At the same time last year, interest rates were sky-high, with some banks paying interest rates of over 10-11% per year. Not to mention, many banks still "cross the line", willing to pay more to depositors if they are regular customers, VIPs...

High-interest deposits have matured after one year, but interest rates have dropped to record lows in the last months of the year. Investors are wondering where to put their money at this time. Stocks and real estate - which "reigned" during the Covid-19 pandemic - are no longer the number one attractive choice for investors due to uncertain macro factors.

Dan Tri Newspaper conducted a survey with nearly 7,000 readers about the preferred investment channel at the end of the year. The most chosen investment channel was surprising.

Gold (48%)

48% of readers participating in the vote said that gold is the priority investment channel at the end of the year.

In the first trading session of this year, the price of SJC gold bars was listed by major stores at 66-66.7 million VND/tael (buy - sell). Currently, gold is listed in the price range of 71-72 million VND/tael (buy - sell), an increase of 5 million VND, about 7.5%. Minus the difference between the two buying and selling prices, gold investors can earn more than 4 million VND, meaning a profit rate of about 6%.

Domestic gold has also made waves many times since the beginning of the year. However, the highest price ever recorded was about 72.2 million VND/tael in the selling direction. The record price recorded for this precious metal was 74.4 million VND/tael in March last year.

Gold is one of the popular investment channels (Illustration: Manh Quan).

In fact, when it comes to diversifying your portfolio, gold is often cited as a good defensive asset. Many investors flock to the precious metal during times of economic uncertainty. Unlike stocks or bonds, gold is expected to retain its value in most economies.

However, like any investment, gold’s performance can fluctuate over time. Investors may want to review their gold holdings and rebalance their portfolios regularly to ensure their investment strategy remains aligned with their goals.

If the proportion of gold in the investment portfolio is too large due to the increase in price, rebalancing can help investors manage risk and maintain a diversified portfolio. Many experts give the figure of holding 5-20% of personal investment portfolio in gold.

Savings (21%)

The trend of decreasing interest rates started in April this year, after the State Bank lowered its operating interest rates four times in a row, including three times lowering the deposit interest rate ceiling. Contrary to the monetary tightening trend of the US Federal Reserve (Fed) and many other countries in the world, Deputy Governor Dao Minh Tu said: "The State Bank wants to convey the message of reducing interest rates."

The maximum interest rate that commercial banks are allowed to mobilize for deposits under 6 months has decreased from 6% to 4.75%/year.

This has led to savings interest rates falling below 6%/year at most banks.

Personal financial planning expert Nguyen Thi Thuy Chi advises that if your current income is enough to cover your monthly expenses, you should not only invest in asset classes that generate cash flow. For example, if you only save money, this cash flow will be "eroded" by inflation and affect investment performance.

"Savings interest rates are no longer attractive, however, a portion of the weight should still be put into this asset class so that your portfolio has balanced liquidity and optimal risk," the consultant advised.

Real estate (14%)

In the context of low bank interest rates, many investors have shifted their investment to real estate with the expectation of capital preservation and profit. According to the Dan Tri newspaper's voting channel, 14% of readers participating in the survey prioritized the real estate channel.

According to Ms. Nguyen Hoai An - Senior Director of Hanoi branch of CBRE Vietnam - when investing in real estate, each investor has a different risk appetite and also depends on the market time to choose the appropriate segment.

Investors often want the fastest possible price increase in the shortest time. However, according to experts, the current market does not have many such opportunities and if there are, they will contain many risks.

Real estate market in Hanoi (Illustration: Manh Quan).

Mr. Vo Hong Thang - Market Director of DKRA Group - said that attractive and flexible sales policies, gifts, and payment discounts are being applied more aggressively by many investors to increase access to potential customers. This is an opportunity for those with cash who want to own a property with a reasonable price and complete legal procedures.

Securities (11%)

Stocks used to be the "king" investment channel during the Covid-19 pandemic. Beyond analysts' predictions, the VN-Index in 2021 increased by 35.7%, ranking among the world's strongest growing stock indices.

In 2022, the market was again volatile, when the VN-Index fell 32.78% from a price range of nearly 1,500 points to 1,007 points. Market capitalization also lost more than 31%, from VND 5.83 trillion to VND 4.02 trillion, breaking the chain of increases in scale that had lasted since 2011.

After the “nightmare” of 2022, investors who lost money hope to recoup their losses after learning many lessons. Many questions are being raised about how to allocate assets, which sectors to prioritize or avoid, and what variables to watch.

Ms. Do Hong Van - Head of FiinGroup's stock data analysis team - said that the P/E valuation - the price-to-earnings ratio - is currently at 13.1 times, lower than the average from 2015 to present, and said that there are many opinions that the market valuation is at a very attractive level.

However, Ms. Van believes that investors need to look deeper into each industry and stock class to assess the real valuation of the market. Because if excluding the two groups of finance and real estate, the P/E is currently around 23.5 times - in the historical peak of the market and even higher than the valuation when the VN-Index surpasses the 1,500 point mark.

Experts from a company specializing in providing financial data analysis services advise investors to focus on stocks with good growth prospects and business results to avoid the risk of paying the price for excessive profit expectations. This unit offers a number of promising industry groups including information technology, seafood, garment, steel, oil and gas, chemicals, industrial park real estate, etc.

Bonds (2%)

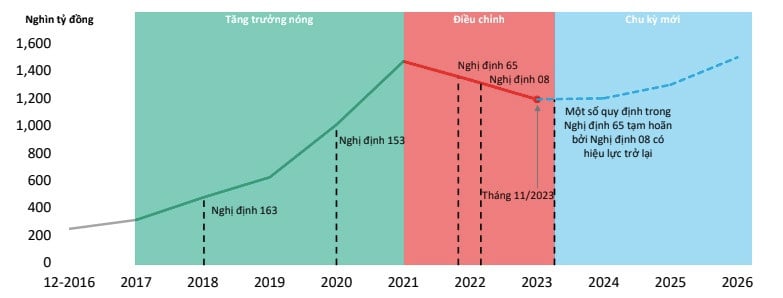

Mr. Tran Le Minh - General Director of VIS Rating - a unit specializing in credit rating - said 2022-2023 is the period when the bond market "slows down".

Specifically, this year is a period of adjustment for the bond market after a period of rapid development for a long time. "Last year, what we saw was a liquidity shock in the corporate bond market. This created many problems for issuers, leading to a trend of interest and principal not being paid on time," said Mr. Minh.

Total face value of outstanding bonds (Photo: VIS Rating).

Recently, the Ministry of Finance has required enterprises with outstanding bond debt to be responsible for their debt obligations and balance cash flow to make timely payments. Companies facing difficulties can use Decree 08 to negotiate with investors to swap debt with legal assets or change the terms and conditions of the bond. In case of bond extension, the maximum period is not more than 2 years.

Mr. Nguyen Hoang Duong - Deputy Director of the Banking and Finance Department (Ministry of Finance) - recommended that investors must assess risks and have full access to information about businesses and issued bonds.

"Investors need to be careful with consulting services, distinguishing between corporate bonds and bank deposits. Only professional securities investors can buy individual corporate bonds," Mr. Duong noted.

A representative of the Ministry of Finance said that investors need to understand that the risks of bonds are associated with the issuing enterprise, not related to the distribution organization, such as commercial banks. Before buying bonds, investors must sign a commitment on access to information, and service providers or sellers must confirm providing relevant documents to investors.

Other channels: Cryptocurrency, fund certificates… (2%)

Fund certificates are securities that confirm the investor's ownership of a portion of the capital contribution of a securities investment fund, with a face value of VND 10,000 offered to the public. This is also considered evidence confirming the investor's ownership, rights, and responsibilities for his or her capital contribution.

Mr. Huynh Hoang Phuong - Director of Investment Research and Analysis of FIDT - a unit specializing in asset management - commented that investing in investment funds through buying fund certificates has not been widely accepted in Vietnam.

The reason is that most people are unfamiliar with new asset classes, especially intangible assets. Not to mention, the fund certificate market in Vietnam is not diverse and the personal finance industry is not yet developed, just in the formation stage.

Fund certificates are a safe form of investment (Illustration: My Tam).

Regarding cryptocurrencies, this market increased sharply in 2021, at times reaching a capitalization of 3,000 billion USD when Bitcoin price increased to a record, leading to a fever of NFT, meme coin, metaverse... Many young people consider cryptocurrencies as one of the few ways to get rich.

However, the crypto winter of 2022 caused this market capitalization to evaporate by $1,000 billion and scared many investors. This can also be considered one of the reasons why investors are afraid of this channel.

Recently, Bitcoin - the most famous and often leading cryptocurrency in the market - is currently at its highest price since May 2022. On November 25, Bitcoin's price exceeded $38,000, in anticipation of investors' expectations of the US Securities and Exchange Commission (SEC)'s approval of a Bitcoin spot exchange-traded fund (ETF).

The possible approval of the BTC ETF (expected in January 2024) is expected to create a new wave of volatility for the cryptocurrency market.

Source

Comment (0)