The world gold price today (February 9) inched up to 2,860 USD/ounce. Domestically, the price of SJC gold bars and gold rings has just experienced a week of strong price increases, closing the week at 90.3 million VND and 89.8 million VND/tael, respectively.

In the domestic market, gold prices remained high after the God of Wealth Day. The difference between buying and selling gold bars was pushed up by businesses to 3.5 million VND/tael.

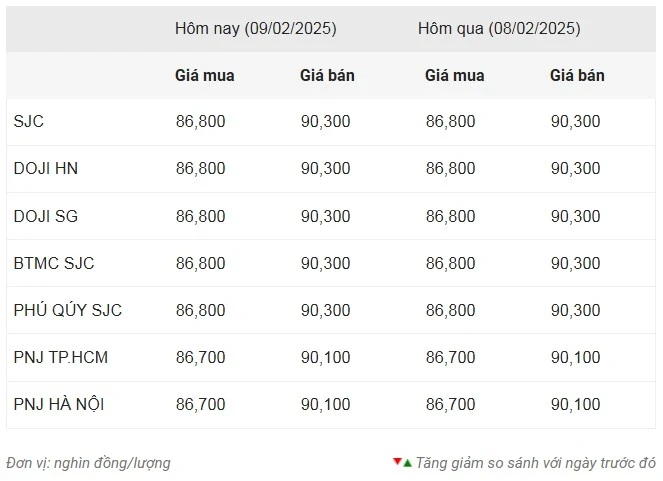

Specifically, at 9:00 a.m. on February 9, Saigon Jewelry Company (SJC) listed the buying and selling price of SJC gold bars at 86.8-90.3 million VND/tael.

SJC 9999 gold ring price is 86.8 million VND/tael for buying and 89.8 million VND/tael for selling.

DOJI gold bar prices in Hanoi and Ho Chi Minh City closed the week at VND86.8 million/tael for buying and VND90.3 million/tael for selling.

This brand listed the buying and selling price of Doji Hung Thinh Vuong 9999 gold ring at a historical peak of 86.6-90.3 million VND/tael.

PNJ gold buys at 86.7 million VND/tael and sells at 90.1 million VND/tael.

As of 9:00 a.m. on February 9 (Vietnam time), gold price World prices increased slightly by 4.7 USD compared to the previous session to 2,860.1 USD/ounce.

Global gold prices continued to witness a remarkable week of gains as the impact of ongoing tariff threats combined with rising inflation fears drove investors to the precious metal as a safe-haven asset.

Spot gold started the week at $2,797 an ounce, and after briefly rising to $2,802, it fell to a weekly low of $2,774. It then surged to a new weekly high of $2,843 and continued to climb higher before hitting a new record high of $2,886.85 after the release of the University of Michigan consumer sentiment survey, which showed that annual inflation expectations rose by 1 percentage point in just one month.

However, this new peak was not sustainable as gold prices returned to $2,860 before moving sideways, trading in a narrow $5 range until the end of the week.

The latest Kitco News weekly gold survey shows that industry experts are more bullish than ever on the yellow metal, while retail traders also see gold prices continuing to rise in the near future.

“Spot gold has just hit a new record high and there is no sign of the rally ending,” said James Stanley, senior market strategist at Forex.com. “I think next week will be higher, although not as strong as this week.”

VR Metals/Resource Letter publisher Mark Leibovit expressed a neutral view as he believes prices are in cyclical top territory.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he remains bullish on gold next week as the precious metal is holding up well on the recent breakout.

For his part, Adrian Day, Chairman of Adrian Day Asset Management, commented: “The momentum that drove gold prices higher over the past year is still intact. A pause and consolidation is necessary, but perhaps not now.”

Seventeen Wall Street analysts participated in the Kitco News Gold Survey this week, with 15, or 88%, expecting gold prices to hit a new record high next week, while two analysts, or 12%, see prices holding steady. None predict prices will fall.

Meanwhile, 120 Main Street retail investors, or 71%, of the 170 who participated in Kitco News’ online poll said they expect gold prices to rise next week. Another 33, or 19%, expect gold prices to trade lower. The remaining 17, or 10%, see a sideways trend.

This morning, the USD-Index continued to increase to 108.04 points; the yield on 10-year US Treasury bonds was at 4.494%; US stocks increased; oil prices increased at the end of the week but still recorded the third consecutive week of decline, trading at 74.66 USD/barrel for Brent oil and 71 USD/barrel for WTI oil.

Source

Comment (0)