With a consistent viewpoint: "Taking reform and modernization as the basis, modernizing the management model as the focus, promoting digital transformation as the foundation", Phu Tho Customs Branch has implemented many solutions, both creating convenience for the business community and meeting the requirements of the assigned tasks.

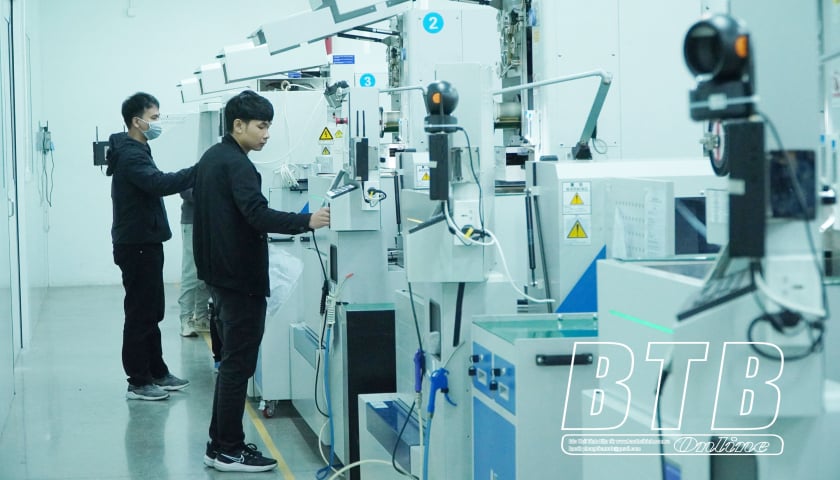

Applying information technology and digital technology helps Customs agencies increase management efficiency and promote trade development.

Improve management efficiency

In 2024, Phu Tho Customs Branch was assigned a budget revenue estimate of 480 billion VND. In the context of the domestic and world economy facing many difficulties and challenges, significantly affecting the import and export activities of goods of enterprises in the province as well as the tasks of the Customs sector, closely following the direction of the Government and the superior Customs, Phu Tho Customs has set out its determination from the beginning of the year, turning challenges into opportunities, promoting creativity, joining hands and making efforts to overcome difficulties, striving to complete the set goals and targets.

The Department has proactively developed key programs and plans, directed specialized departments to resolutely and synchronously implement budget collection solutions; grasped the fluctuations of revenue sources, developed monthly and quarterly collection plans to have solutions for revenue management and revenue nurturing. Accordingly, the unit focused on removing difficulties for import and export activities; increased sharing and accompanying with businesses, and encouraged businesses to voluntarily comply with customs laws.

In the first 6 months of this year, the unit has organized dialogues with local businesses, contributing to promoting the Customs - Business partnership, increasing business satisfaction, contributing to improving the effectiveness of state management of customs, and increasing state budget revenue.

In addition, tighten discipline, order, management, closely monitor the work handling process, raise awareness, responsibility, public ethics, professional ethics, resolutely and strictly handle civil servants who violate, cause trouble and harassment to businesses.

There are currently nearly 300 enterprises with import-export activities in the province. To create the most favorable conditions for enterprises to carry out import-export procedures in the province as well as neighboring provinces, the unit focuses on propaganda and guidance on new policies; removing and resolving obstacles and difficulties for enterprises through many forms such as direct exchanges, emails, telephones, etc. With that approach, since the beginning of the year, the Department has attracted 50 new enterprises to carry out customs clearance procedures, contributing to increasing the province's budget revenue.

In addition, the work of considering tax exemption, reduction, refund, non-collection, and settlement of processed and exported goods was carried out promptly, seriously, and in accordance with legal regulations. During the period, the Department issued decisions not to collect tax for 10 dossiers, the amount of tax not collected was nearly 345 million VND, and decisions to refund tax for 24 dossiers, the amount of tax refunded was nearly 2.8 billion VND; after checking the tax refund of 1 dossier, the amount recovered after the tax refund was nearly 1.2 billion VND, and no new tax debt arose.

The Department closely coordinates with functional forces to combat budget losses through monitoring, inspecting customs procedures, post-clearance inspections, specialized inspections, and combating smuggling and trade fraud. In the first 6 months of this year, the Department has drawn up records and handled 19 cases, with fines totaling more than 400 million VND. Violations were mainly due to exceeding the customs clearance deadline, false declaration of quantity and name of goods, etc. With drastic participation, in the first half of 2024, the Department has collected 332 billion VND for the state budget, reaching 69% of the assigned target of the year, equal to 119% compared to the same period in 2023.

The remote camera surveillance system for manufacturing enterprises at ICD Thuy Van Port has supported enterprises to quickly clear goods.

Step by step formalization and modernization

The 4.0 industrial revolution and the explosion of e-commerce require the Customs to have appropriate management methods, in accordance with international standards and practices, creating fairness, convenience as well as ensuring strict control, preventing and combating trade fraud. The inevitable requirements of digital transformation pose challenges but are also the driving force for the Customs sector in general, and Phu Tho Customs in particular, to implement Digital Customs and apply information technology in state management to gradually become more standardized and modern.

To facilitate businesses in customs clearance procedures, the Department has promoted the implementation of level 4 online public services for all business stages. Accordingly, all customs clearance procedures for businesses are calculated in seconds for green lane documents, yellow lane documents are completed in no more than one hour if the documents are valid, red lane documents will be cleared immediately when the goods are confirmed to have the actual inspection results in accordance with regulations.

Since the beginning of the year, the Department has received more than 87,500 declarations, of which the rate of file classification in the green channel is 65,200 declarations, reaching 74.4%; the yellow channel is 20,500 declarations, reaching 23.4%; the red channel is 1,800 declarations, reaching 2.1%, the number of declarations that need to be transferred is 65.

Along with that, the Department coordinates with commercial banks to pay taxes electronically, import-export enterprises pay taxes, fees, and charges on import-export goods using advanced electronic methods. The implementation of the 24/7 electronic tax payment and customs clearance system not only serves the Customs agency, creating favorable conditions for enterprises but also helps agencies perform state management more effectively. The Department promotes comprehensive administrative procedure reform of specialized inspection of import-export goods to below 15%, reduces and simplifies 50% of the list of goods, products and procedures, innovates post-clearance inspection methods...

Mr. Nguyen Thai Binh - Head of Phu Tho Customs Branch said: The Customs sector has set a target of striving to complete Digital Customs by 2025, building a regular and modern Customs. Therefore, the Branch continues to improve the management level and capacity of its staff; promote comprehensive digital transformation in state management of customs with a highly integrated, open information technology system, in line with international standards, meeting the need for automatic processing of all customs operations, performing customs procedures anytime, anywhere, on any means. At the same time, determined to realize the goal by 2030, completing Smart Customs with 100% of documents in customs dossiers for basic types converted to electronic data, moving towards digitalization.

Phuong Thao

Source: https://baophutho.vn/hai-quan-phu-tho-huong-toi-chinh-quy-hien-dai-216600.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)