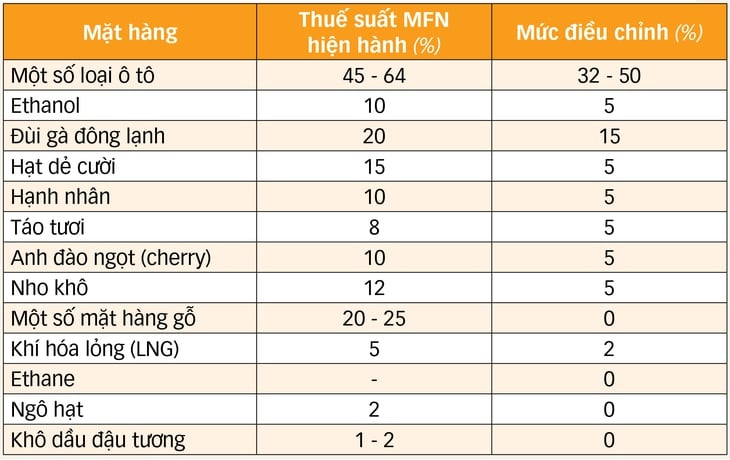

Source: Decree 73/2025/ND-CP dated March 31, 2025 amending and supplementing preferential import tax rates for a number of goods - Data: NGOC AN

A series of imported goods from the US have had their taxes reduced to low levels, even 0%, according to a recently issued Government decree.

This move took place before President Donald Trump announced the imposition of reciprocal tariffs on all countries, and is considered positive in the context of Vietnam's recent sharp increase in exports to the US.

Proactive tax reduction

According to the new decree, the preferential import tax rate for cars with HS codes 8703.23.63 and 8703.23.57 is reduced from 64% to 50%, and HS code 8703.24.51 is reduced from 45% to 32%. These are car models with cylinder capacity from 2,000cc to 2,500cc and 4-wheel drive models.

Many agricultural products also have their taxes reduced: frozen chicken thighs from 20% to 15%, pistachios from 15% to 5%, almonds from 10% to 5%, fresh apples from 8% to 5%, cherries from 10% to 5%, raisins from 12% to 5%.

In particular, wood and wood products in groups 44.21, 94.01 and 94.03 (including clothes hangers, chairs and wooden furniture) will have their tax reduced from 20% and 25% to 0% from March 31.

Other items also have their taxes reduced: corn from 2% to 0%, soybean meal from 1%, 2% to 0%, liquefied natural gas (LNG) from 5% to 2%, ethanol from 10% to 5%. Only ethane has been added HS code 2711.19.00 with a tax rate of 0%.

Mr. Vu Tan Cong, former general secretary of the Vietnam Automobile Manufacturers Association (VAMA), assessed that the Government's tax reduction move was proactive and positive, especially when the Trump administration announced a plan to impose a 25% import tax on all cars not manufactured in the US (effective from April 2) and a 25% tax on auto parts (applied no later than May 3).

Although Vietnam does not import many US car models and the tax reduction does not apply to popular car models, this tax reduction helps diversify supply, increase market competition and promote the domestic auto industry.

Currently, domestic enterprises mainly produce low-capacity vehicles (under 2,000cc), suitable for the needs of the majority of consumers, while vehicles with higher capacity are mainly imported.

Expectations from business

The fruit and vegetable industry is considered to be able to "avoid" the reciprocal tax. Mr. Dang Phuc Nguyen, general secretary of the Vietnam Fruit and Vegetable Association, hopes that the reciprocal tax will not be applied to fruits, because the balance of import and export turnover is maintaining a trade deficit.

In 2024, Vietnam exported 360.4 million USD worth of fruit to the US, but imported 543 million USD worth of fruit from the US, mainly apples, cherries, and oranges.

"With a trade deficit and a small value, the possibility of being taxed may be difficult to happen," Mr. Nguyen commented. Currently, businesses are still boosting exports to the US but are facing difficulties in logistics and preservation technology.

Only a few items can be transported by sea, such as fresh coconuts and grapefruits; dragon fruit and mangoes must be transported by air. Therefore, although the US imports up to 60 billion USD worth of fruits and vegetables, the presence of Vietnamese goods is still modest.

Mr. Nguyen Chanh Phuong, Vice President of the Handicraft and Wood Processing Association of Ho Chi Minh City, said that the wood industry has proposed a policy to reduce taxes on wood materials imported from the US. He assessed that the State's prompt issuance of a tax reduction policy is a positive move and brings hope to businesses.

Regarding the wood industry, Mr. Phuong said that the Vietnam-US relationship is not directly competitive but complementary. In the US, the cost of producing wooden furniture is very high due to wages and other conditions.

Meanwhile, the US has abundant timber resources, and Vietnam imports US timber with a large turnover, ranking second in the world. Importing raw materials helps the US timber industry consume products and promote forestry production. Conversely, when wooden products are produced in Vietnam at competitive costs, exporting to the US market and other countries will help supplement the US timber industry.

However, Mr. Phuong noted that the tax could be applied at the national level. Therefore, he hopes that the Government will have stronger tax reduction measures for products imported from the US, for example popular car models.

Because the proportion and export turnover of textiles, footwear, and wooden products from Vietnam to the US is very large, just one unfavorable tax move will make partners hesitate to buy goods, directly affecting hundreds of thousands of export enterprises.

Mr. Phuong also recommended that the Government review import flows from countries that are unfriendly to the US, as well as strictly manage investment from these countries to avoid tax evasion investigations that could harm the entire industry.

Source: https://tuoitre.vn/giam-thue-hang-my-truoc-gio-g-20250402223637065.htm

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)