A blank savings book is essentially a savings book blank that has not been filled in with any information. It is like a blank sheet of paper, ready to record information related to customers' savings deposits at people's credit funds.

Article 36b of Circular 31/2012/TT-NHNN is supplemented by Clause 19, Article 1 of Circular 21/2019/TT-NHNN regulating blank savings books as follows:

From January 1, 2020, people's credit funds are only allowed to use blank savings books according to the form issued and provided by cooperative banks to receive savings deposits from customers when performing the activities specified in Clause 1, Article 36 of this Circular.

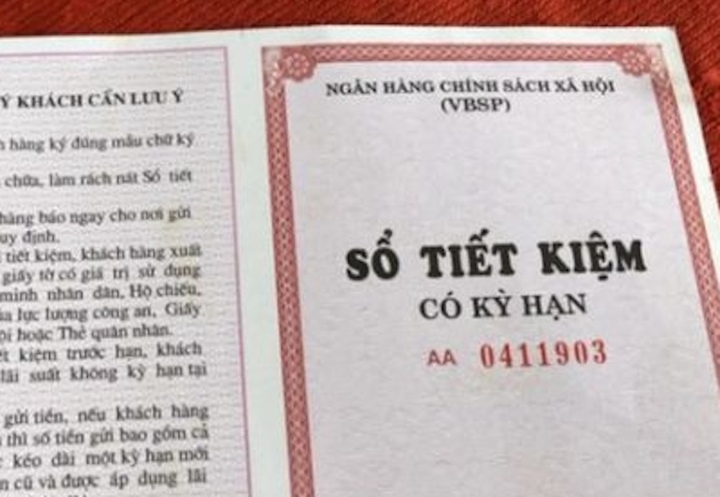

Illustration photo.

Features of white savings book

No information: The book has not been filled with any information such as deposit amount, term, owner name...

For credit funds: Mainly used by people's credit funds, not popular in commercial banks.

According to the prescribed form: The blank savings book form must comply with the regulations of the State Bank and be provided by the cooperative bank.

Why have a blank savings book?

Using blank savings books helps people's credit funds easily record information of many different customers, helping to reduce printing costs. Customer information will be recorded completely and accurately as soon as the deposit transaction is made.

Blank savings books are a useful tool to help people's credit funds manage customers' deposits effectively. However, customers also need to pay attention to carefully preserving savings books to ensure their rights.

Source: https://vtcnews.vn/so-tiet-kiem-trang-la-gi-ar903401.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)