If businesses, cooperatives, and farmers share the same vision and orientation for sustainable development, focusing on transparency and environmental protection, they will have the opportunity to access green credit sources and receive worthy support from credit institutions and non-governmental organizations...

Green credit "comes naturally" thanks to sustainable production

Previously, Mr. Tran Van Tien's family in Vam Ray Hamlet (Ham Tan Commune, Tra Cu District, Tra Vinh Province) had income mainly from growing 1 hectare of sugarcane. However, since the sugarcane industry has been competing with smuggled sugar, sugarcane prices have continuously dropped. Mr. Tien has spent a lot of time researching other production models and realized that rice-shrimp rotation is less risky, suitable for local land, and especially the products are safe, so they are favored by the market.

He decided to "knock on the door" of the bank to borrow capital. After reviewing, seeing that Mr. Tien's project was suitable for the "green" loan program, with a more preferential interest rate than a regular loan, the bank staff supported him in completing the necessary procedures. Thanks to that, he had money to renovate the fields, do irrigation, and completely switch to rice cultivation combined with shrimp farming.

Every year, after harvesting two rice crops, he continues to add water to grow another crop of shrimp and crabs in rotation. Shrimp and crabs eat organisms and residues of rice plants, helping to reduce some of the cost of food and care. When it rains, fresh water pushes salt water back into the sea, and Mr. Tien grows rice again. In years when prices are good, his family makes a profit of about 80 million VND/ha/crop, 2-3 times higher than when he only grew sugarcane before.

Mr. Danh Mam, Dong Yen commune (An Bien district, Kien Giang province) developed a clean shrimp - fragrant rice model from the Kien Giang Farmers Support Fund, bringing in nearly 3 times higher income than monoculture rice, and nearly 2 times higher than shrimp farming alone. Photo: Tra My

"Initially, only a few households followed this model, but now more households have joined. This model is very safe because if the rice yield does not reach the desired level, there will still be shrimp, and if the shrimp price drops, there will still be crab to compensate. In addition, the shrimp-rice model adapts well to climate change and has little impact on the environment, so the government encourages, supports, facilitates and guides us to participate in the sustainable rice-shrimp production chain," Mr. Tien affirmed.

Mr. Tien's story is not unique, green capital "comes to you". Green credit is an important driving force for people in rural areas to convert ineffective models to safe, organic rice-shrimp farming, meeting quality and GAP standards (VietGAP, GlobalGAP). Even if they have a sustainable, environmentally friendly production model, people and businesses will have the opportunity to access green capital sources from domestic and foreign financial institutions and non-governmental organizations.

As the owner of a leading coffee and pepper exporting business to Europe, 14 years ago, Mr. Phan Minh Thong (Phuc Sinh Joint Stock Company - Ho Chi Minh City) carried out sustainable development work in the raw material area in the Central Highlands to meet customer requirements. At that time, the European importer required that by 2015, all coffee and pepper products of Phuc Sinh must have European food safety certificates before being imported and distributed to supermarkets.

Sharing with Dan Viet, Mr. Thong said that at that time, he simply thought of "doing as per customer's request". After a while, Mr. Thong realized that this path not only brought more profit but also sustainable development would be a mandatory trend.

In fact, when Phuc Sinh achieved Rainforest Alliance certification (RA - Sustainable Agriculture Standard Certification to help protect forests and the environment), customers were willing to pay more for certified products.

Farmers in Mai Son district (Son La province) harvest ripe coffee beans that meet standards to supply to Phuc Sinh Son La factory of Phuc Sinh Joint Stock Company. Photo: TL

Thanks to that, Mr. Thong has more money and motivation to continue sustainable development, build a traceability system, invest in training programs for farmers and company employees to help them raise awareness and improve their skills in practicing ESG standards (Environment, Society and Governance).

In fact, when Phuc Sinh's coffee region achieves Rainforest Alliance certification (RA - Sustainable Agriculture Standard Certification to help protect forests and the environment), customers are willing to pay more for certified products.

Thanks to that, Mr. Thong has more money and motivation to continue pursuing the path of sustainable development, building a traceability system; investing in training programs for farmers and company employees to help them raise awareness and improve their skills in practicing ESG standards (Environment, Society and Governance).

The sweet fruit of Phuc Sinh's persistence in green production is that last October, the company received a non-refundable grant from the Netherlands Fund for Climate and Development (DFCD), worth 575 million Euros, to support the company's ESG and sustainable development initiatives. This is the largest non-refundable grant ever granted by DFCD to an agricultural company in Vietnam. Previously, in mid-August 2024, Phuc Sinh also received an investment worth 25 million USD from the Netherlands' Green & Investment Fund to do sustainable agriculture.

Sharing with Dan Viet, Mr. Phan Minh Thong said: "The key here is that even without investment funds providing money, Phuc Sinh still does sustainable development projects for farmers in coffee and pepper raw material areas. We do it because it benefits the business itself, the products are easily traceable, not for achievements."

Farmers tend sustainable coffee gardens in the raw material area system of Phuc Sinh Joint Stock Company in Nhan Dao commune, Dak R'Lap district, Dak Nong. Photo: Hoai Yen

The demand for green credit in the agricultural sector is huge.

Mr. Le Duc Thinh - Director of the Department of Economic Cooperation and Rural Development (Ministry of Agriculture and Rural Development of Vietnam) said that the demand for green capital of farmers, cooperatives and enterprises is very large. The project of 1 million hectares of high-quality, low-emission rice associated with green growth from now to 2030 alone is expected to require capital of about 2.7 billion USD. Along with that, the pilot project to build a standard agricultural and forestry raw material area for domestic consumption and export in the period of 2022-2025 needs a total budget of about 2,500 billion VND.

In addition, the Ministry of Agriculture and Rural Development is also implementing Decision 3444/QD-BNN-KH on the plan to implement the national strategy on green growth for the period 2021-2030 and implementing the Project to improve the capacity to adapt to climate change of agricultural cooperatives in the Mekong Delta for the period 2021-2025.

"On October 15, the State Bank informed about the implementation of the Project of 1 million hectares of high-quality, low-emission rice associated with green growth, with 2 phases of capital lending (based on the 2 phases of the Project implementation according to Decision 1490). In which, the pilot phase from now until the end of 2025 is with Agribank as the main lending bank and the expansion phase from the end of the pilot to 2030 is at credit institutions. The State Bank also requires credit institutions to proactively balance capital sources, reduce costs to consider applying a lending interest rate that is at least 1%/year lower than the lending interest rate of the corresponding term currently applied to customers of the same term/same group".

PV

In fact, agriculture is not only the main economic sector of Vietnam but also the livelihood of the majority of the population. The agricultural sector is the second largest source of greenhouse gas emissions in Vietnam, after the industrial sector – according to research results from the Food and Agriculture Organization of the United Nations (FAO) and the World Bank (WB).

Therefore, the above projects all aim to transform production towards green and sustainable development, with the main goal of reducing production costs, reducing environmental pollution, protecting natural resources and increasing farmers' income.

"With an export-oriented economy like Vietnam, the green transformation of enterprises, cooperatives and farmers is considered inevitable and vital. In this context, green credit is an important financial tool, helping actors participating in the production chain access preferential capital sources to invest in sustainable agriculture, organic agriculture and circular agriculture projects," said Mr. Le Duc Thinh.

However, not all people, businesses or projects can easily access green capital. As shared by Mr. Nguyen Ba Hung, Chief Economist of ADB in Vietnam, not all customers who say they plant forests or do organic agriculture are qualified to access green credit and green finance.

"Currently, the legal corridor of green economy and green finance is still being gradually completed. Therefore, banks are not only financial intermediaries but also play a supporting role, accompanying people and businesses in completing procedures to prove that the project is green and meets lending criteria," said Mr. Hung.

This is also one of the problems raised by Mr. Le Duc Thinh - Director of the Department of Economic Cooperation and Rural Development (Ministry of Agriculture and Rural Development) when mentioning the problem of supply and demand of green credit capital not meeting.

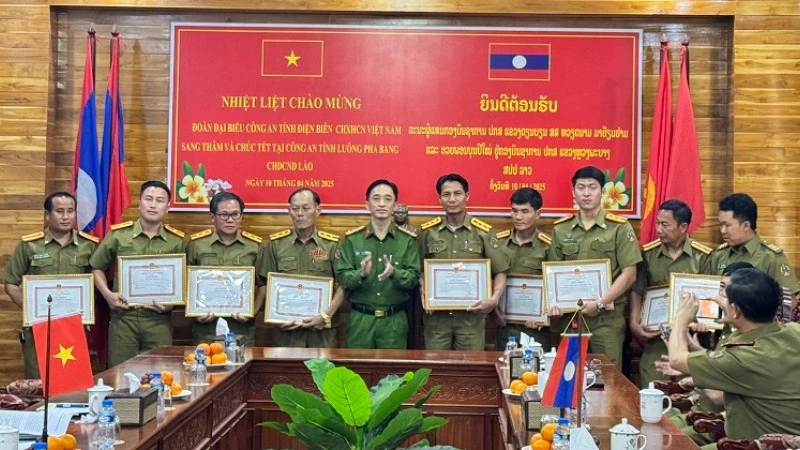

Mr. Le Duc Thinh - Director of the Department of Cooperative Economics and Rural Development (Ministry of Agriculture and Rural Development) affirmed that the demand for green credit capital of farmers, cooperatives and enterprises is very large. Photo: K. Nguyen

Mr. Thinh said that in reality, whether borrowing green capital or conventional capital, businesses and people still have to meet conditions such as having a project with collateral and a feasible business plan. At the same time, they must meet environmental and emission conditions depending on the requirements of each credit institution. However, proving that the project and production plan meet all of the above criteria is not simple for people and businesses in the agricultural sector.

Some projects in the value chain, people borrow but they do not invest in production but to rotate capital, purchase raw materials, advance to farmers to build linkage contracts. In some countries, with these loans, they will not base on credit but through agricultural product purchase contracts, frequency of agricultural product transactions. But in Vietnam, credit institutions do not lend in this direction because the agricultural value chains in our country are not transparent enough and do not have enough data for them to believe that these are real transactions.

"This is not the fault of credit institutions making things difficult, nor is it because farmers or businesses have too weak capacity, but because we currently do not have a legal corridor, clear regulations, or technical standards for green production processes, so there is nothing to guarantee risks for lending institutions, leading to banks having difficulty making decisions on capital injection. Lenders and borrowers cannot come together," said Mr. Thinh.

From this reality, Mr. Thinh believes that there needs to be synchronous solutions to meet the supply and demand of green credit capital. However, on the part of farmers, businesses and cooperatives, according to Mr. Thinh, they must coordinate closely with each other, reorganize production to make the entire process of participating in the value chain in production transparent.

In particular, cooperatives and enterprises need to pay attention to financial transparency, environmental improvement solutions and governance. These factors are "plus points" in loan/funding applications.

Mr. Albert Bokkestijn - Project Manager of the Netherlands Fund for Climate and Development (SNV-DFCD):

“Companies that put sustainability at the core of their business operations are more likely to attract funding. This funding comes not only from commercial funds but also from NGOs, including SNV-DFCD, especially at a time when the term ESG is becoming a global focus.”

Ms. Natalia Pasishnyk - Director of Sustainable Development, Investment & Green Fund (Netherlands):

"Vietnamese agriculture is making many changes and attracting the attention of international investors. In the world, agriculture is also considered one of the most effective ESG investments and is being chosen by investors and businesses to comply. If it is not developed sustainably and does not practice good ESG, funds and credit institutions will not access capital."

Source: https://danviet.vn/tin-dung-xanh-dong-luc-phat-trien-ben-vung-lam-sao-de-von-xanh-tu-tim-den-bai-3-20241105155917353.htm

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] The capital of Binh Phuoc province enters the political season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c91c1540a5744f1a80970655929f4596)

Comment (0)