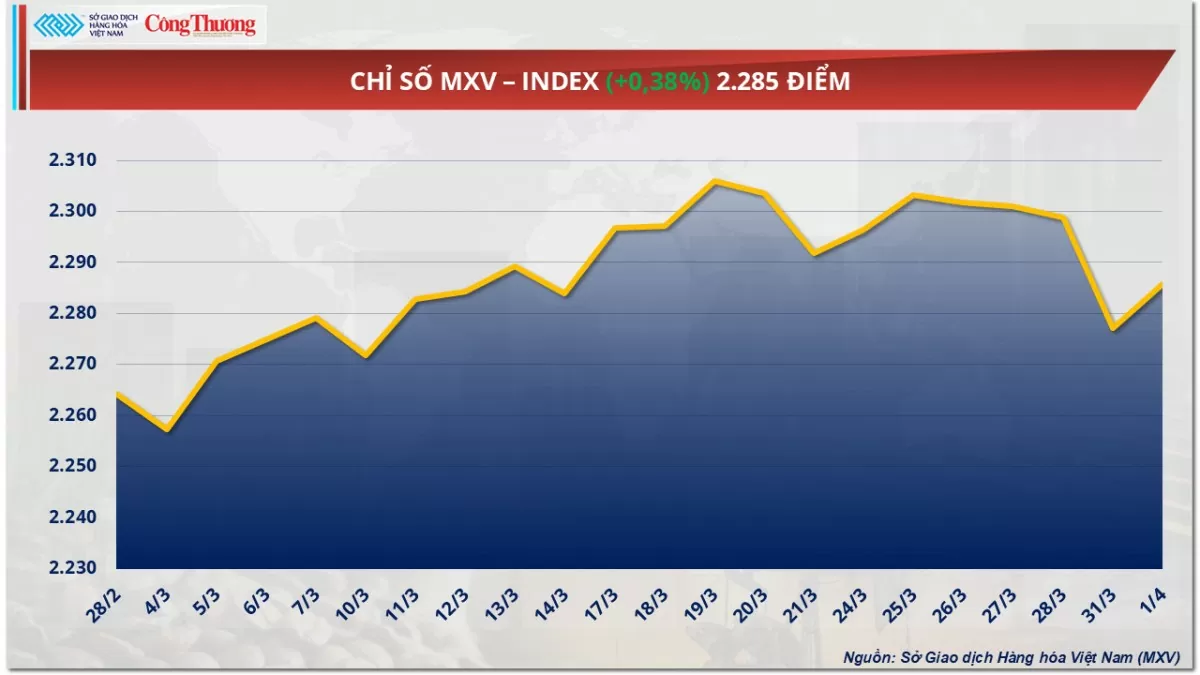

The Vietnam Commodity Exchange (MXV) said that cautious sentiment continued to dominate the world commodity market before the US is expected to announce the reciprocal tax rate. At the close of trading yesterday, the MXV-Index increased by 0.38% to 2,285 points. Notably, after a series of "hot" increases since the trading session on March 19, oil prices are showing a cooling trend. Meanwhile, concerns about future supply have fueled the increase in soybean prices.

MXV-Index |

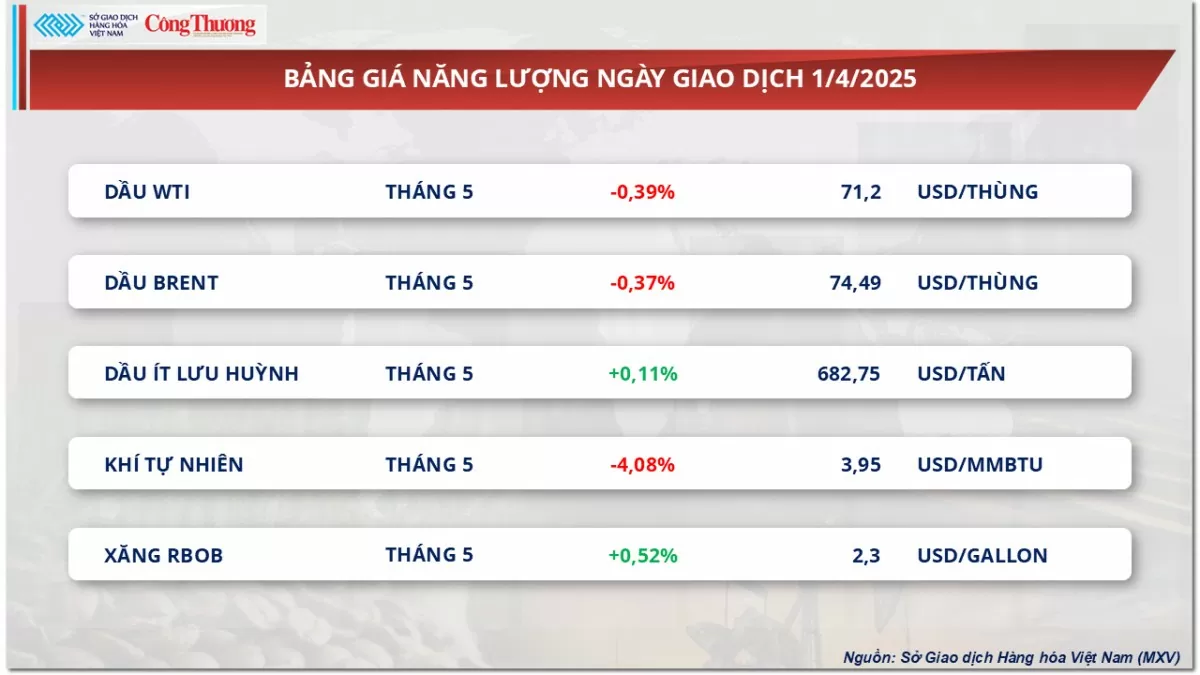

Oil prices cool down

According to MXV, selling pressure dominated the energy market in yesterday's trading session. Oil prices fell in the first trading session of April as previous supply concerns were eased by OPEC+'s plan to increase production, while the market faced new pressure from the weakening global oil demand outlook.

After reaching a one-month high, at the end of the session on April 1, Brent crude oil for June delivery fell 0.37% to $74.49/barrel, while WTI crude oil fell 0.39% to close at $71.2/barrel.

Energy price list |

Global oil supplies have eased as OPEC+’s production increase plan officially took effect on April 1. According to the plan announced in early March, production will increase by about 138,000 barrels per day this month. In addition, the market also expects OPEC+ to continue raising production in May, with a proposal to increase by 135,000 barrels per day expected to be considered at the OPEC+ Ministerial Meeting this week.

In addition, two other factors also increase the prospect of excess supply.

First , a report from the American Petroleum Institute (API) showed that US commercial crude oil reserves increased sharply by 6.04 million barrels in the week ending March 28, reversing the sharp decline of 4.6 million barrels in the previous week.

Second, Kazakhstan’s crude oil production continued to set a new record of 2.17 million barrels per day in March, far exceeding the OPEC+ quota of 1.47 million barrels per day. This is putting Kazakhstan under pressure from other OPEC+ members to cut the excess production.

However, the market still faces greater risks from demand. New tariff policies expected to be announced by the Trump administration on April 2 are escalating global trade tensions. Strong reactions from major US trading partners could lead to a slowdown in global economic growth, thereby causing oil demand to plummet, surpassing previous concerns about supply shortages.

In addition, short-term upward pressure on prices remains due to US sanctions targeting crude oil exports from Iran and Venezuela. Secondary tariffs on countries importing oil from Venezuela will take effect on April 2, thereby increasing the risk of regional supply shortages.

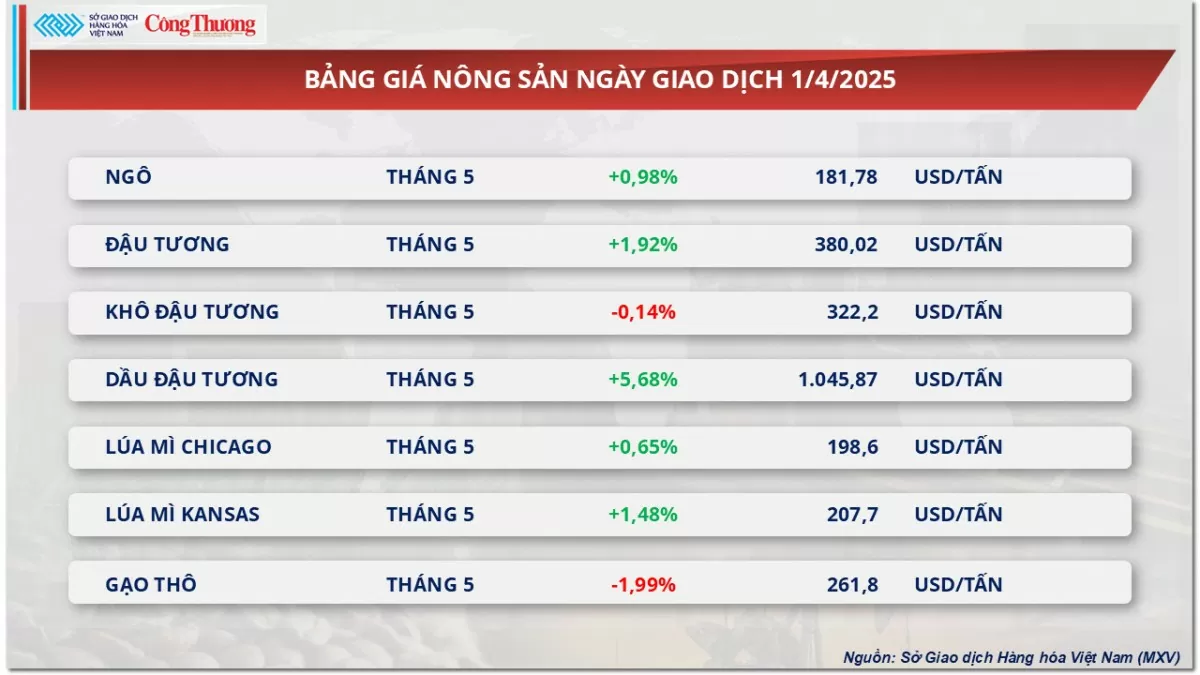

Soybean prices rebound strongly

At the end of yesterday's trading session, green dominated the agricultural market. Closing, soybean prices increased sharply by nearly 2% to 380 USD/ton, reflecting a strong recovery thanks to a series of positive information from the market.

Agricultural product price list |

One of the main drivers of prices was the previous Planting Outlook Report, which showed a trend of shrinking soybean acreage in the US. Forecasts of lower future supplies have strengthened market sentiment, creating a driving force for prices. In addition, prolonged wet weather in the US continues to hinder planting progress and increases the risk of replanting in some areas due to flooding. These factors have raised concerns about crop yields in the coming crop year, increasing buying power.

Soybean oil prices also jumped more than 5.5% yesterday on expectations of increased biofuel blending limits in the US. Discussions on biodiesel blending regulations have supported the outlook for domestic demand for soybean oil. Crushing margins also hit a six-week high, indicating that demand for the product remains strong and is an important factor driving soybean prices.

In addition, information from consulting firm StoneX said that Brazil's soybean output in the 2024-2025 crop year is expected to fall to 167.54 million tons, lower than the previous forecast of 168.34 million tons. The main reason is due to adverse weather conditions in the state of Rio Grande do Sul. This raises concerns that supplies from South America may not meet expectations, contributing to supporting prices.

However, the market still faces significant risks. Trade tensions between the US and major partners such as China could negatively impact US soybean exports... At the same time, global supplies remain ample thanks to the rapid progress of the harvest in Brazil and record exports from that country in March, which could limit the potential for long-term price increases.

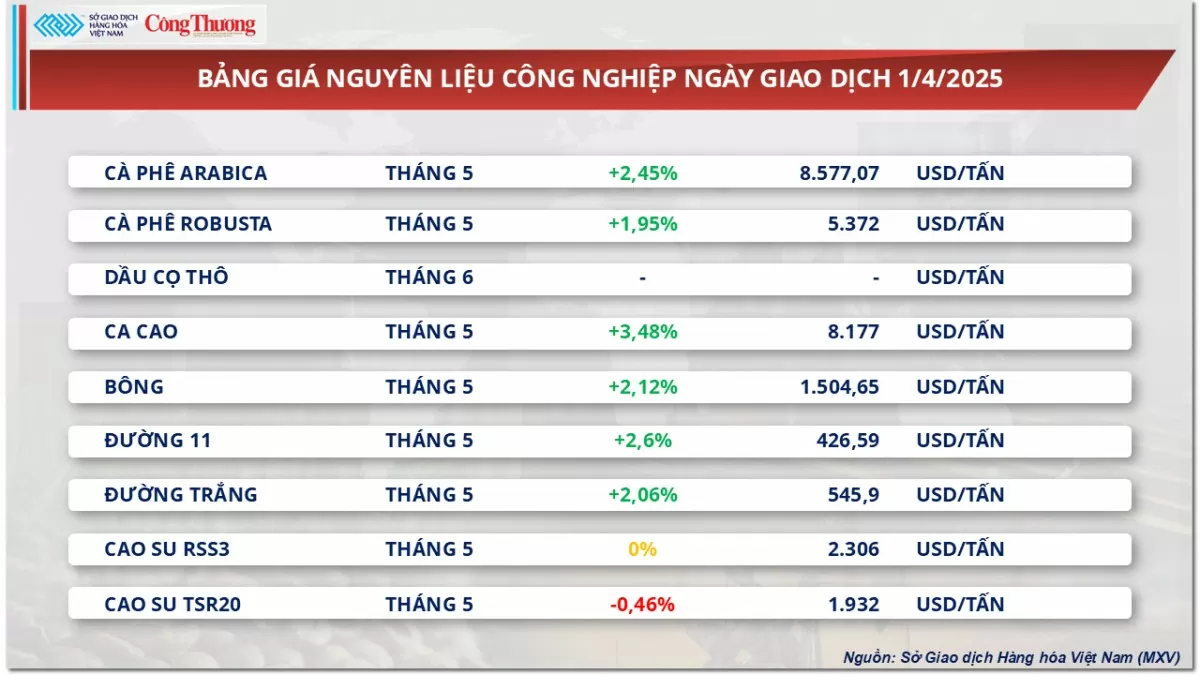

Prices of some other goods

Industrial raw material price list |

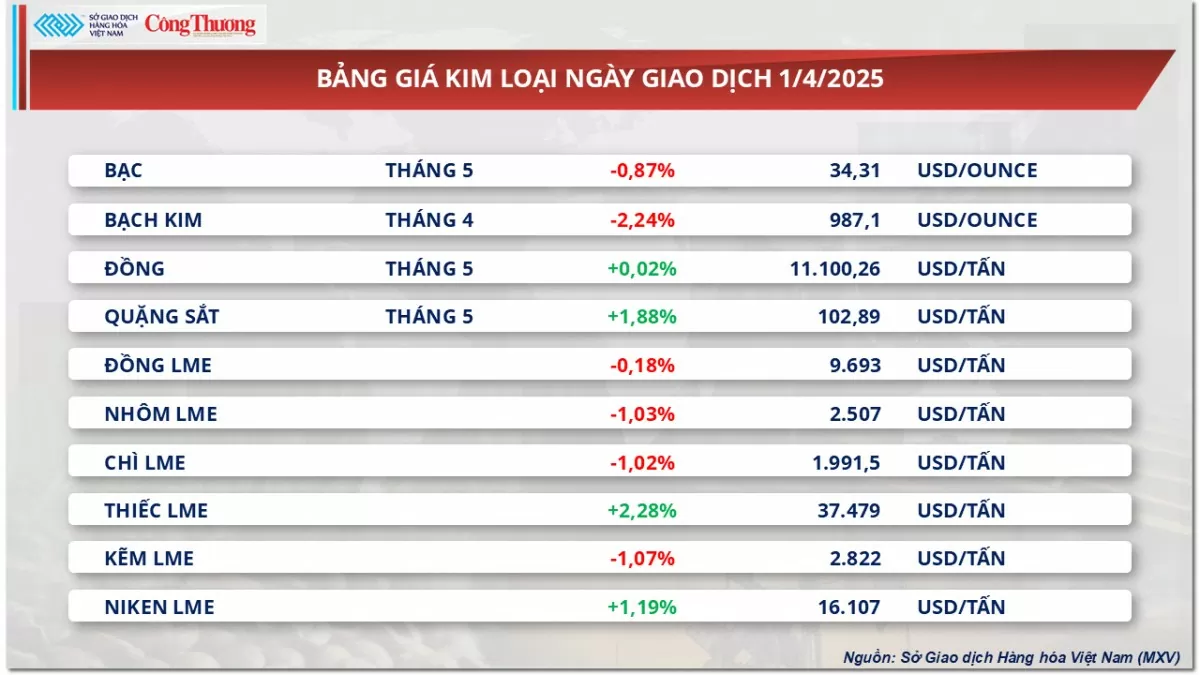

Metal price list |

Ngoc Ngan

Source: https://congthuong.vn/lo-ngai-ve-nguon-cung-gia-dau-the-gioi-ha-nhiet-381089.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)