With the aim of promoting digital transformation and the legal framework for the application of digital technology in the banking sector, the Smart Banking 2023 conference and exhibition took place with the theme "Creating, exploiting and connecting data: Shaping the future of banking in the digital age" on the morning of October 6.

In his opening speech, Mr. Tran Van Tan - Vice Chairman of the Vietnam Banking Association Council said that data is a valuable asset. By collecting, analyzing and applying information from different data sources, banks can better understand customers as well as predict market trends and optimize business processes.

Technologies such as artificial intelligence (AI), machine learning and big data analytics have brought the ability to analyze data in detail and quickly. These modern technologies help create valuable information and support businesses to make the most appropriate business decisions.

Specifically, banks can increase customer engagement, create highly personalized products and services, optimize risk detection and fraud prevention processes, improve loan processing and processing, and enhance market forecasting and analytics.

Mr. Tran Van Tan - Vice Chairman of the Board of Vietnam Banks Association.

In addition, the entire industry has focused on cleaning up all 51 million customer data at the Vietnam National Credit Information Center and credit institutions, ensuring that 100% of customer data is verified with the national population database.

However, in the process of applying new models based on modern technology, the banking industry also faces many challenges, including maintaining a balance between data exploitation and protection.

At the workshop, Deputy Governor of the State Bank Pham Tien Dung emphasized: "Banks focus on cleaning and digitizing existing data and must use technology to create clean data in the process of providing services to customers.

During the process of customers making transactions, banks must apply data to ensure that the person making the transaction is the person who registered for the service. The State Bank will always accompany banks in creating a legal basis for banks to develop their products and services."

At the same time, prevent the abuse of bank accounts to conduct illegal transactions. The Deputy Governor also requested the National Credit Information Center CIC to provide more products and services to help banks assess customers' ability to repay debts.

Regarding infrastructure, the State Bank has also provided two basic infrastructures: payment, CIC... Besides developing services, banks must also ensure seamless and continuous operation of the system and ensure security and safety. The entire banking industry is actively implementing Project 06 to increasingly provide better services to customers, ensuring "correct and clean" data.

Deputy Governor of the State Bank Pham Tien Dung.

In order to orient solutions to effectively exploit digital data and ensure security and safety, Mr. Pham Anh Tuan - Director of the Payment Department of the State Bank recommended that the banking industry needs to continue to improve policy mechanisms and legal frameworks.

In addition, it also continues to implement tasks in the Implementation Coordination Plan No. 01 between the Ministry of Public Security and the State Bank in applying population data to clean data, authenticate online, optimize the lending process with credit scoring solutions...

Continue to upgrade and develop technology infrastructure to serve digital transformation such as Interbank Electronic Payment infrastructure, Financial Switching and Electronic Clearing; CIC credit information infrastructure;...

Apply technology to develop convenient, low-cost digital banking products and services; upgrade and expand connections to expand the customer-centric digital ecosystem. Finally, strengthen training and propaganda, financial education for people; Allocate resources to serve digital transformation .

Source

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

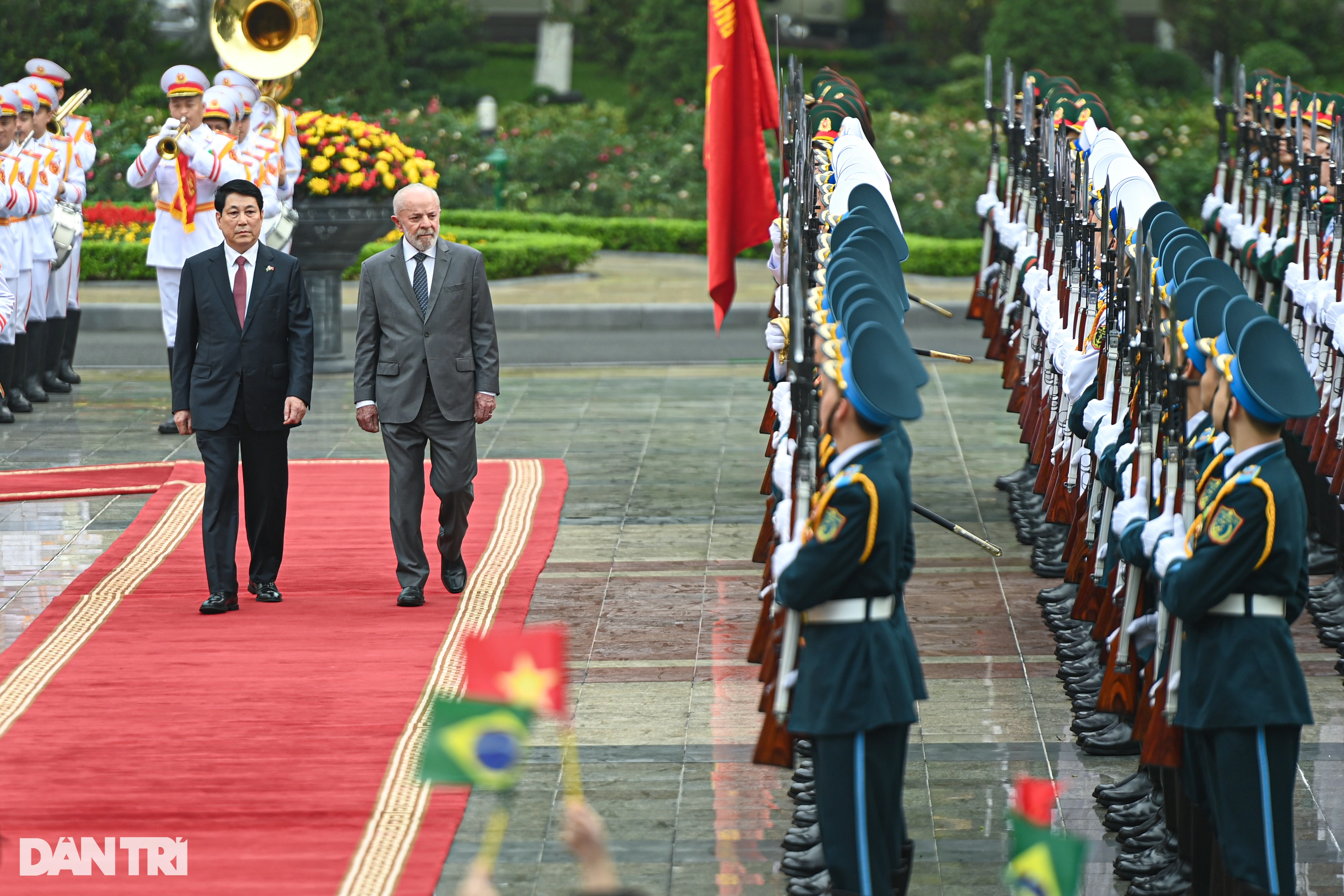

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

Comment (0)