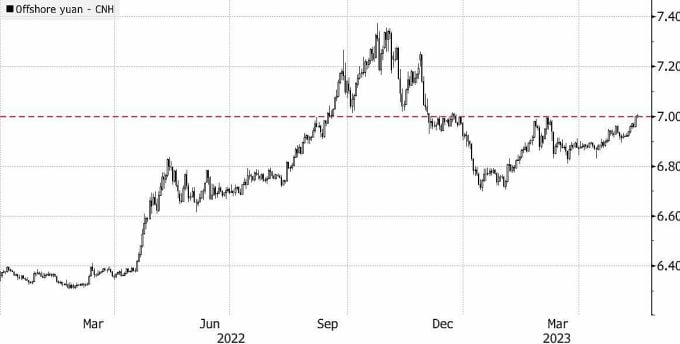

This afternoon, the price of the yuan on the international market decreased by 0.2% compared to the USD, the lowest in the past 5 months, due to this week's less optimistic Chinese economic data.

In total, the yuan has decreased by 1.2% since the beginning of the year. Accordingly, each USD is now worth 7 yuan. In the Chinese market, the price of this currency today also decreased by 0.2%, to 6.995 yuan per USD.

The Chinese currency weakened as a series of April data showed slower-than-expected increases in factory output, retail sales and fixed-asset investment. The yuan is also likely to depreciate this quarter as capital flows out and people travel abroad.

USD/CNY exchange rate from December 2022. Chart: Bloomberg

Six months after China ended its zero-Covid policy, optimism about the world’s second-largest economy’s recovery is fading. The yuan has fallen more than 4% since hitting a peak in January. Investors are losing patience with economic data and betting Beijing will ease monetary policy further.

So far, however, the People's Bank of China (PBOC) has stayed out of the picture. Today, it set the reference rate at 6.9748 yuan per dollar, higher than yesterday. At this week's meeting, the PBOC also kept its benchmark lending rate unchanged.

"There is no sign yet that the PBOC will intervene to prop up the yuan. However, the PBOC has many tools at its disposal, and investors should be cautious about pushing the yuan too low," said Khoon Goh, head of Asia research at ANZ.

China’s large trade surplus has not yet pushed the yuan higher. Exporters are reluctant to sell dollars, expecting the yuan to depreciate further.

In March, PBOC Governor Yi Gang said that 7 yuan per dollar was no longer a psychological barrier for the currency, citing the increasingly flexible exchange rate mechanism and the volatility was not a big problem for businesses or households. In April, he said that China had stopped intervening in the currency market.

If the currency falls too low, the PBOC has several ways to slow the decline. The most common is to change the reference rate to reorient market expectations.

Nomura Holdings believes that the PBOC's current concern is the 7.3 yuan per dollar level. The possibility of short-term intervention is also very low.

Ha Thu (according to Bloomberg)

Source link

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)