Not only in Vietnam, IPO delays are occurring in many countries in the Southeast Asian region in 2024. However, there are still factors that are driving the IPO process to accelerate next year.

Not only in Vietnam, IPO delays are occurring in many countries in the Southeast Asian region in 2024. However, there are still factors that are driving the IPO process to accelerate next year.

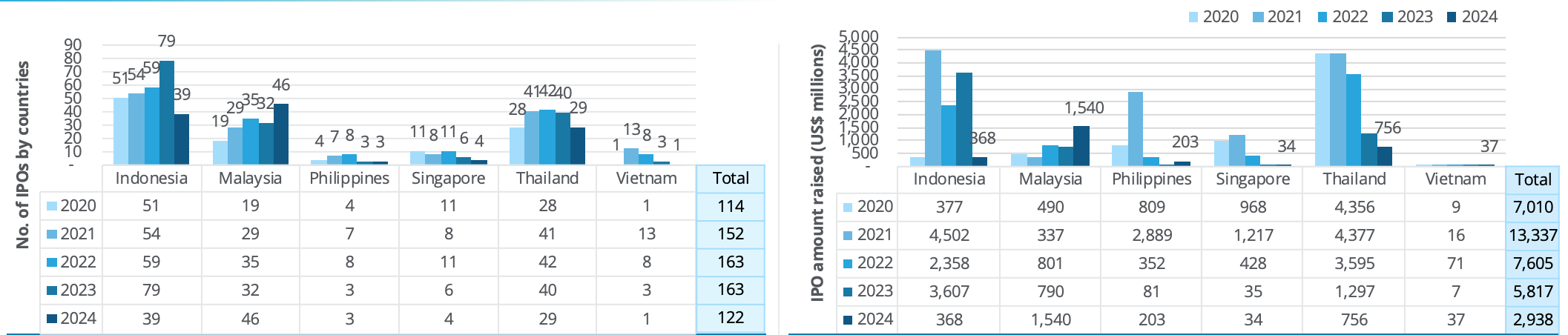

Number of IPOs drops sharply in many Southeast Asian countries

Deloitte's report on the IPO capital market in Southeast Asia said that from the beginning of the year to November 15, 2024, Vietnam only had 1 IPO deal, which was DNSE Securities Company.

In terms of quantity, the number of IPO deals this year in Vietnam is much lower than in 2023 (3 deals), but the value raised through IPOs has grown dramatically. DNSE's IPO raised about $37 million, surpassing the total fundraising results of the entire Vietnamese market in 2023.

Vietnam is not the only market in Southeast Asia that has seen a decline in the number of IPOs but an increase in the amount of capital raised.

In Thailand, although the number of IPOs declined year-on-year, with only 29 in 2024, the total amount raised – $756 million – accounted for 26% of the region’s total, making Thailand one of the top three markets in Southeast Asia. There are currently many opportunities in the Thai market with a series of upcoming IPOs in the Consumer, Life Sciences and Healthcare, and Real Estate Investment Trust (REIT) sectors.

The bright spot in the region was Malaysia, with 46 IPOs – surpassing the 32 for all of 2023 and the highest since 2006. The total amount raised through IPOs reached $1.5 billion, the highest since 2017, while the market capitalization reached $6.6 billion, double the previous year and the highest since 2013. The ACE market continued to be influential this year with 34 IPOs, the highest ever recorded since the market was established in 2009. Malaysia leads the region in all three key metrics: number of IPOs, total amount raised, and IPO market capitalization.

On the other hand, Indonesia’s 2024 IPO market recorded a significant decline with 39 IPOs raising $368 million, compared to 79 IPOs raising $3.6 billion in all of 2023. Smaller companies participated in IPOs with more cautious fundraising targets due to the country’s election year in 2024 and were negatively impacted by global market headwinds.

Singapore has seen four IPOs on Catalist, raising about $34 million so far this year. The Singapore Exchange (SGX) has also seen two new secondary listings from the Hong Kong Stock Exchange: Helens International Holdings, a China-based investment holding company primarily engaged in bar operations and franchising, and PC Partner Group Limited, a manufacturer and distributor of electronic products.

With Indonesia’s sharp decline, the IPO capital market in Southeast Asia saw 122 IPOs in the first 10.5 months of 2024, raising about $2.9 billion. While the number of IPOs still showed positive signs, the total capital raised was at its lowest level in the past 9 years, down sharply from the $5.8 billion raised through 163 IPOs in 2023.

|

| Number of IPOs and value raised by countries in the Southeast Asian region. Source: Deloitte |

Prepare for cash flow into new IPOs in 2025

In terms of sectors, Consumer and Energy - Resources are the two dominant sectors in the region, accounting for 52% of total IPO deals and 64% of total IPO capital raised.

The Southeast Asian consumer industry is undergoing significant transformation due to changing consumer behavior, leading to increased competition between domestic, regional and international companies. This change is driven by the region’s growing GDP, resulting in an expanding and increasingly affluent middle class with greater spending power. As incomes rise, these consumers are better positioned to make more informed choices, opt for premium products and seek out new experiences.

The Energy and Resources sector, especially renewable energy, continues to be a focus for Southeast Asia as the region grapples with the triple whammy of ensuring energy security, equity and environmental sustainability as it transitions to more sustainable resources while balancing growing energy demand.

However, Deloitte said that the region’s decline in IPO activity compared to last year was largely due to the lack of blockbuster IPOs. In 2024, there was only one IPO raising more than $500 million, compared to four similar deals in 2023.

|

| 10 largest IPOs in Southeast Asia from the beginning of 2024 to November 15, 2024. Source: Deloitte |

Tay Hwee Ling, Accounting Assurance & Reporting Leader, Deloitte Southeast Asia, said that the Southeast Asian IPO market faced significant challenges in 2024, including currency volatility, regulatory divergence between markets, and geopolitical tensions, which impacted trade and investment. High interest rates across ASEAN economies continued to constrain corporate borrowing, slowing IPO activity as companies chose to delay their listings.

Additionally, market volatility among major trading partners has weighed on investor confidence, while differing regulatory requirements across Southeast Asian countries complicate companies’ aspirations to list across borders.

Looking ahead to the future of the region’s IPO market, Ms. Hwee Ling expects: “The expected interest rate cuts, coupled with a reduction in inflation, could create a more favorable environment for IPOs in the coming years. Southeast Asia’s strong consumer base, growing middle class, and strategic importance in sectors such as real estate, healthcare, and renewable energy remain attractive to investors. As foreign direct investment continues to flow into the region, 2025 is poised to be a year for new IPOs across Southeast Asia.”

Regarding the Vietnamese market, Mr. Bui Van Trinh, Deputy General Director of Assurance Services, Deloitte Vietnam believes that the Vietnamese stock market in 2024 is experiencing certain difficulties, but this is also an ideal time to seize opportunities, supported by favorable macroeconomic conditions and a low interest rate environment. In addition, the Government has also issued new regulations to help upgrade the stock market to strengthen investor confidence in 2025.

Source: https://baodautu.vn/ky-vong-cac-thuong-vu-ipo-tang-toc-trong-nam-2025-d230540.html

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

![[Photo] President Luong Cuong hosts state reception for Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/56938fe1b6024f44ae5e4eb35a9ebbdb)

Comment (0)