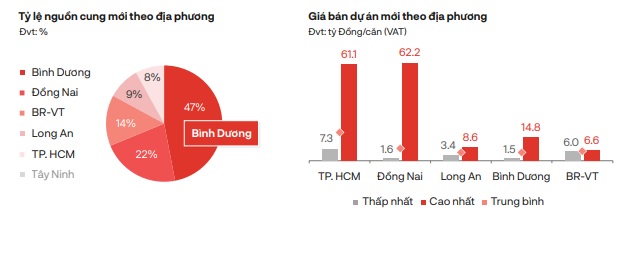

According to DKRA's market report in Ho Chi Minh City and neighboring provinces, in 2023, the selling price of new projects of townhouses and villas in Ho Chi Minh City is at the highest level of 61.1 billion VND/unit, the lowest is 7.3 billion VND/unit. Meanwhile, in Dong Nai market, the highest selling price of new projects of townhouses and villas is recorded at 62.2 billion VND/unit, the lowest is 1.6 billion VND/unit.

The highest price in Dong Nai has surpassed expensive markets like Ho Chi Minh City, especially higher than other neighboring markets such as Ba Ria - Vung Tau (6.6 billion VND/unit), Long An (8.6 billion VND/unit), Binh Duong (14.8 billion VND/unit). This is a survey price based on new projects launched in 2023, not including secondary product prices or the general price level of the entire regional market.

Villas and townhouses in Dong Nai have the highest prices, surpassing Ho Chi Minh City.

According to this report, compared to 2022, the new supply of this type decreased sharply, equivalent to only about 13%, in which the localities with the deepest decrease were Dong Nai, Long An and Ho Chi Minh City with the decrease rates of 91%, 94% and 95% respectively.

New market consumption was very low, down 92% year-on-year. Transactions occurred mainly in the product group with an average price of 1.9 - 2.4 billion VND/unit and were concentrated mainly in the first 6 months of the year.

Binh Duong is the leading locality in the townhouse and villa segment in the region, accounting for about 47% of the supply and 45% of the new consumption of the market. Despite the pressure of input costs, the primary price level recorded an average decrease of 6% - 10% compared to the previous launch.

Report on prices and supply of townhouses and villas in Ho Chi Minh City and neighboring provinces.

Along with that, a series of policies are applied by investors such as: discounts, promotions, interest rate support, extended payment period, etc. to stimulate market demand. The secondary price level recorded an average decrease of 8% - 10% compared to the beginning of 2023.

Secondary market liquidity remains modest, with transactions occurring mainly in project groups that ensure construction progress, reasonable prices, clear legal status, and are developed by reputable investors in the market.

The Government's moves to remove difficulties for the market such as Resolution 33/NQ-CP, Official Dispatch No. 469/CD-TTg, Circular 02/2023/TT-NHNN, Circular 03/2023/TT-NHNN, etc. are expected to bring many positive signals to the market in the coming time.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to urge highway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/6a3e175f69ea45f8bfc3c272cde3e27a)

![[Photo] Dong Ho Paintings - Old Styles Tell Modern Stories](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/317613ad8519462488572377727dda93)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

Comment (0)