(NLDO) - Entering 2025, Minister Nguyen Van Thang directed the tax sector to organize effective collection work and strictly manage revenue sources.

On December 19, at the conference to review tax work in 2024 and deploy tax work tasks in 2025, the General Department of Taxation (Ministry of Finance) said that the total state budget revenue in 2024 managed by the entire tax sector is estimated at VND 1,709,800 billion, equal to 115% of the estimate, equal to 112.3% compared to the implementation in 2023.

Of which, crude oil revenue is estimated at VND58,100 billion, equal to 126.3% of the estimate, equal to 93.8% of the same period. Domestic revenue is estimated at VND1,651,700 billion, equal to 114.7% of the estimate, equal to 113% of the same period.

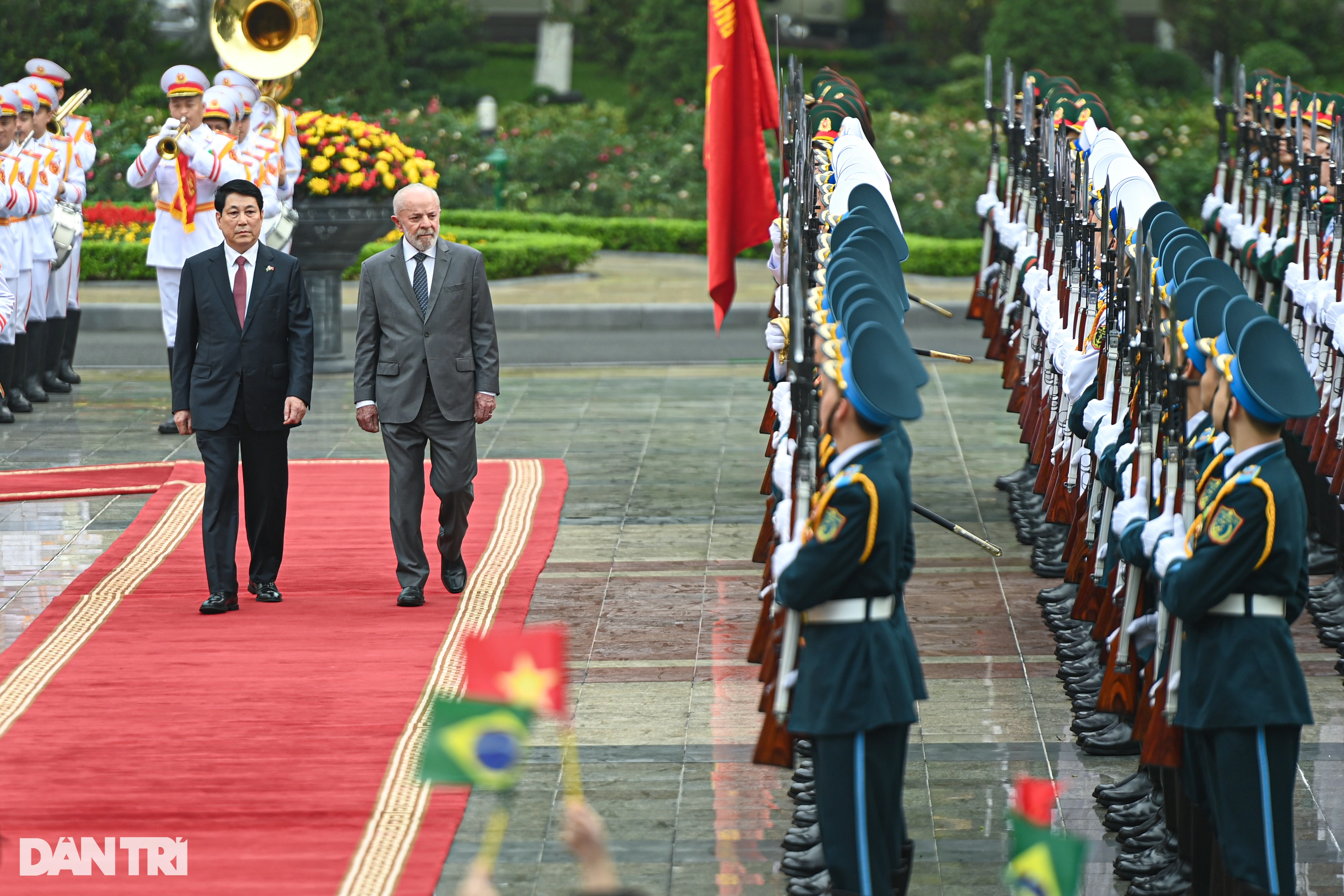

Minister of Finance Nguyen Van Thang speaks

In terms of revenue targets, 19/20 revenue items and taxes completed and exceeded the estimate; 16/20 revenue items and taxes had growth compared to the same period. In terms of revenue collection areas, 60/63 localities and 61/64 tax departments assessed that they completed and exceeded the estimate; 3/63 localities assessed that they did not complete. 53/63 localities had revenue growth, some localities had high growth of over 15%.

Speaking at the conference, Minister of Finance Nguyen Van Thang emphasized that in 2024, e-commerce tax collection will continue to grow strongly, reaching VND116 trillion, up 20% over the same period. There have been 120 foreign suppliers registering, declaring and paying taxes via the electronic information portal with the tax paid amount of VND8,687 billion, up 26% over the same period in 2023.

Along with that, the tax sector has drastically implemented solutions to urge and collect outstanding debts. As a result, in 2024, 61,227 billion VND of debt was recovered, an increase of 33.2% over the same period. In particular, the implementation of the temporary exit suspension measure has recovered 4,289 billion VND.

In addition to the achieved results, Minister Nguyen Van Thang also pointed out some shortcomings and limitations such as a number of taxpayers not complying with tax laws, the situation of buying and selling invoices, and tax refund fraud is still complicated. Although tax debt has decreased, it is still high, and some tax officials violate discipline.

According to Minister Nguyen Van Thang, 2025 will see many major events in the country. The global economic context still has many potential risks. The implementation of the plan to reorganize and streamline the apparatus will bring about huge changes in tax administration.

Therefore, the Minister requested the General Department of Taxation and the entire sector to seriously implement Resolution 18 of the 6th Central Conference, term XII, urgently complete functions and tasks and prepare necessary conditions for the new apparatus to operate smoothly after streamlining to ensure efficiency, effectiveness and efficiency, and not leave any gaps that affect the service to people and businesses.

Along with that, strive to exceed the State budget collection task in 2025; Strictly manage and exploit potential revenue sources. According to the Minister, it is necessary to identify new revenue sources, potential revenue sources, promptly detect areas with revenue losses to have solutions to manage, exploit to increase revenue, and prevent revenue losses.

The Minister noted the task of combating invoice fraud and VAT refund fraud. In particular, it is necessary to coordinate with the police in verifying, investigating, prosecuting, strengthening deterrence, and building a healthy and fair business environment for compliant taxpayers.

Emphasizing that digital transformation is an inevitable trend, especially in the context of the increasing number of tax system management objects and increasingly streamlined apparatus, Minister Nguyen Van Thang requested that in 2025, the tax sector needs to accelerate the application of artificial intelligence (AI), processing large databases (Big Data) in all stages and steps of the management process, speed up the implementation of automatic personal income tax refunds...

The head of the Ministry of Finance requested the tax sector to strongly transform its management mindset into a service and support mindset. Resolve taxpayers' problems and difficulties early and remotely. Thoroughly transform its administrative management mindset into a service-oriented one, with taxpayers at the center.

In addition, it is necessary to do a good job of ideological work, restructure the staff, innovate the work of evaluation, promotion and appointment to create the necessary motivation to attract and retain talented people, with high enthusiasm and responsibility for the work, and at the same time remove incompetent and unqualified staff from the system.

At the conference, the General Department of Taxation officially announced the "Electronic information portal for households and individuals doing business to register, declare, and pay e-commerce and digital business taxes" (https://canhan.gdt.gov.vn).

According to the General Department of Taxation, the portal helps simplify administrative procedures for taxpayers, thereby contributing to saving costs and time in complying with the law for taxpayers. The portal will contribute to building a professional, modern, transparent, honest and effective tax sector.

At the same time, encouraging the development of the digital economy and e-commerce, providing a clear and easy-to-understand tax environment will facilitate households and individuals doing business to participate in the field of e-commerce and digital platforms more legally and effectively.

Source: https://nld.com.vn/nganh-thue-lan-dau-thu-ngan-sach-vuot-17-trieu-ti-dong-bo-truong-nguyen-van-thang-chi-dao-gi-196241219121137969.htm

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)