|

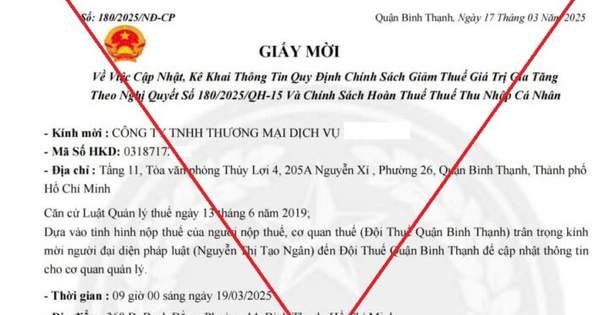

| National Assembly delegates meeting in the hall. |

It is expected that in the morning , National Assembly deputies will discuss in the hall the results of monitoring the settlement of voters' petitions sent to the 5th Session of the 15th National Assembly.

Government members and relevant agencies and individuals explained and clarified a number of issues raised by National Assembly deputies.

In the afternoon , National Assembly deputies discussed in the hall the draft Resolution on applying additional corporate income tax according to regulations against global tax base erosion.

The Minister of Finance explained and clarified a number of issues raised by National Assembly deputies.

The National Assembly will also hear Minister of Finance Ho Duc Phoc, authorized by the Prime Minister, present a Report on reducing value added tax;

Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh presented the Verification Report on the reduction of value added tax.

Discussion in the hall about reducing value added tax and the Minister of Finance explained and clarified a number of issues raised by National Assembly deputies.

* During the working week, regarding legislative work , the National Assembly discussed a number of draft laws and resolutions including: Law on Organization of People's Courts (amended); Law on Social Insurance (amended); Law on Credit Institutions (amended); Law on Roads; Law on Road Traffic Order and Safety; Resolution on the application of additional corporate income tax according to regulations against erosion of the global tax base.

The National Assembly voted to pass the Law on Telecommunications (amended); the Law on Management and Protection of National Defense Works and Military Zones.

* The National Assembly Standing Committee has just issued Resolution 39, adding to the law and ordinance making program in 2023 to submit to the National Assembly for comments and approval at the 6th Session according to the procedure at one session with 2 draft resolutions:

One is the Resolution of the National Assembly on the application of additional corporate income tax according to the provisions against global tax base erosion;

Second , the Resolution of the National Assembly on reducing value added tax (reported to the National Assembly for resolution in the Resolution of the 6th session, 15th National Assembly).

* Previously, at the press conference on the expected agenda of the 6th session of the 15th National Assembly, Mr. Vu Tuan Anh, Standing Member of the National Assembly's Finance and Budget Committee, said the reason why the National Assembly has not yet submitted a resolution on applying the Global Minimum Tax.

According to Mr. Vu Tuan Anh, two draft Resolutions on the application of regulations on the application of Global Minimum Tax and the Resolution on the pilot application of investment support policies in the high-tech sector have been submitted by the Government to the National Assembly Standing Committee for consideration at the September session.

At the October meeting, the Government submitted for the second time a draft Resolution on piloting investment support policies in the high-tech sector.

"This is an important and unprecedented policy that needs to be carefully, thoroughly and comprehensively studied to ensure the goal of maintaining Vietnam's taxing rights, retaining old investors and attracting new investors. At the same time, it must ensure that it does not violate the principle of Global Minimum Tax and does not affect Vietnam's competitiveness and investment environment," said the Standing Member of the Finance and Budget Committee.

In addition, Mr. Vu Tuan Anh added that according to the Global Minimum Tax regulations, the deadline for declaring additional corporate income tax is 12 months, and the minimum taxable income is 18 months from the end of the fiscal year. Thus, the payment of additional tax in the parent country of corporations is not from January 1, 2024, and if there is any payment, it will be from 2025.

Therefore, these two draft resolutions have not been submitted to the National Assembly at the 6th session to continue to carefully assess the actual situation in the country, the implementation situation in other countries, and refer to international experience. The National Assembly Standing Committee has assigned the Government to complete the above two drafts to submit to the National Assembly Standing Committee and the National Assembly for consideration and decision at an appropriate time, meeting the requirements of international commitments and being suitable to the domestic situation.

Source

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

Comment (0)