(NLDO) – Savings interest rates are expected to continue to increase as banks increase capital mobilization for lending since the beginning of the year.

On January 14, according to the reporter of Nguoi Lao Dong Newspaper, the interest rate of savings deposits is differentiated among commercial banks. In the state-owned commercial bank group - including Vietcombank, BIDV, VietinBank and Agribank - the highest interest rate for 3-month term is from 1.9% to 2.5%/year. In particular, the highest interest rate for 3-month savings deposits at Agribank is 2.5%/year.

For large-scale joint stock banks such as VPBank, Techcombank, MB, ACB..., 3-month term interest rates range from 2.7% to 3.9%/year, with VPBank having the highest rate of 3.9%/year.

Some banks have just adjusted their 3-month interest rates up, such as Vietbank to 4.1%/year, up 0.2 percentage points compared to last week.

The highest savings interest rate for 3-month term exceeds 4%/year

Banks that are mobilizing deposits with 3-month interest rates above 4%/year include BVBank, Vietbank, TPBank, Oceanbank, OCB, NCB, Nam A Bank, DongABank, BacABank.

Some other banks offer online savings customers an additional interest rate of 0.1-0.2 percentage points compared to over-the-counter savings. Cake by VPBank digital bank has a 3-month term interest rate of 4.4%/year; Eximbank offers 3-month online savings at 4.3%/year...

Ms. Ngoc Ngan (living in District 1, Ho Chi Minh City) said that she has 600 million VND in idle money after 1 year of accumulation and the 2025 Lunar New Year bonus. She plans to deposit the money for a 3-month term and then find an investment channel after Tet. If she chooses a bank with an interest rate of about 4%/year, the amount of principal and interest she receives after 3 months, with interest paid at the end of the term, will be more than 606 million VND (interest of more than 6 million VND).

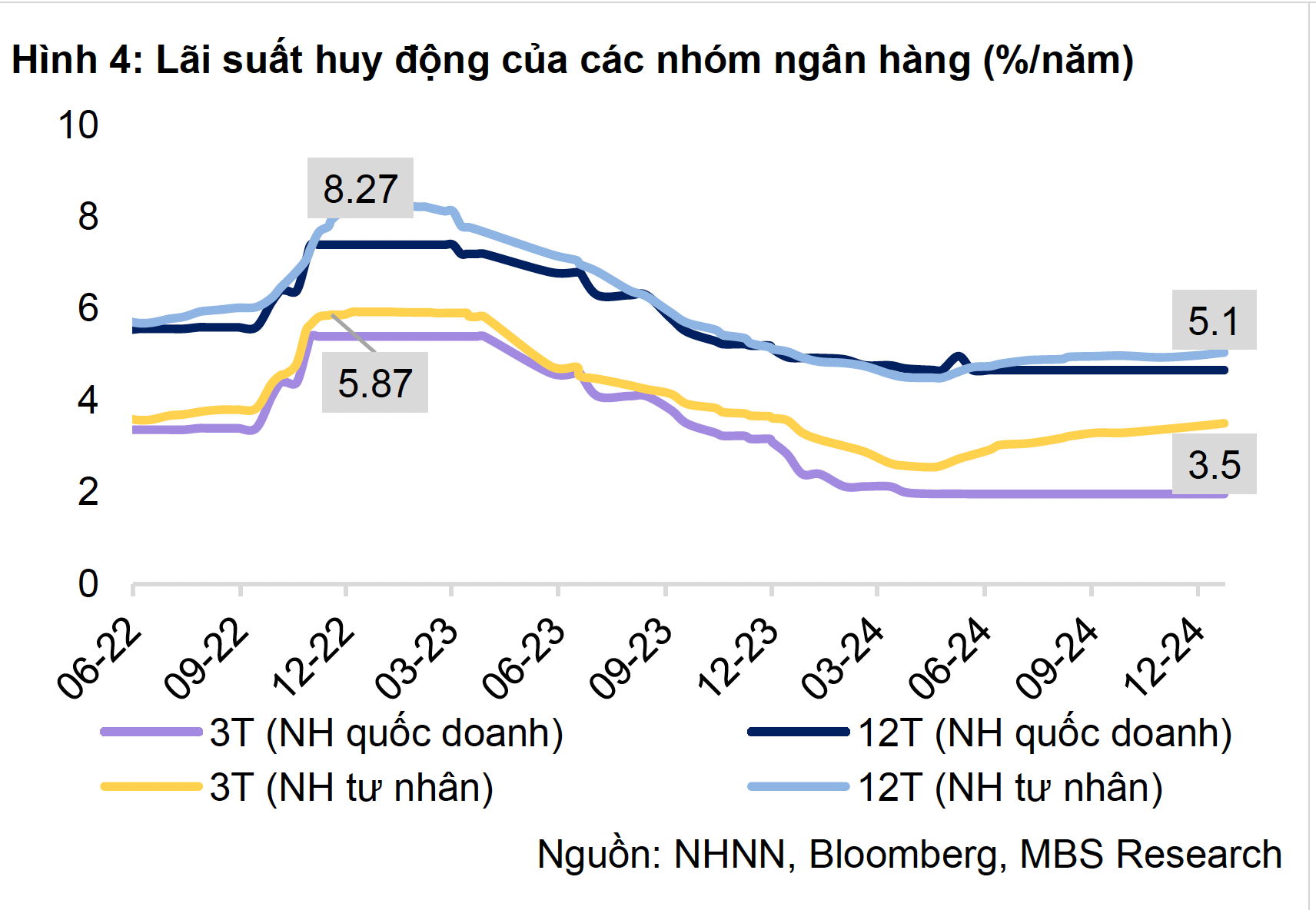

The January 2025 money market report of MBS Securities Company shows that when it bottomed out in March 2024, deposit interest rates have tended to increase again since April until now, because the previous low interest rates have caused people to gradually withdraw deposits from the banking system.

Credit growth 2-3 times faster than capital mobilization growth has prompted banks to increase deposit interest rates. Interest rates at some banks have even exceeded 6%/year.

Input interest rates continued to maintain an upward trend in December 2024 with 12 banks increasing savings interest rates by 0.1% - 0.3%. This upward trend is supported by impressive credit growth. According to data from the State Bank, credit as of the end of December increased by 15.08% compared to the end of the previous year, exceeding the set target of 15%.

According to banks, deposit interest rates will continue to increase to attract new capital, thereby helping to ensure liquidity and meet the need to boost credit right from the beginning of the year to reach the target of about 16% this year.

Mr. Hoang Huy, an analyst at Maybank Securities Company, forecasts that increased credit demand will push domestic deposit interest rates up by 0.5 percentage points, but this increase will not disrupt the economic recovery momentum.

Meanwhile, MBS forecasts that 12-month deposit interest rates of major commercial banks will fluctuate around 5% - 5.2% this year.

Source: https://nld.com.vn/lai-suat-hom-nay-14-1-nhan-tien-thuong-tet-gui-tiet-kiem-3-thang-ngan-hang-nao-lai-nhat-196250114094748455.htm

Comment (0)