Although the business situation in the fourth quarter of 2023 has improved, it is not enough to help textile and garment enterprises prosper. There are many positive signals and expectations for 2024, but difficulties will still remain.

According to data from the Vietnam Textile and Apparel Association (VITAS), in 2023, textile and garment export turnover is estimated to reach about 40.3 billion USD, down 10% compared to 2022 and much lower than the initial target set by the industry (47-48 billion USD).

In addition to the decrease in orders, production unit prices also decreased by an average of 30%, and some types even decreased by 50%.

Expected to recover in the fourth quarter of 2023 due to increased year-end shopping demand, but, in the context of general difficulties, although orders have improved, the textile and garment industry's business results in the fourth quarter and 2023 are still quite gloomy.

In order to save costs, many businesses have even had to cut a large number of employees.

Profits plummet, drastic cuts in labor

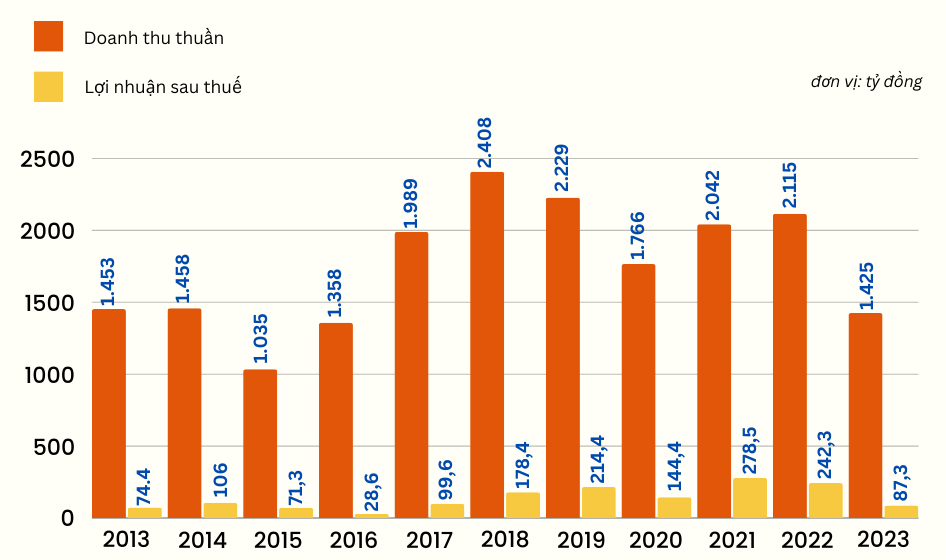

Profit at the lowest level in the past 7 years, Century Fiber Corporation (STK, HOSE) only earned 87.3 billion VND in profit, a sharp decrease of 64% compared to 2022. The main reason comes from the revenue decreasing by 33% compared to the same period.

According to the plan for the whole year, STK has only completed 66% of revenue and 35% of profit.

Revenue and profit developments at Century Fiber Corporation over the past 10 years

Source: Financial Statements

Notably, total assets by the end of 2023 at STK increased to VND 2,975 billion, an increase of 40% compared to the beginning of the year. Mainly due to the debt payable skyrocketing 2.3 times compared to the beginning of the year, up to VND 1,347 billion, accounting for 55% of total assets.

Thanh Cong Textile - Investment - Trading Joint Stock Company (TCM, HOSE) earned VND3,325 billion in net revenue in 2023, down 23% compared to 2022. However, due to high deferred tax collection costs, 3 times higher at VND2.2 billion, after-tax profit decreased by more than half compared to last year, at VND133.8 billion.

With this result, TCM has only achieved 76% of revenue and 49% of profit according to the yearly plan.

According to the company's explanation, the business results in 2023 have not met the plan and decreased compared to 2022 due to a sharp decrease in demand for textile and garment products in the context of many global economic difficulties and prolonged inflation in export markets, of which the strongest impact is from the US and EU markets. In addition, input costs of raw materials and logistics have also increased.

In 2023, not only affected by the general difficult context, Binh Thanh Production, Trading and Import-Export Joint Stock Company - Gilimex (GIL, HOSE) faced even more difficulties when a dispute arose over a sales contract with Amazon.

Although the results of the fourth quarter of 2023 recovered quite quickly, increasing 9 times compared to the same period, it still could not help the results to be more positive.

Net revenue in 2023 decreased sharply by 70.4% compared to the same period, profit after tax at Gilimex was also pulled down, only 28 billion VND. This figure in 2022 was 361.4 billion VND, down more than 92%, at the same time, the lowest level in the past 7 years.

In addition, compared to the third quarter, by the end of 2023, the number of employees at the company had decreased significantly, about 390 people, down to 968 employees. Previously, in the first 9 months of 2023, GIL had cut nearly 530 employees.

Thus, in just 1 year, the number of employees at Gilimex has decreased by about 920 people.

Also drastically cutting a large number of employees , Garmex Saigon Joint Stock Company (GMC, HOSE) by the end of 2023, will have only 35 employees, thus, compared to the beginning of 2023, the staff at Garmex has decreased by nearly 2,000 people.

In the past two years, the company has cut nearly 3,800 employees.

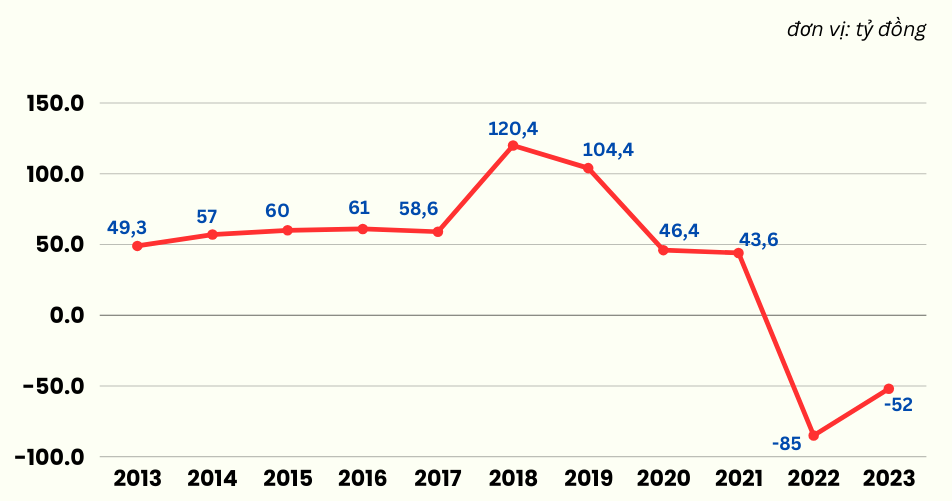

Profit development at Garmex Saigon JSC over the past 10 years

Source: Financial Statements

In 2023, Garmex only earned 8.3 billion VND in net revenue, down 97% year-on-year; negative profit of 52 billion VND. This is also the second consecutive year of losses for this business.

According to the explanation, in the fourth quarter of 2023, the company had no orders, which caused the company to continue to incur losses, despite cutting costs.

A few "bright spots" that create expectations

Closing 2023, although difficulties were predicted, businesses were cautious in making plans, but only a few textile and garment businesses had results exceeding the annual profit plan.

Typically, Hung Yen Garment Corporation (HUG, UPCoM) completed 92% of revenue and exceeded 121% of the year's planned profit, reaching VND690.5 billion and VND75.8 billion, respectively.

Also exceeding targets, May10 Corporation (M10, UPCoM) completed nearly 100% of revenue and 112% of profit according to the yearly plan when net revenue reached 4,139 billion VND, profit reached 123.4 billion VND.

There are also names such as Viet Tien Garment Joint Stock Corporation (VGG, UPCoM), Hue Textile and Garment Joint Stock Company (HDM, UPCoM),... that have tried to complete the yearly plan.

The export situation of Vietnam's textile and garment industry in January 2024 showed positive signs, with export turnover increasing by nearly 29% over the same period. The industry's production indexes also increased, especially the production of natural fiber fabrics increased by 57%.

With the above results, many expect a prosperous year for the textile and garment industry . In 2024, the Vietnam Textile and Apparel Association (VITAS) set a positive export turnover target for the entire industry at 44 billion USD, an increase of 9.2% compared to 2023.

Assessments from many financial institutions show that the textile and garment industry's order outlook in 2024 will be positive, however, difficulties will still remain.

According to SSI Research, tensions in the Red Sea could have a ripple effect on the business performance of export enterprises in the first quarter of 2024. In 2024, the gross profit margin of textile and garment companies is expected to gradually improve to 14-15%, due to a slow recovery in demand throughout the year.

Source

Comment (0)