Vietbank announces shareholders holding over 1% of capital - Photo: VBB

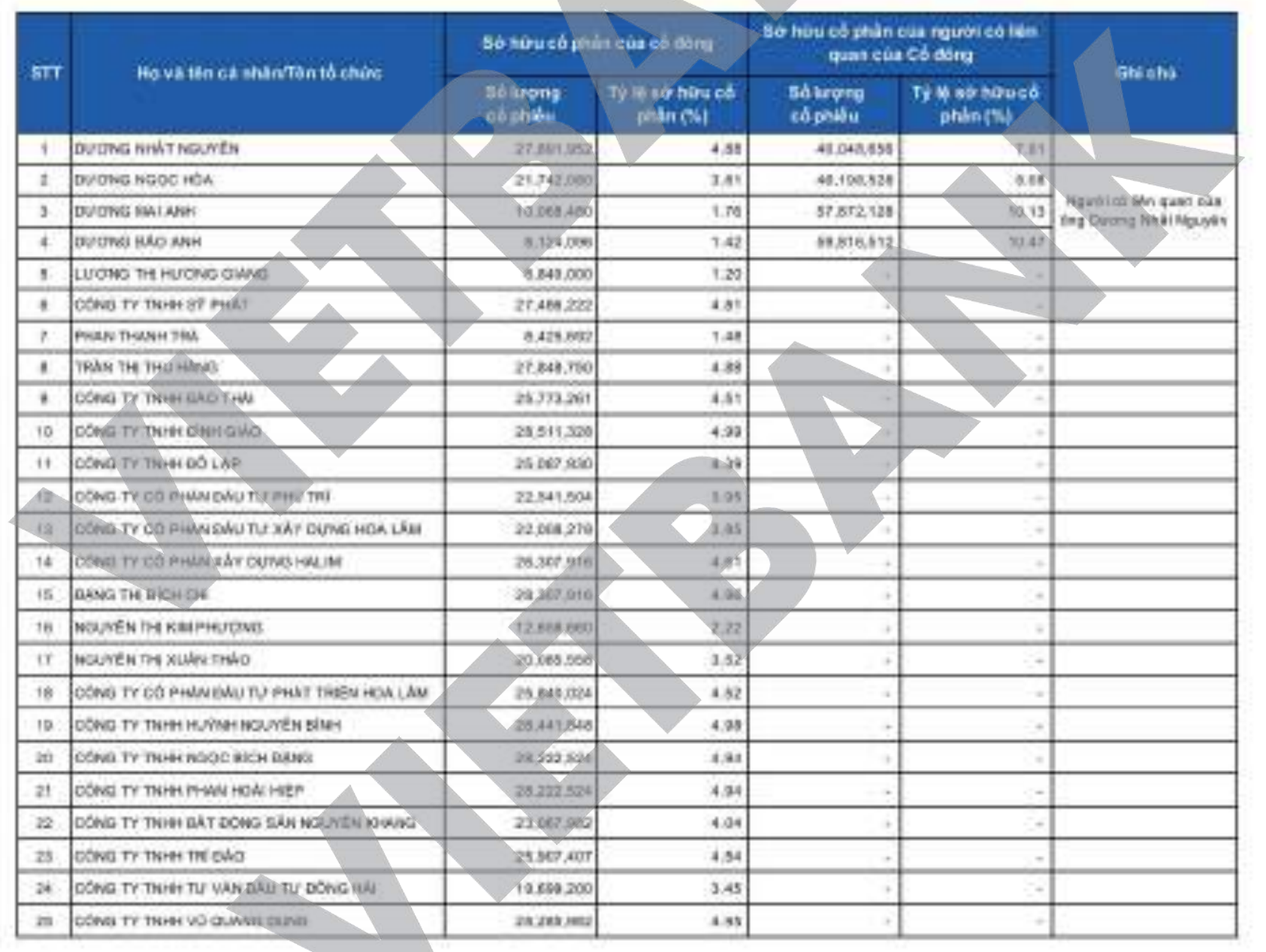

Specifically, the list recently announced by Vietbank shows that this bank has 15 institutional shareholders and 10 individual shareholders holding more than 1% of charter capital.

Mr. Duong Nhat Nguyen - Chairman of the Board of Directors and his family members are the group of shareholders holding the largest number of shares, with an ownership ratio of 11.89%.

Of which, Mr. Nguyen alone holds more than 27.89 million shares, equivalent to 4.88% of capital, while Mr. Duong Ngoc Hoa - Mr. Nguyen's father - holds 3.81% of capital, equivalent to more than 21.74 million shares.

This list does not include the name of Ms. Tran Thi Lam - Mr. Nguyen's mother. In March this year, Ms. Lam left the position of Deputy General Director of Vietbank, moving to the role of senior advisor to the board of directors .

According to the management report for the first 6 months of 2024, Ms. Lam only holds 114,000 shares, equivalent to 0.02% of capital.

Meanwhile, Ms. Duong Mai Anh and Duong Bao Anh - Mr. Nguyen's younger sisters - are on the recently announced list, holding 1.76% and 1.42% of Vietbank's capital, respectively.

In addition, Ms. Luong Thi Huong Giang - a member of VietBank's board of directors - also holds 6.84 million shares, equivalent to 1.2% of the bank's charter capital.

Most of the remaining leaders in the board of directors such as Mr. Nguyen Huu Trung - vice chairman, Ms. Quach To Dung - member... do not hold any shares.

List of institutional and individual shareholders holding more than 1% of capital announced by Vietbank

Regarding institutional shareholders, there are many names on the list, but the most notable is Hoa Lam Investment and Development Joint Stock Company.

This company is known as the core legal entity in the Hoa Lam ecosystem, founded by Mrs. Tran Thi Lam and her husband.

In general, Hoa Lam Group does not have much information appearing in the media.

In 2019, Forbes Vietnam voted Hoa Lam Group as one of the top 20 business families in Vietnam. Ms. Lam was also in the top 50 most influential women in Vietnam.

How does Vietbank do business?

Regarding Vietbank's business situation, the 2024 semi-annual financial report said the bank reported a profit after tax of VND326 billion, up nearly 11% over the same period. A major contributor to the business results was net interest income, reaching VND1,260 billion, up nearly 36%.

At the end of June this year, Vietbank's total assets reached nearly VND144,103 billion. Of which, customer loans reached VND88,000 billion, up 10% compared to the beginning of the year. Customer deposits reached VND93,577 billion, up 4%.

In 2024, Vietbank sets a pre-tax profit target of VND 1,050 billion, an increase of 29% compared to 2023; total assets of VND 150,000 billion; capital mobilization of VND 116,000 billion; total outstanding loans of VND 95,000 billion.

Recently, Vietbank announced information on increasing its charter capital to VND7,139 billion through the issuance of shares to pay dividends from retained earnings. Accordingly, the bank will pay dividends in 2024 in shares at a rate of 25%.

Source: https://tuoitre.vn/hoa-lam-va-nhung-co-dong-nao-dang-nam-von-tai-vietbank-20240929210106933.htm

Comment (0)