Vietnam National Shipping Lines will be equitized and change its trading name to VIMC from 2020 - Photo: VIMC

Maritime Corporation reports big profits, leaders' incomes are all in billions

Vietnam National Shipping Lines (VIMC) has just announced its audited financial report for 2024. The income levels of key managers are also disclosed in this report.

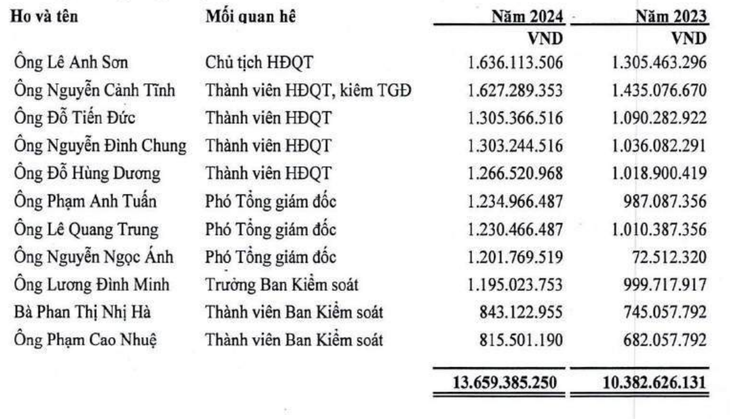

Accordingly, last year VIMC spent more than 13.65 billion VND on income for leaders, an increase of 32% compared to 2023.

The highest earner is Mr. Le Anh Son, chairman of the board of directors, with nearly 1.64 billion VND, equivalent to 136 million VND/month, an increase of more than 25% compared to last year.

Mr. Nguyen Canh Tinh, member of the board of directors and general director, received an income of nearly 1.63 billion VND for the whole year of 2024, an increase of 13%.

Last year, all members of the board of directors and general director of VIMC received an income of over 1 billion VND, higher than the previous year.

On the board of supervisors, Mr. Luong Dinh Minh also received an income of nearly 1.2 billion VND, an increase of 20%.

VIMC transparent leadership income

Regarding business performance, VIMC recorded consolidated revenue last year of VND16,961 billion, up 32% compared to 2023.

During the period, VIMC's financial revenue increased by 29% to VND856 billion. However, interest expenses also increased by 84% to VND372 billion.

In return, profits from joint ventures and associates increased sharply, reaching VND225 billion. As a result, after deducting expenses, VIMC's consolidated after-tax profit reached VND2,629 billion, up 55%.

In its separate financial report, parent company VIMC contributed VND1,640 billion in revenue last year, while after-tax profit reached VND1,353 billion, 3.8 times higher than in 2023.

The reason for the sharp increase in after-tax profit of parent company VIMC is thanks to the "other profit" reaching 960 billion VND, while last year it only recorded nearly 41 billion VND.

According to the explanation, this corporation recorded a revenue of 104 billion VND from liquidation and sale of fixed assets, more than 377 billion VND from written-off loan interest and 468 billion VND from revaluation of assets for capital contribution.

How is the equitization at Quy Nhon Port?

In the separate financial report, the independent auditor also raised two issues that need to be emphasized to VIMC. In it, it mentioned that this corporation is monitoring the investment in Quy Nhon Port Joint Stock Company under the "Investment in subsidiaries" indicator of the balance sheet with a value of 415 billion VND.

The auditor said this is the value that the corporation transferred to Hop Thanh Investment and Minerals Joint Stock Company according to the provisions of the contract for transferring ownership of shares.

By the end of 2024, the parties were still in the process of discussing the value of Hop Thanh Company's legitimate interests during the investment period in Quy Nhon Port Joint Stock Company.

Currently, VIMC still holds 75.01% of shares at Quy Nhon Port, according to the 2024 financial report. Previously, in September 2015, this corporation divested capital at Quy Nhon Port Joint Stock Company under a share transfer contract with Hop Thanh Investment and Minerals Joint Stock Company.

However, in May 2019, implementing the conclusion of the Government Inspectorate on the equitization work at Quy Nhon Port and the direction of the Deputy Prime Minister, VIMC signed a contract with Hop Thanh Company on receiving the transfer of ownership of Quy Nhon Port shares.

By May 2019, the transfer of ownership of more than 30.3 million shares, equivalent to 75.01% of Quy Nhon Port's charter capital to VIMC was carried out.

The total transfer value includes the transfer amount and the legal interests of the investor. Accordingly, the amount of VND 415 billion was paid by VIMC to Hop Thanh in May 2019.

However, by the end of 2024, the parties have not yet determined the value of the legitimate benefits that Hop Thanh enjoys during the investment, management and operation participation period.

Therefore, VIMC said that the corporation has not paid this amount to Hop Thanh and has not recorded the investment value in the separate financial statements.

Regarding Quy Nhon Port's business situation, revenue last year reached VND1,165 billion, an increase of more than 23% compared to 2023, while profit after tax reached VND128 billion, an increase of 11%.

According to the report, Mr. Le Hong Quan - member of the board of directors and general director - received an income of more than 1.23 billion VND in 2024, an increase of 33% compared to 2023. The three deputy general directors, Mr. Ho Lien Nam, Mr. Tran Vu Thanh Quang, and Mr. Dang Van Hoa, all received an income of more than 899 million VND.

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)