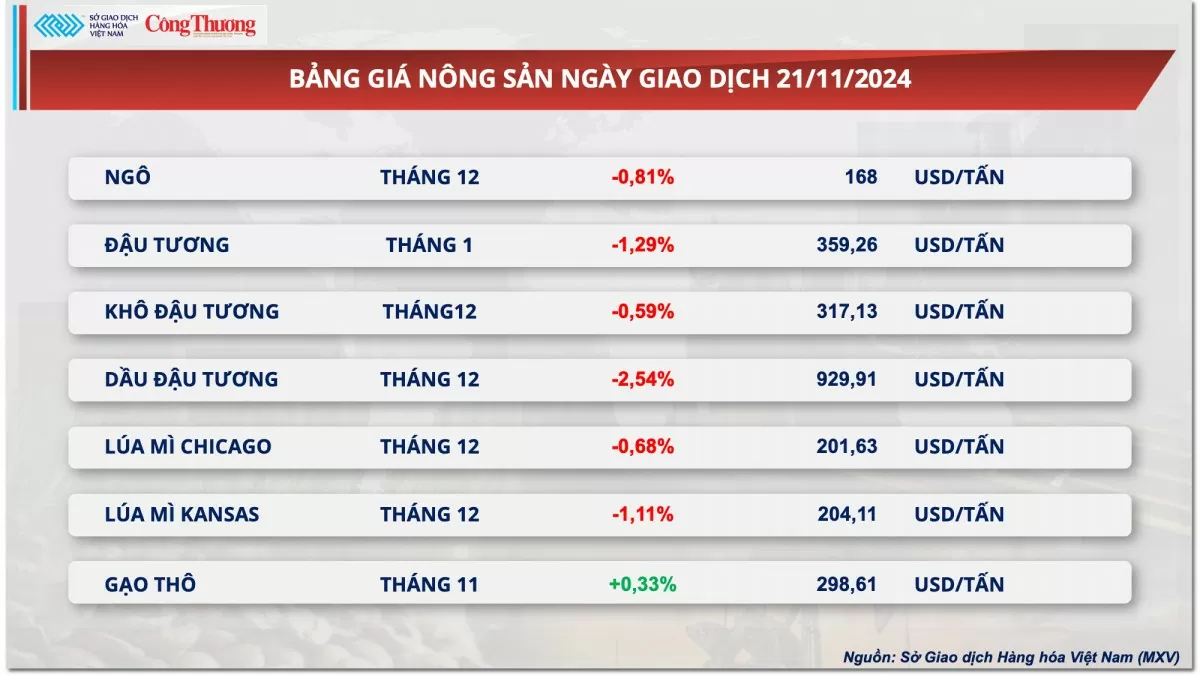

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2211-gia-dau-leo-thang-360231.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)