The General Department of Taxation (Ministry of Finance) emphasized that it will strictly handle violations of tax laws in e-commerce and livestream sales activities.

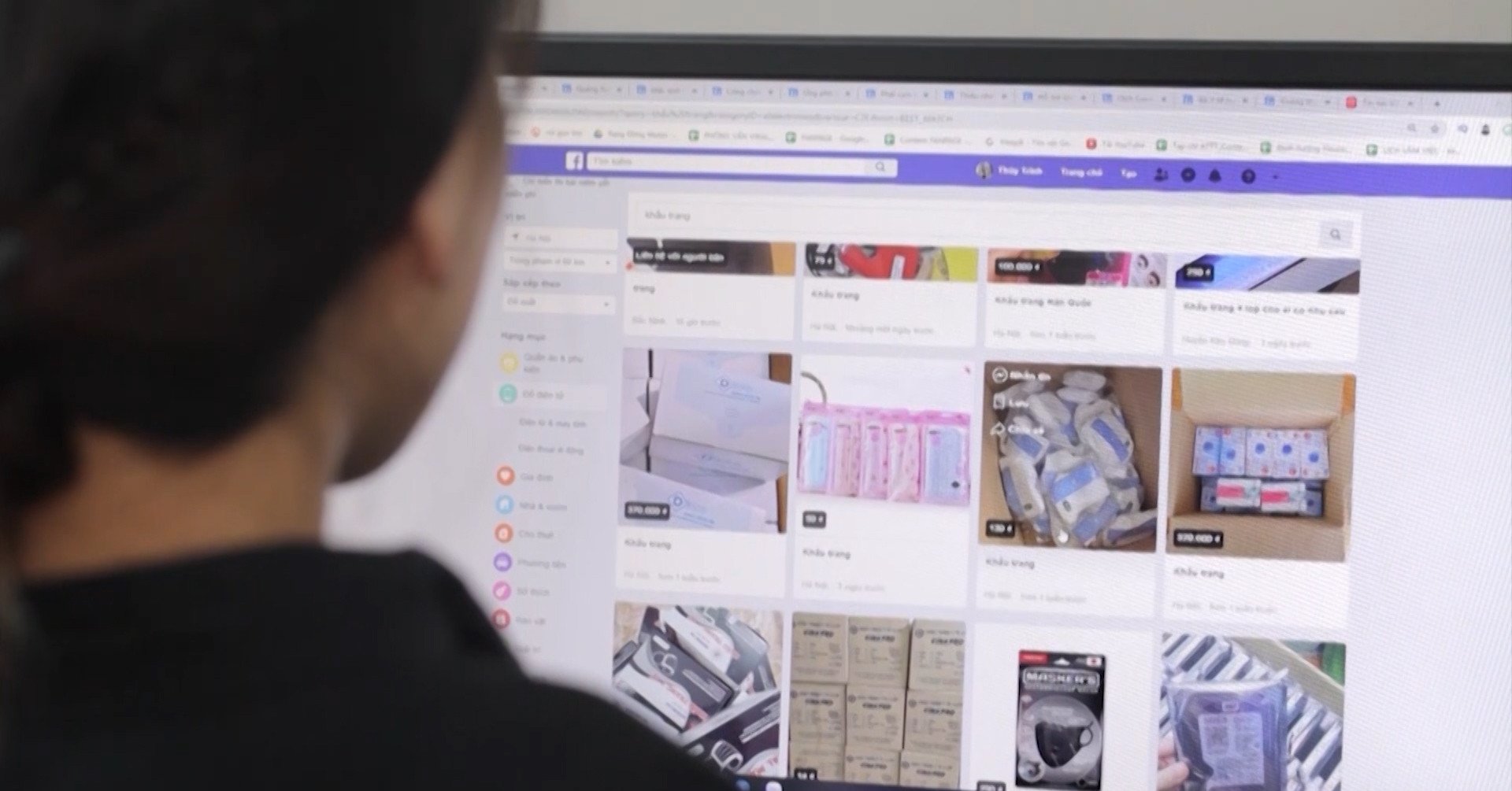

In order to continue strengthening tax management for e-commerce activities, the General Department of Taxation has just issued an official dispatch directing tax authorities at all levels to strengthen inspection and examination of e-commerce and digital platform businesses. Strengthen compliance monitoring for organizations and individuals selling goods and receiving commissions from advertising in livestream sales activities.

The General Department of Taxation requests the Directors of the Tax Departments of provinces and cities to strengthen propaganda work for organizations and individuals participating in e-commerce business activities, livestream sales, and business on digital platforms, through synchronous implementation of propaganda forms.

In addition, the tax authority continues to regularly review, update and enrich the e-commerce database to have sufficient input information for tax management. Coordinate with departments, branches and local authorities to review and identify individuals and business households in the area that have e-commerce and digital platform business activities, ensuring full management of subjects.

The General Department of Taxation requests the Tax Departments to direct tax departments, branches and relevant units to request businesses to strictly implement the issuance of electronic invoices. Ensure that 100% of transactions, including e-commerce transactions, are recorded and fully issued with electronic invoices. Step by step, strictly control input invoices, ensure tax declaration and payment in accordance with legal regulations from production to circulation, from import to sales.

"The General Department of Taxation requests tax authorities at all levels to strengthen inspections of e-commerce and digital platform businesses right from the inspection planning stage to implementation, thereby collecting information to serve tax management," the document stated.

At the same time, the Head of the tax authority needs to assign departments and civil servants to group subjects according to management requirements to include in the review list. Fill in additional data for the list to be reviewed; review and compare database sources with the tax declaration and payment status of organizations and individuals with e-commerce business activities to identify cases of non-declaration of taxes or incomplete tax declarations. From there, collect and impose penalties in accordance with the procedures and regulations of the Law on Tax Administration.

In addition to strengthening compliance monitoring for organizations and individuals selling goods and receiving commissions from advertising during livestream sales activities, tax authorities need to continue to strengthen inspection and examination work.

"If cases with signs of tax law violations are detected, it is necessary to simultaneously make a list and coordinate with local departments and branches to inspect the area to handle them according to tax laws and specialized laws, or transfer the case to the police agency for coordination in handling if it is determined that this is an act of tax evasion," said the General Department of Taxation.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)