Lan Man Cafe in Hai Hoa Village, Hai Long Commune (Nhu Thanh) receives about 30% of its total revenue from cashless payments every day. Mr. Le Van Luong, owner of Lan Man Cafe, said: In recent years, instead of paying in cash, customers coming to the cafe have switched to paying by scanning QR Codes to transfer money more. This not only helps the cafe avoid having to prepare a lot of small change to give back to customers, but also helps the cafe manage cash and plan expenses more conveniently.

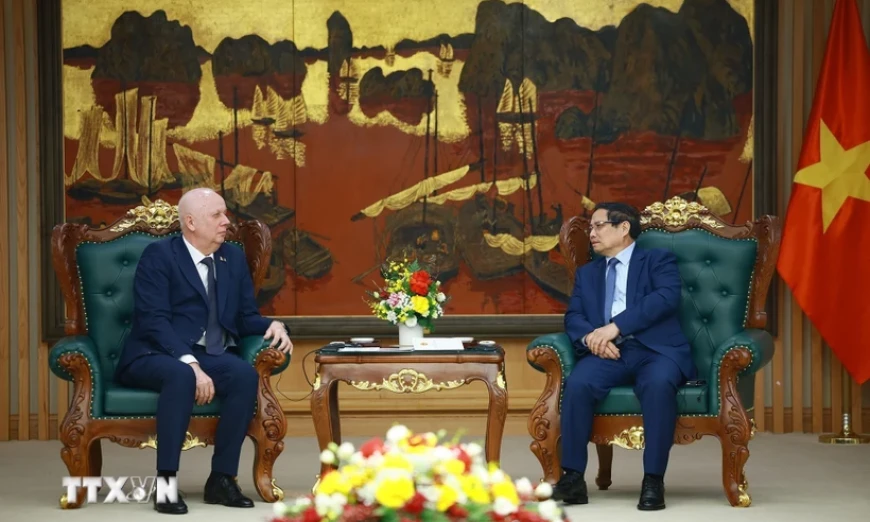

People pay cashless at Lan Man cafe.

People pay cashless at Lan Man cafe.

Although it is a mountainous commune, Hai Long has boldly chosen digital transformation as a prominent field in the model of new rural development. Vice Chairman of the People's Committee of Luc Dai Truong commune said: To promote cashless payments in the area, the commune has coordinated with banks to organize peak periods to guide people, small traders, businesses, and traders in the area to open accounts, create QR Codes to make cashless payments, install personal digital signatures... Thereby, helping people save time and effort to go to the place to pay for essential services such as electricity, water, buying and selling goods, tuition fees...

“The locality has the advantage of having AKALIA Shoe Company located in the area with more than 8,000 workers. The fact that shoe company workers are paid through bank accounts also makes non-cash payment activities in the area more convenient,” Mr. Luc Dai Truong added.

According to preliminary statistics, Nhu Thanh currently has over 76% of people with smartphones and nearly 80% of people aged 15 and over have bank accounts. Along with promoting the implementation of the "3 No" model, including the content of "No cash in payment for some essential services", the district also coordinates with banks and intermediary units to guide people to open bank accounts, e-wallets, and request Agribank Nhu Thanh branch to create free QR Codes for small traders in the area... To date, the whole district has opened about 37,000 Agribank accounts. In addition, the district is also promoting the payment of social insurance benefits through bank accounts to promote cashless payments in the area.

In Thieu Hoa district, along with implementing digital transformation goals and tasks in the area, the district has promoted propaganda and guided people to install and use accounts and electronic wallets for non-cash payments.

Nguyen Quang Hoa, Deputy Head of the District Culture and Information Department, said: Up to now, the whole district has 142,000 people of working age with bank accounts or e-wallets, reaching a rate of about 60 - 70%. To soon achieve the criteria for digital transformation at the commune level, Thieu Hoa is promoting coordination with telecommunications networks and banks in the area to diversify solutions to create non-cash payment accounts for people.

With the advantage of being able to use Viettel money service wherever there is a mobile signal, along with a network of hundreds of thousands of transaction points nationwide, people can deposit and withdraw money without having to go to a bank branch. In addition, when using Viettel money accounts, people do not have to pay any service fees, nor do they need to maintain a minimum balance in their accounts. This is convenient for people in rural, mountainous areas or with low incomes.

Director of Viettel Thieu Hoa Branch Truong Huu Toan said: We have opened 15,600 Viettel money accounts in Thieu Hoa district. To continue developing Viettel money accounts, Viettel Thieu Hoa is actively promoting propaganda, coordinating with authorities at all levels to install and instruct people to use Viettel money accounts, contributing to promoting non-cash payments with local authorities.

Currently, the whole province has more than 550,000 people registered and using Viettel money accounts. Viettel Money application has contributed to the realization of digital payment, forming the habit of not using cash of digital citizens. According to the plan, in 2024, Viettel Thanh Hoa will open more than 50,000 new accounts, contributing with local authorities to achieve the goal of people being able to pay for all services, especially in remote areas, places where bank branches cannot reach.

According to the report of the Department of Information and Communications, in the first 6 months of 2024, the whole province made cashless payments to social security beneficiaries, 14,523/255,441 people (reaching 56.85% of the total number of people with accounts. Of which, 10,294/189,960 were beneficiaries of social protection policies; 4,229/65,481 were beneficiaries of policies for people with meritorious services). Regarding online payment of fees and charges on the National Public Service Portal, the whole province had 81,361 successful transactions with a total amount of 10,004 billion VND. Electronic land tax payment, there were 1,705 successful transactions with a total amount of 6,923 billion VND. Personal tax collection, there were 56 successful transactions with 62.8 million VND. Collecting registration fees, there were 97 successful transactions with 2.46 billion VND...

These are positive signals showing that cashless payments are present everywhere from mountainous areas to urban areas, in all transaction activities of people, authorities... contributing to promoting digital government, digital economy, digital society.

Article and photos: Linh Huong

Source: https://baothanhhoa.vn/no-luc-phu-thanh-toan-khong-dung-tien-mat-222668.htm

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Podcast] News on March 26, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/c3d9c3c48b624fd9af79c13ff9e5c97a)

Comment (0)