(NLDO) – Banks constantly innovate, flexibly mobilize capital, reduce costs, stabilize interest rates, and contribute to economic development.

On the occasion of the Lunar New Year, a reporter from Nguoi Lao Dong newspaper had a conversation with Mr. Tu Tien Phat - General Director of Asia Commercial Joint Stock Bank (ACB) about this issue.

- Reporter: In 2025, the Government expects the economy to grow by 8%. In your opinion, what factors will help Vietnam achieve this goal?

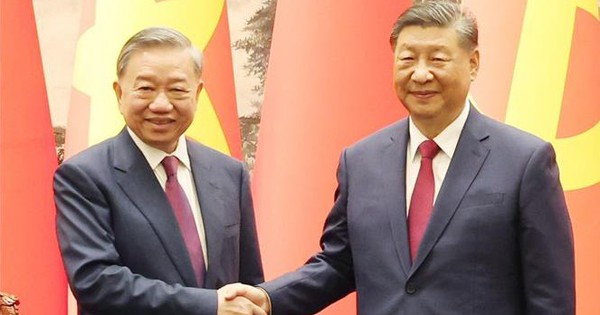

Mr. Tu Tien Phat

*Mr. Tu Tien Phat: By the end of 2024, our country's economy will achieve a growth rate of 7.09%, exceeding the set target. Of which, the credit growth of the entire banking industry will reach 15.08%, with ACB alone reaching 19.1%.

In 2025, the Government expects the economy to grow strongly based on a solid foundation from 2024. I believe the 8% growth target can be achieved because our economy is gradually stabilizing and business activities are improving.

The trend of shifting global supply chains is creating great opportunities for Vietnam to attract foreign investment in the industrial sector, especially in processing, manufacturing and high-tech industries.

In particular, innovation and institutional improvement are important driving forces to help achieve high economic growth results. Government policies that have taken effect since mid-2024 are gradually having a positive and clear impact on the economy. The timely listening and response of the Government and relevant agencies through dialogues, documents and policies have been proposed.

- To contribute to economic development, how have ACB and other banks made efforts to mobilize capital and stabilize interest rates, sir?

*Mr. Tu Tien Phat: Many banks, including ACB, always strive to mobilize capital at reasonable costs, not competing to increase deposits from the residential sector with high interest rates, while diversifying other sources of capital at low costs to support credit activities.

In addition, the entire banking industry unanimously took drastic actions to reduce input costs, including reducing capital mobilization interest rates and balancing cash flow to match capital needs, optimizing capital costs. Operating costs were also optimized to create more room to support reducing lending interest rates for customers.

In 2024, ACB's mobilization growth from the residential sector will reach 11.3% (lower than the credit growth of 19.1% as mentioned). The term structure of mobilized deposits will also be flexibly adjusted to save costs for the bank.

In terms of credit activities, ACB has made efforts to launch preferential interest rate programs, contributing to the supply of cheap capital to the market, promoting economic development. In the past year, the sales of preferential loans that ACB disbursed to customers reached nearly VND570,000 billion, corresponding to a total interest rate reduction of nearly VND5,700 billion (of which, VND3,800 billion was for new loans and VND1,900 billion was the interest rate reduction for existing loans).

This shows the bank's flexibility in ensuring capital to serve the economy, stabilizing interest rates, while maintaining safety and liquidity for the entire system.

- Currently, Ho Chi Minh City needs hundreds of thousands of billions of VND for development investment. What has ACB done to contribute to providing capital for this need?

*Mr. Tu Tien Phat: Ho Chi Minh City is focusing on mobilizing development investment capital to achieve a minimum growth target of 10% in 2025. The city estimates that it needs up to VND620,000 billion in capital, including VND110,000 billion from public investment capital and more than VND510,000 billion from non-budgetary capital. Of which, capital from banks accounts for about VND370,000 billion.

As a capital supply channel, in January 2025, ACB signed a cooperation agreement with Ho Chi Minh City State Financial Investment Company (HFIC) to boost capital sources for key socio-economic infrastructure development projects in Ho Chi Minh City, contributing to the city's sustainable growth in the coming period.

The cooperation agreement with HFIC marks a strategic step forward for ACB in accompanying the Ho Chi Minh City government in promoting socio-economic infrastructure. With a pioneering role and long-term commitment, ACB will continuously innovate to contribute to changing the prosperous face of Ho Chi Minh City and the Vietnamese economy.

- How does ACB provide capital with preferential interest rates to support the economy?

*Mr. Tu Tien Phat: In order to increase capital supply to support the economy, ACB and other banks have implemented many key solutions. Specifically, the bank provides loans with low interest rates and incentives to large leading enterprises, focusing on priority areas.

The reduction of lending interest rates has been seriously implemented by ACB and many other banks, bringing practical results, demonstrating companionship and sharing with customers in the context of many economic difficulties.

Particularly for individual customers and business households, ACB has launched programs to promote loan disbursement for production, business and consumption, creating conditions for customers to access capital easily and conveniently. At the same time, ACB always reviews and adjusts product policies to suit the actual situation, ensuring risk control, compliance with credit limits and legal regulations.

Along with the above measures, ACB also increases the application of technology to provide convenience to customers and reduce operating costs, such as registering information via facial biometric authentication, eKYC, online disbursement, online lending, etc.

Source: https://nld.com.vn/ngan-hang-cung-ung-von-vay-the-nao-trong-nam-moi-196250131083935065.htm

Comment (0)