Update latest OCB interest rates

According to the Lao Dong Newspaper reporter (February 14, 2024), the interest rate table OCB is posting for savings customers is fluctuating from 2.9 - 6%.

In particular, OCB's high interest rate applies to savings terms of 12 months or more. The highest interest rate is 36 months, at 6%/year, applied to online deposits with interest received at the end of the term.

2.9% is the lowest interest rate OCB lists when customers deposit savings for 1 month. For 3-month term, OCB interest rate is 3.1%. In addition, readers can refer to and compare OCB interest rates for different terms in the table below.

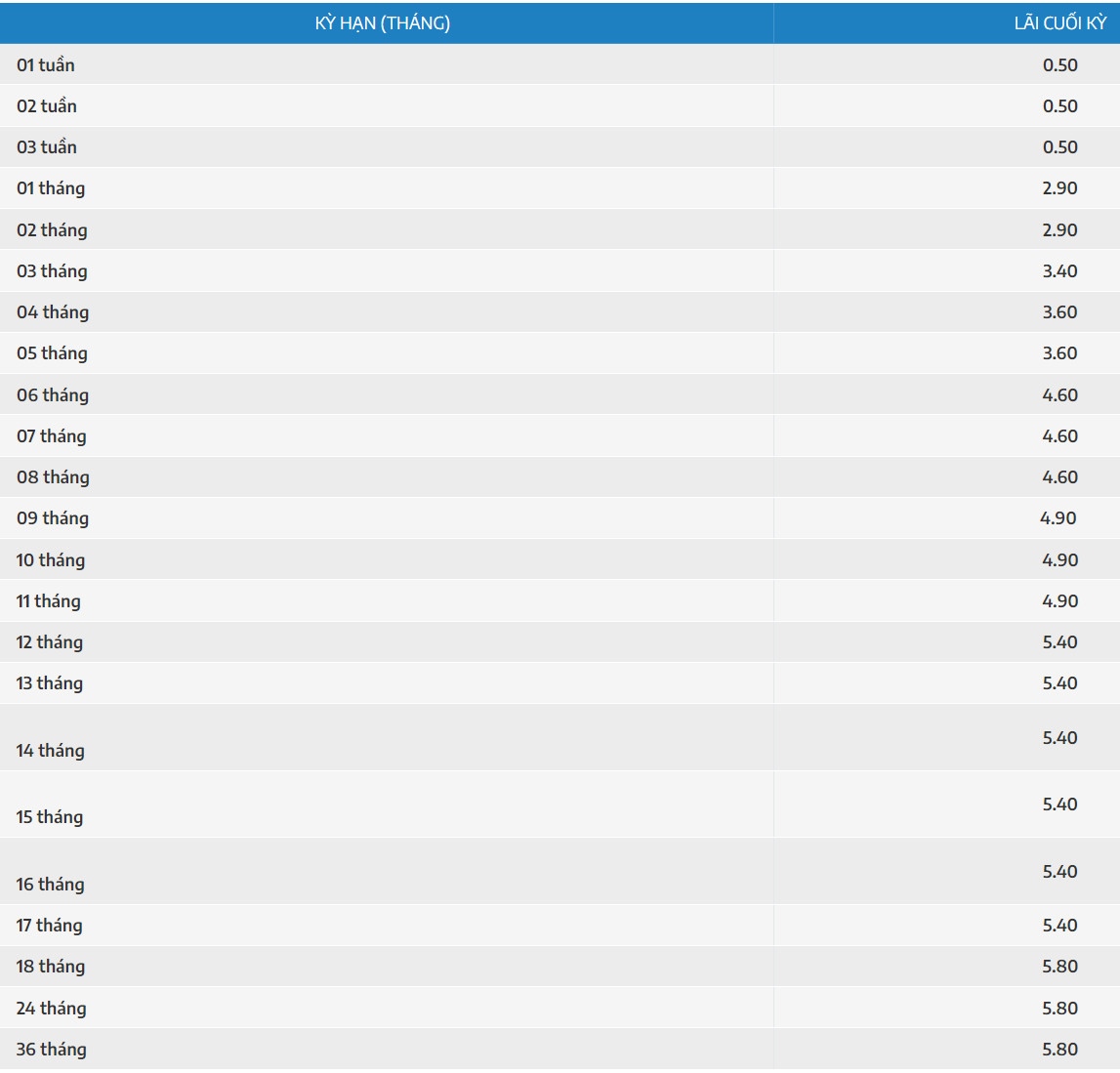

Update latest VRB interest rates

According to the record, VRB's listed interest rates for customers with savings deposits are fluctuating from 4.1-5.4%. In particular, VRB's high interest rate applies to savings deposits of 15 months or more (5.4%/year - applied to online deposits with interest received at the end of the term).

24.1% is the lowest interest rate listed by VRB when customers deposit savings for 1-2 months. For a 3-month term, VRB's interest rate is 4.3%. In addition, readers can refer to and compare VRB's interest rates for different terms in the table below.

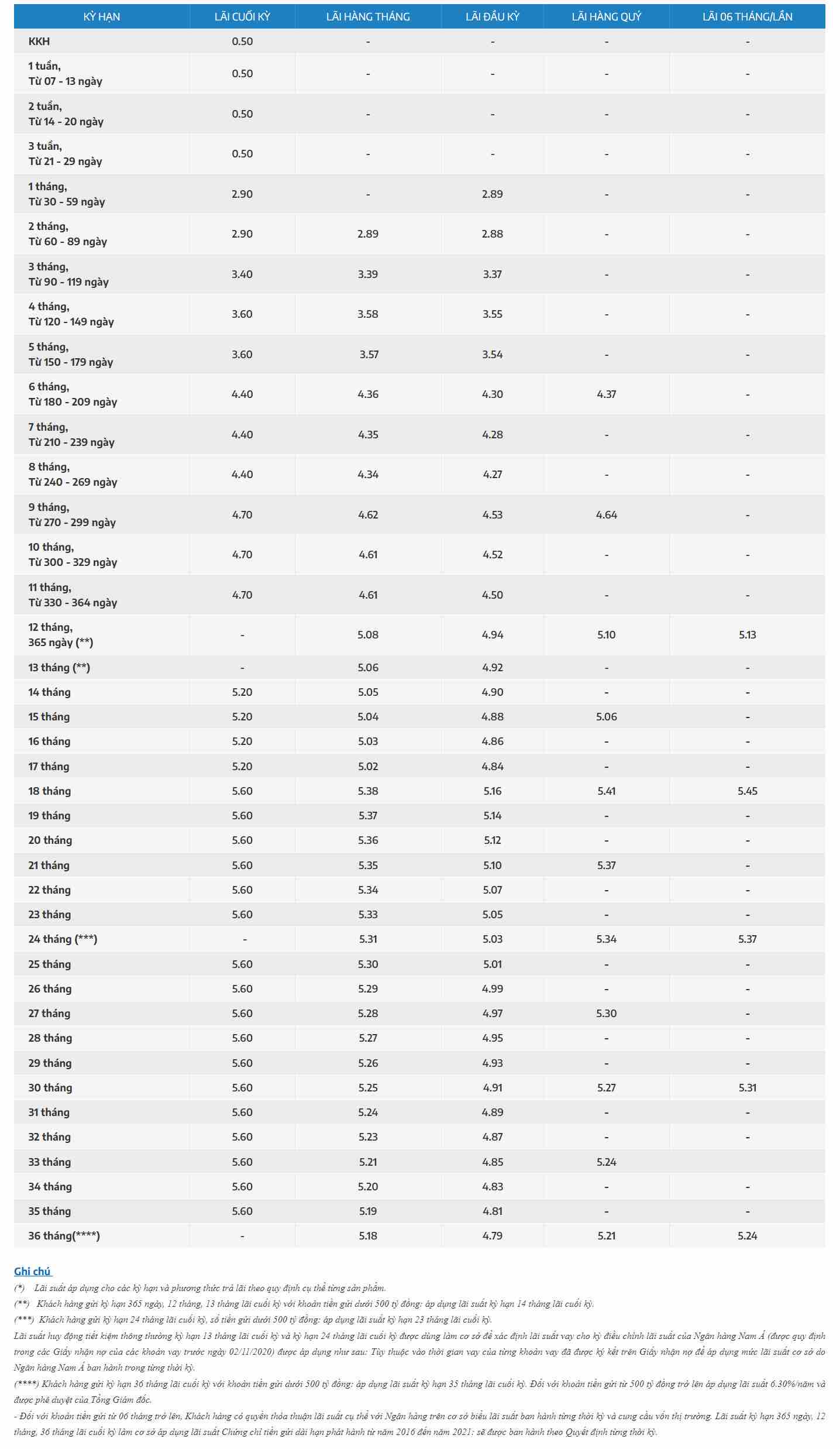

Update the latest Nam A Bank interest rates

According to the record, Nam A Bank's listed interest rates for customers depositing savings are fluctuating from 2.9-5.8%.

In particular, VRB's high interest rate applies to savings terms of 18 months or more. In particular, the highest interest rate is applied by Nam A Bank for terms of 18-24-36 months (5.8%/year - applied to online deposits with interest received at the end of the term).

Readers can refer to and compare Nam A Bank interest rates for different terms in the table below:

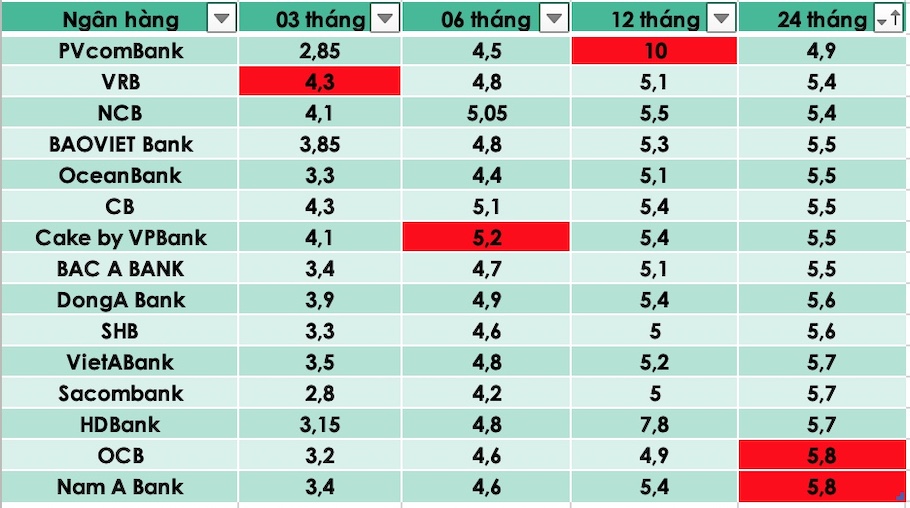

Readers can refer to banks with high interest rates on the market through the following table:

How to calculate interest when saving at the bank accurately

You can calculate the interest you receive when saving in banks using the formula:

Interest = Deposit x interest rate (%)/12 months x number of months of deposit.

For example, you deposit 500 million in OCB, with an interest rate of 4.8% for a 12-month term. After 1 year, the amount you can receive is:

Interest = 500 million x 4.8%/12 months x 12 months = 24 million VND.

You deposit 500 million in VRB, with an interest rate of 5.1% for a 12-month term, after 1 year, the amount you can receive is:

Interest = 500 million x 4.8%/12 months x 12 months = 25.5 million VND.

Or you deposit 500 million in savings at Nam A Bank, 12-month term with 5.4% interest rate, after 1 year, the interest you can receive is:

Interest = 500 million x 5.4%/12 months x 12 months = 27 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

In addition, readers can refer to more articles about interest rates from Lao Dong Newspaper HERE

Source

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)