Bank of America (BofA) has just raised its forecast for average gold prices to $3,063 and $3,350 per ounce for this year and next, up from its previous forecasts of $2,750 and $2,625, respectively.

If investment demand increases by 10%, spot gold prices could hit $3,500 an ounce in the next two years, according to BofA. The bank said central banks currently hold about 10% of their reserves in gold and could raise that to more than 30%.

Last week, Citi Research also raised its three-month gold price forecast to $3,200 per ounce from $3,000, due to strong demand from the official sector and exchange-traded funds (ETFs).

"In our bullish scenario, we forecast gold prices could reach $3,500 per ounce by year-end, supported by significantly higher investment and protectionist demand due to concerns about a severe recession or stagflation in the US," Citi analysts said. This is a situation where the economy has high inflation but slow growth or recession, accompanied by high unemployment.

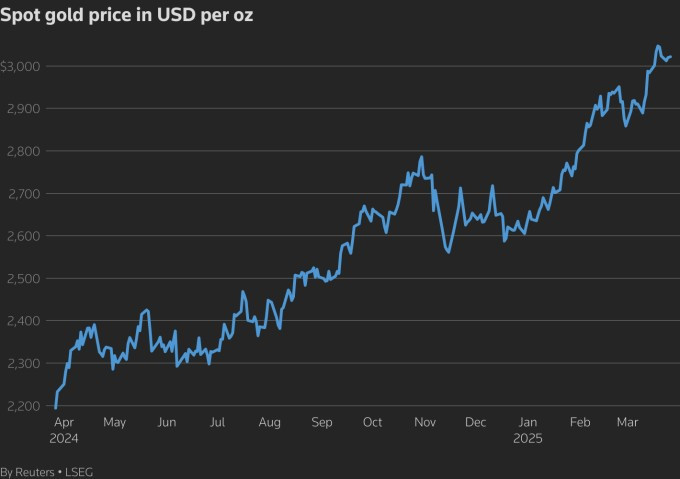

Considered a hedge against uncertainty and inflation, gold prices have risen more than 15% since the beginning of the year, peaking at $3,057.21 per ounce on March 20 and currently hovering around $3,024 per ounce.

The precious metal’s record rally was largely driven by economic and geopolitical concerns stemming from US President Donald Trump’s trade policies. “Gold remains supported by safe-haven demand amid tariff uncertainty and geopolitical risks. A new record high would set the stage for gold to hit its next target of $3,150 an ounce,” said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Earlier this week, US President Donald Trump announced that he would soon impose auto tariffs, but hinted that not all of the tariffs he had threatened would take effect on April 2 and that some countries might be exempt.

Investors are worried that tariffs will increase inflation and slow economic growth, so they are looking for safe haven assets like gold. "Precious metal bulls are benefiting from steady haven flows as markets remain cautious on volatile U.S. trade and foreign policy," said Jim Wyckoff, analyst at Kitco Metals.

Investors are now focused on the US personal consumption expenditure (PCE) data due on March 28, looking for prospects of a Federal Reserve interest rate cut. "A low PCE will reinforce the dovish stance and continue to support gold prices," said Peter Grant at Zaner Metals.

Source: https://baohatinh.vn/gia-vang-co-the-len-3500-usd-neu-bat-on-kinh-te-tang-post284947.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)