Quang Ngai Road is about to pay 268 billion VND in advance for cash dividend, phase 1/2024

Quang Ngai Sugar will pay the first dividend of 2024 at a rate of 10%. The dividend will be paid to shareholders by the Company on September 11, 2024.

Quang Ngai Sugar Joint Stock Company (UPCoM: QNS) announced the Board of Directors' Resolution on the first interim dividend payment in 2024 in cash at a rate of 10% (VND 1,000/share). The last registration date to close the shareholder list as announced is August 29, 2024, so the ex-dividend date will be August 28, 2024. The company will pay dividends to shareholders on September 11, 2024. The expected amount to be paid this time is approximately more than VND 267.6 billion.

According to the 2024 plan approved by the General Meeting of Shareholders, this year's dividend rate will be equal to or above 15% in cash. In recent years, Quang Ngai Sugar has regularly paid high dividends, such as in 2023, it paid up to 40%. The company also maintains the "tradition" of paying the first interim dividend in August in recent years.

In addition, this year, Quang Ngai Sugar is stepping up its investment activities. The company has just announced a plan to invest a total of VND2,000 billion to increase the capacity of the sugar processing system from sugarcane at An Khe Factory (Gia Lai province) to 25,000 tons/year, and increase the capacity of An Khe Biomass Power Plant to 135 MW. Quang Ngai Sugar is also in the process of researching to build a project to produce Ethanol from molasses - a by-product of the sugar production process. The Ethanol factory is expected to have a total investment capital of VND1,500 - 2,000 billion, a capacity of 60 million liters/year, and is expected to be operational by 2026. This project will help Quang Ngai Sugar complete the Sugarcane - Sugar - Biomass Power - Ethanol value chain and bring new revenue sources to the business in the future.

At the same time, the company is in the process of expanding the sugarcane growing area by 3,000 hectares per year, expected to reach 40,000 hectares in the 2027/2028 crop year. It is estimated that after expansion, QNS's annual sugarcane output can reach 2.4-2.5 million tons. Along with that, Quang Ngai Sugar.

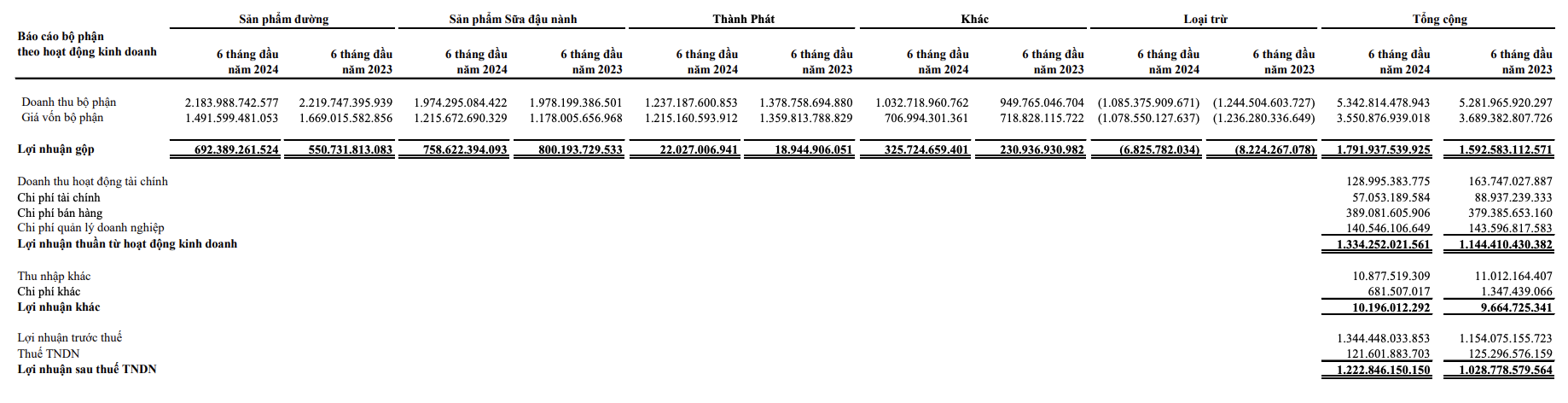

According to the financial report for the second quarter of 2024, net revenue reached more than VND 2,820 billion, down 10.5% over the same period last year. Net profit reached VND 960 billion, down 3% over the same period in 2023. In the second quarter of 2024, revenue from the soy milk segment accounted for 42% of total revenue and reached VND 1,185 billion, up 2% over the same period. However, due to the high price of soybeans, the gross profit margin of this segment decreased from 41% to 38%. Revenue from sugar products accounted for 37.6% of total revenue, reaching VND 1,060 billion, down 28% over the same period last year. However, the gross profit margin of this business segment increased quite a bit.

Accumulated revenue in the first 6 months of the year reached VND5,343 billion, a slight increase compared to the same period last year, and net profit increased by 19% to VND1,222 billion. The main growth driver also came from the sugar segment.

|

| Structure of Quang Ngai Sugar's business activities in the first 6 months of 2024 |

As of June 30, Quang Ngai Sugar's total assets reached VND13,570 billion, up 13% compared to the beginning of this year, of which cash and bank deposits accounted for more than 53% and reached about VND7,200 billion. Undistributed profit after tax reached more than VND5,000 billion.

On the stock market, after reaching a historic peak in mid-May 2024 (around VND 51,600/share), QNS's stock price later adjusted by more than 9% to VND 46,800/share.

Source: https://baodautu.vn/duong-quang-ngai-sap-chi-268-ty-dong-tam-ung-co-tuc-bang-tien-dot-12024-d222553.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)