Quang Ngai Road is about to spend nearly 368 billion VND to pay cash dividends in the first phase of 2024

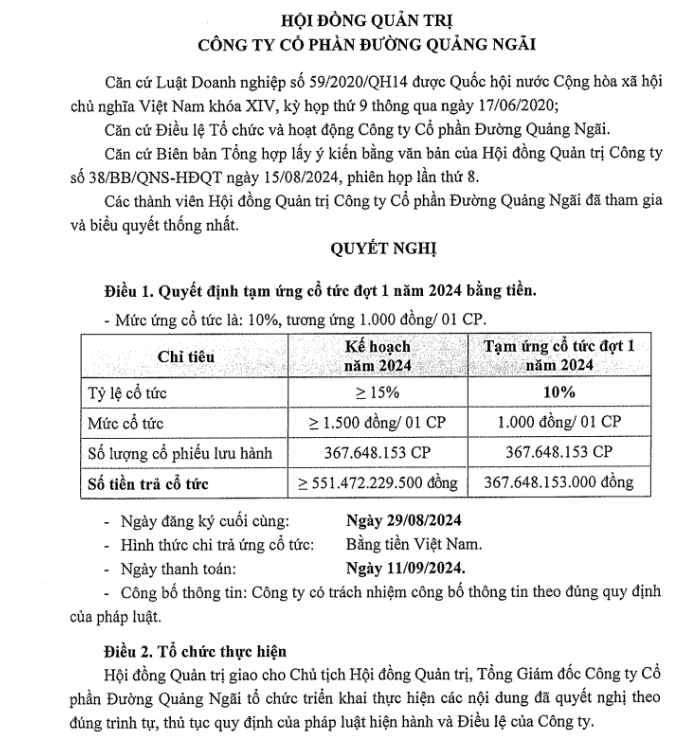

The Board of Directors of Quang Ngai Sugar Joint Stock Company (UPCoM: QNS) has approved the plan to pay the first interim dividend in 2024 in cash.

Specifically, the advance payment rate is 10%/share (1 share receives 1,000 VND). The last registration date is August 29, 2024, the payment date is September 11, 2024.

With nearly 367.7 million shares in circulation, it is estimated that Quang Ngai Sugar needs to spend about 367.7 billion VND for this dividend payment.

With nearly 367.7 million shares in circulation, it is estimated that Quang Ngai Sugar needs to spend about 367.7 billion VND for this dividend payment.

According to this year’s plan, Quang Ngai Sugar will spend at least VND551.5 billion to pay dividends at a minimum rate of 15% in cash. Thus, it is expected that the company will need to pay the remaining 5% dividend once more.

In recent years, Quang Ngai Sugar has maintained high dividend payments to shareholders, ranging from 25-30%. Most notably, in 2023, Quang Ngai Sugar increased the dividend payout ratio to 40% in cash amid record profits of nearly VND2,200 billion.

Quang Ngai Sugar maintains the "tradition" of paying high dividends to shareholders.

After a booming year in 2023, Quang Ngai Sugar's second quarter 2024 business results were somewhat less bright, with net revenue reaching VND 2,820 billion and net profit reaching VND 960 billion, down 10.5% and 3% respectively over the same period last year.

Gross profit also decreased slightly by 2% compared to Q2/2023. However, gross profit margin is still maintained at a relatively good level compared to operating history.

Although business results decreased compared to the same period, in the first 6 months of this year, Quang Ngai Sugar still recorded VND 1,222 billion in net profit, an increase of 19% over the same period in 2023, completing 90% of the annual profit plan.

In terms of the structure of the main business segments, Quang Ngai Sugar's sugar segment has "cooled down" when revenue in the second quarter of 2024 decreased by 28% compared to the same period last year, down to VND 1,060 billion.

In the second quarter of 2024, the price of RS sugar at Quang Ngai Sugar's An Khe Sugar Factory continued to move sideways, fluctuating around VND20,000/kg. The decline in sugar revenue in the second quarter of 2024 was mainly due to the high base effect in the second quarter of 2023.

Meanwhile, the Vinasoy and Fami branded soy milk segment of Quang Ngai Sugar recorded the first signs of recovery in the second quarter of 2024 with net revenue reaching VND 1,185 billion, up 2% compared to the second quarter of 2023 and up 50% compared to the first quarter of 2024.

Since the first quarter of 2023, this is the first quarter that Quang Ngai Sugar's milk segment has achieved positive growth compared to the same period thanks to improved purchasing power.

Ambition to close the Sugarcane - Sugar - Biomass Electricity - Ethanol value chain

It is known that Quang Ngai Sugar is currently boosting investment with a total capital of 2,000 billion VND to increase the capacity of the sugarcane processing factory in An Khe (Gia Lai) to 25,000 tons/year and increase the capacity of An Khe Biomass Power Plant to 135 MW.

The company is also researching and developing an Ethanol production plant from molasses, with an investment capital of VND 1,500 to 2,000 billion and a capacity of 60 million liters/year, expected to be completed in 2026. This project will complete the ambition to close the Sugarcane - Sugar - Biomass Electricity - Ethanol value chain of Quang Ngai Sugar, creating a new source of revenue in the future.

In addition, the company is expanding its sugarcane growing area by 3,000 hectares each year, with a target of reaching 40,000 hectares by the 2027/2028 crop year, helping to increase annual sugarcane output to about 2.4-2.5 million tons.

Quang Ngai Sugar is expanding its sugarcane growing area by 3,000 hectares each year, with the goal of reaching 40,000 hectares by the 2027/2028 crop year, helping annual sugarcane output reach about 2.4-2.5 million tons.

DSC Securities assessed that the results of Quang Ngai Sugar's sugar segment in the first half of this year were still quite good, thanks to the increase in factory capacity and expansion of raw material areas. Domestic sugar prices are expected to only decrease slightly or remain stable due to limited supply and high exchange rates, helping domestic sugar reduce competition from imported sugar.

With domestic sugar prices anchored at around VND20,000 - 21,000/kg, DSC Securities forecasts that the gross profit margin of Quang Ngai Sugar's sugar segment will remain at 29 - 31% in 2024. Quang Ngai Sugar has planned a "cautious" business for this year with total expected revenue of VND9,000 billion and pre-tax profit of VND1,500 billion.

Source: https://danviet.vn/mot-doanh-nghiep-nganh-mia-duong-sap-chi-gan-368-ty-dong-tam-ung-co-tuc-bang-tien-20240816222539601.htm

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Steering Committee on Regional and International Financial Centers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/47dc687989d4479d95a1dce4466edd32)

![[Photo] Ho Chi Minh City speeds up sidewalk repair work before April 30 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/17f78833a36f4ba5a9bae215703da710)

Comment (0)