"Big hands" buy land hoping to catch the new "wave"

Up to now, the 12-month savings interest rates of most major banks are below 5.3%/year. Specifically, at Techcombank, the deposit interest rate is 5.25%, Vietcombank (5.1%), Agribank (5.5%), BIDV (5.3%), VPBank (5.3%). The interest rate is recorded as the lowest since the Covid-19 pandemic.

Faced with the trend of decreasing savings interest rates, many real estate investors believe that people with money will no longer be interested in depositing money in banks. Instead, they will turn to investment channels that bring higher profits than savings.

Real estate will attract cash flow when interest rates decrease (Illustration: Tien Tuan).

In fact, the "cheap money" period from early 2020 to mid-2022 was the time when the real estate market was "surging" and real estate prices were "dancing". Therefore, in the coming time, when cheap bank interest rates hit rock bottom, many investors expect "old books rehashed", and the cash flow into real estate will explode.

No longer on the defensive like over the past year, early last September, Mr. Nguyen Minh Quang - an experienced real estate investor in Hanoi - and his investment group went looking for land in the suburbs. The criteria for this investment group to buy are land plots with financial value of 3-5 billion VND, with clear legal status.

"In my opinion, this is the time for the market to recover, buying real estate at this time brings more opportunities than risks. The cash flow into real estate due to low interest rates is also expected to create a new "wave" for the market," said Mr. Quang.

Similar to Mr. Quang, Mr. Tran Duy Hai - a professional real estate investor - is optimistic that the real estate market is showing good signs of recovery. Currently, it is in the early stages of the recovery process, so the investment opportunities are huge.

"Except for apartments, prices of many other real estate products such as land, resort real estate, etc. have stagnated and many products are being sold at a loss or at deep discounts. With interest rates falling sharply, I think that investing now will generate big profits in the next 1-2 years," Mr. Hai shared.

The time of "land fever " is difficult to predict

It can be seen that the information about the sharp decrease in bank interest rates has somewhat warmed the real estate market, helping to relieve the psychology of investors. However, according to experts, the period of "cheap money" for real estate is over.

First, the current low interest rate incentives only last for 3-6 months, the longest is only 12 months. These figures are not attractive enough for investors to borrow money to buy real estate and wait for prices to increase.

Second, the wait-and-see mentality is still heavy, both individual investors and home buyers are not really ready to have cash flow or credit to buy real estate, unless there is a really good product.

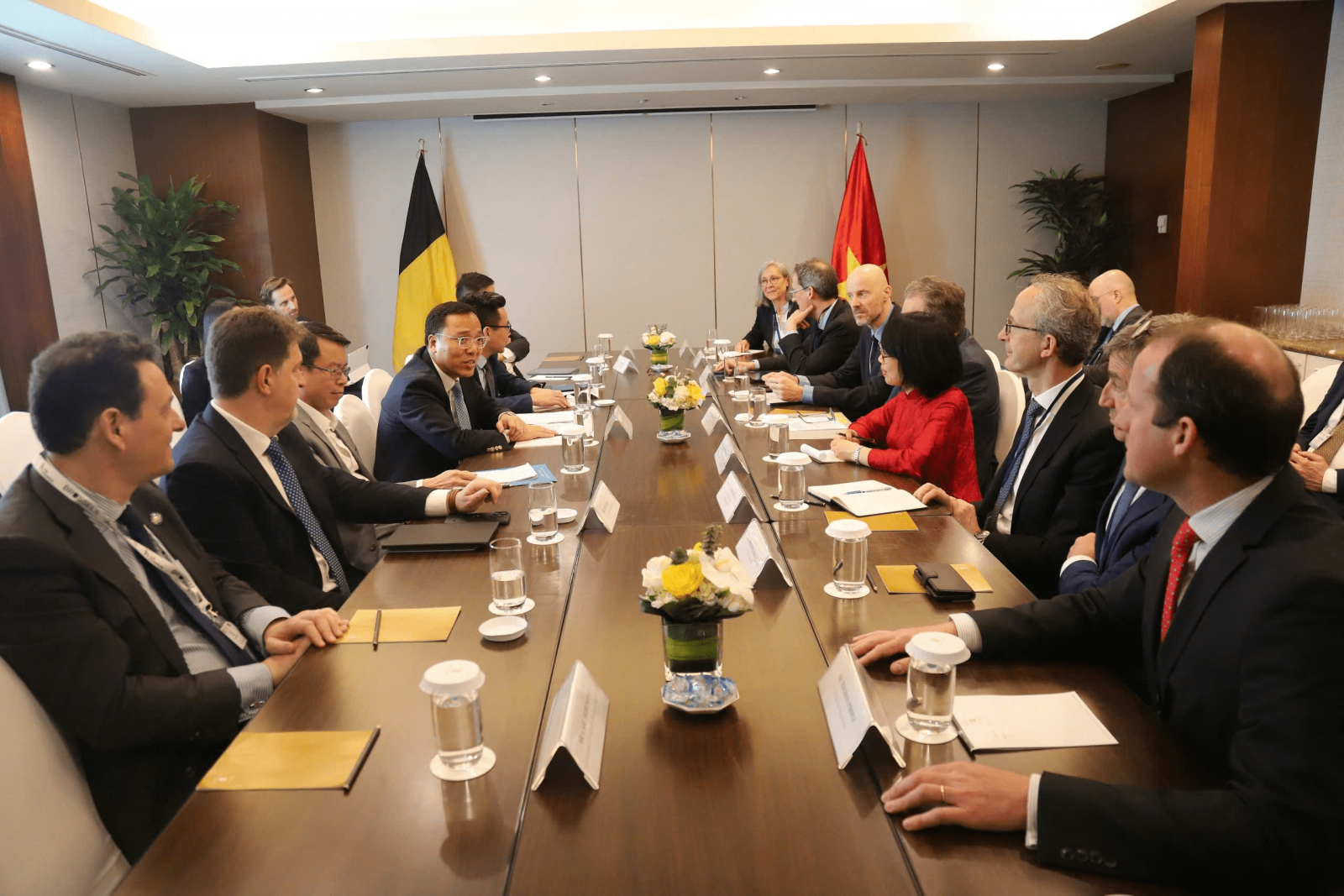

Experts predict that a "land fever" is unlikely to occur in 2024 (Illustration: Ha Phong).

In a recent report, VNDirect forecasted that the real estate market will remain sluggish in 2024, and the recovery will be clearer from the second half of 2024 when monetary policy is loosened.

According to this securities company, there is a big difference between the current period and the period of 2011-2012. In the previous period, the market was in a state of oversupply and inflation was at a very high level, while currently the project supply is very limited and demand is still lurking at a high level.

Based on research that spans the repeating cycle, the above unit predicts that the "land fever" may return in the period 2025-2026.

According to Mr. Nguyen Van Dinh - Chairman of the Vietnam Association of Realtors (VARS), although investor sentiment is gradually becoming more positive, it is still quite cautious, especially for customers facing financial pressure from previous losing investments, so many people choose to deposit money in banks.

To remove the waiting mentality of investors and customers, thereby stimulating the flow of bank maturity money into real estate, according to this expert, the most important thing right now is to speed up the process of removing legal obstacles and accessing capital for businesses, unblocking supply in the market.

Sharing about this issue, Mr. Vo Hong Thang - an expert of DKRA Group - said that the current time until the first half of 2024 can be seen as the beginning of a recovery and next growth cycle of the real estate market. It is difficult to predict the time of "land fever" but the market currently needs recovery.

Source

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

Comment (0)