In the third quarter of 2024, Masan brought in VND 701 billion in profit, nearly 14 times higher than the same period last year and completed 130% of the profit plan in the base scenario. The company is looking towards the last quarter of the year with the goal of getting closer to the VND 2,000 billion profit plan.

In the third quarter of 2024, Masan's net revenue reached VND21,487 billion, up 6.6% compared to VND20,155 billion in the third quarter of 2023 thanks to sustainable growth from retail consumer businesses. Accordingly, at the end of the first 9 months of 2024, Masan recorded VND60,476 billion in net revenue, equivalent to VND220 billion per day. The company reported that it had completed 130% of the base-case after-tax profit plan and was looking towards a positive scenario in the fourth quarter of 2024.

Masan Consumer maintains double-digit growth momentum, will IPO in 2025

Masan's branded consumer goods segment, Masan Consumer (MCK: MCH), continued to perform positively in the third quarter of this year. Masan Consumer's revenue in Q3/2024 increased by 10.4% year-on-year to VND7,987 billion. This positive figure was contributed by the premiumization strategy implemented in the convenience food and seasoning categories, helping to achieve growth of 11% and 6.7% year-on-year, respectively. Innovation in the beverage and home and personal care categories helped achieve growth of 18.8% and 12.4% year-on-year, respectively. The business continued to maintain a high gross profit margin of 46.8% in Q3/2024.

Masan Consumer's IPO process has also recently seen positive developments. Accordingly, on October 2, Masan Consumer announced its plan to transfer MCH shares from UPCoM to HoSE. In addition, the company also announced its plan to offer 326.8 million shares to existing shareholders at a ratio of 100:45.1 (shareholders owning 1,000 shares have the right to buy 451 new shares at VND10,000/share). This could be a move to prepare for the listing of MCH shares on the Ho Chi Minh City Stock Exchange (HoSE). According to information from the company, Masan aims to complete the listing of MCH shares on HoSE in 2025.

WinCommerce achieves positive profit after tax for the whole quarter

For Masan's retail segment, WinCommerce (WCM) recorded a 9.1% year-on-year revenue growth in Q3/2024, reaching VND8,603 billion across the entire network. This was mainly contributed by the new store models WIN (serving urban shoppers) and WinMart+ Rural (serving rural shoppers). WCM's after-tax profit reached a positive figure of VND20 billion in Q3/2024, the first time since the Covid-19 period. This is a sign of a sustainable profit path in the coming time.

As of September 2024, WCM operates 3,733 WCM stores, with 60 new stores opening since Q2 2024. New store openings have been ramping up again. WinMart supermarkets have achieved positive operating profit (EBIT) while revenue growth has been flat, mainly due to improved loss ratios.

According to the report, WCM's strategic focus for the last quarter of 2024 is to continue to achieve positive profit after tax, accelerate LFL growth while accelerating store openings to reach approximately 100 new stores per quarter. WCM continues to strengthen its position in rural areas with the proven WinMart+ Rural model.

Masan MEATLife recorded positive profits for 3 consecutive quarters

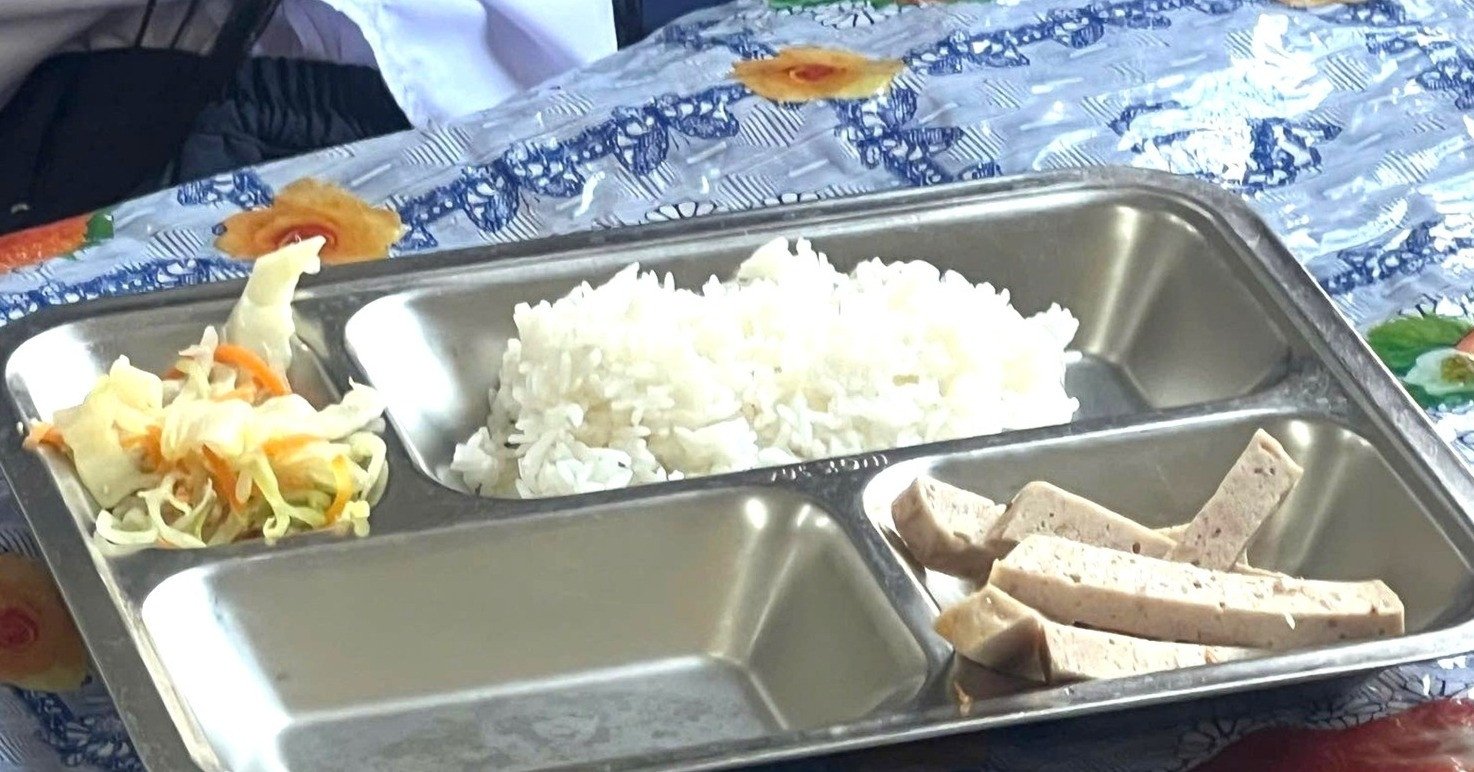

In Q2/2024, Masan’s branded meat segment, Masan MEATLife (MML), recorded a year-on-year increase in operating profit (EBIT) of VND43 billion and a year-on-year increase of VND105 billion in pre-tax profit before minority interest distribution (NPAT Pre-MI) in Q3/2024. This is the third consecutive quarter that MML has reported positive EBIT and the first quarter with positive NPAT Pre-MI (VND20 billion) since 2023. This positive result was driven by increased sales of processed meat segment while benefiting from higher market prices for chicken and pork.

MML continues its mission to “revolutionize” Vietnam’s growing processed meat market with delicious, high-quality products under its two “Love brands” Ponnie and Heo Cao Boi. These two brands have achieved approximately 50% market share in the sterilized sausage product market.

The restructuring of the farm segment is an effort by the company to reduce risks in the volatile farm market, while maintaining the segment at an appropriate scale to ensure uninterrupted supply of raw materials for domestic meat production needs.

Masan's tea and coffee chain - Phuc Long Heritage (PLH) increased 12.8% year-on-year to VND425 billion in Q3/2024, mainly thanks to the contribution from 21 new stores outside WCM opened in the same quarter. PLH currently operates 174 stores nationwide.

“I believe that Masan will be close to achieving its post-tax profit target of VND2 trillion in the positive scenario. We have been focusing on integrating our entire retail consumer platform, aiming for double-digit consolidated revenue and profit growth by 2025,” said Nguyen Dang Quang, Chairman of Masan Group.

The positive business results of the consumer retail business reflect the strong recovery of Masan as well as the consumer market in the first 9 months of 2024. Looking forward to the last quarter of 2024, according to the management, Masan is confident that it will get closer to the 2024 profit plan under a positive scenario.

Vinh Phu

Source: https://vietnamnet.vn/masan-lai-701-ty-dong-trong-quy-iii-nam-2024-2336425.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)