Announcing the draft Circular on securities transactions and payments: Removing obstacles to Prefunding, planning a roadmap for information disclosure in English

The time from when the foreign organization must fulfill its payment obligation to when the securities are withdrawn is only a few hours. The securities company also has an additional day to negotiate if the foreign organization has not paid.

On July 19, the State Securities Commission (SSC) officially published the Draft Circular amending and supplementing a number of articles of the Circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions; activities of securities companies and information disclosure on the stock market.

Previously, the State Securities Commission published the first draft of the Circular amending and supplementing 4 circulars in March 2024 and consulted with affected subjects according to the provisions of the Law on promulgation of legal documents thereafter, and at the same time completed the acceptance and finalization of the draft Circular.

Two major issues added and amended in the Draft Circular include solutions for foreign institutional investors to be able to buy securities without having 100% of the money in their accounts (Pre-funding) and creating conditions for foreign investors to have equal access to information.

According to the content of the recently announced Draft, the additional regulation on the purchase of shares by foreign investors who are organizations (foreign organizations) allows for an additional day of negotiation if the foreign investor has not paid. Specifically, the securities company is allowed to sell by agreement the number of shares transferred to the self-trading account in case the foreign organization lacks money to pay for the purchase of shares no later than the trading day following the day the shares are recorded in the self-trading account. Except for the above transaction, for shares purchased by a foreign organization but not completed payment, the securities company will sell the shares on the securities trading system. Financial expenses arising when performing the transaction are carried out according to the agreement between the two parties.

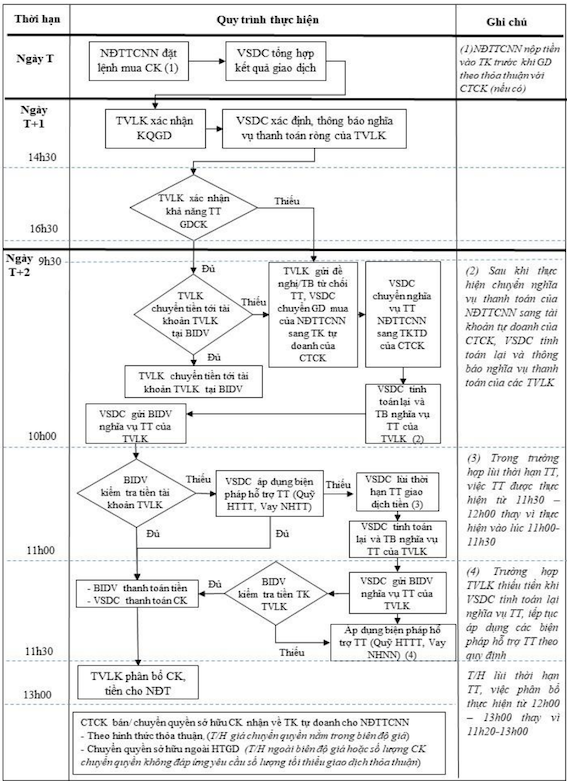

Another important change compared to the first draft version is that the time when foreign organizations need to have enough money in the transfer account has been changed from around 2:30 p.m. on T+1 (after 1 day of trading) to 9:30 a.m. on T+2. This means that the time from when the foreign organization must fulfill its payment obligation to when the securities arrive is only a few hours, from 9:30 a.m. to 1 p.m. on T+2.

|

| Payment flowchart according to the Draft Circular amending 4 recently announced Circulars - Source: SSC |

In addition to regulations to remove transaction obstacles for foreign institutional investors, the Draft Circular continues to add regulations on simultaneous information disclosure in English to create conditions for foreign investors to have equal access to information.

According to the outlined roadmap, listed organizations and large-scale public companies will periodically disclose information in English from January 1, 2025. Subsequently, listed organizations and large-scale public companies will additionally disclose extraordinary information, information upon request, and disclose information on other activities of the public company in English from January 1, 2026.

Public companies not subject to the provisions of Points a and b of this Clause shall periodically disclose information in English from January 1, 2027. Public companies shall disclose extraordinary information, disclose information upon request, and disclose information on other activities of the public company in English from January 1, 2028.

Speaking at the annual “July Dialogue” program on the stock market with the theme “Upgrading, calling for capital and developing institutional investors” held on the same day, Ms. Phuong said that the Ministry of Finance will next hold a conference in Singapore to collect investors’ opinions for the last time at the end of July, before signing and promulgating.

In the Strategy for Stock Market Development to 2030, a major goal set for the stock market is to strive to upgrade from a frontier market to an emerging market by 2025. Changing regulations to allow securities companies to implement payment support solutions (Non-Prefunding Solution - NPS) for foreign institutional investors is also one of the efforts towards the upgrade goal.

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, said the new draft has also been sent to a number of international organizations and received consensus on the main contents.

“In the review period next September, we expect positive results,” Mr. Hai also said.

According to Mr. Nguyen Khac Hai - Director of Legal and Compliance Control, SSI Securities Company, FTSE Russell will usually need 6 months to review the trading volume, then decide. With the current progress, SSI representative said that approval for a quick upgrade can be achieved in the first quarter of 2025, or later in the third quarter of 2025.

Source: https://baodautu.vn/publication-of-circular-request-to-issue-of-transaction-of-stock-transaction-go-vuong-prefunding-len-lo-trinh-publication-of-information-in-english-d220434.html

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)