| Proposal to reduce import tax on corn and wheat to reduce animal feed prices Animal feed businesses in the context of constantly fluctuating raw material prices |

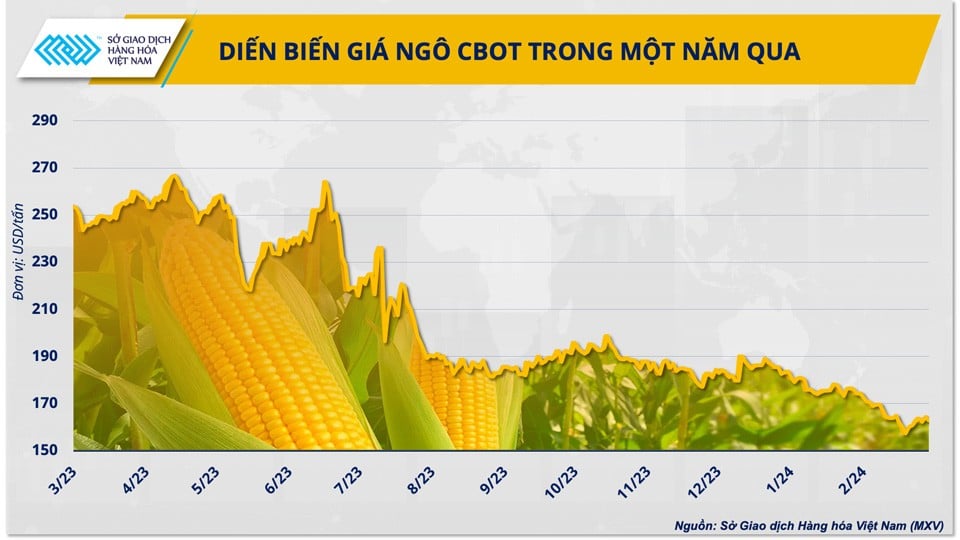

Last week, the price of this commodity suddenly reversed and had a series of 4 consecutive recovery sessions. Faced with this development, many Vietnamese animal feed enterprises cannot help but worry…

|

| CBOT corn price movements over the past year |

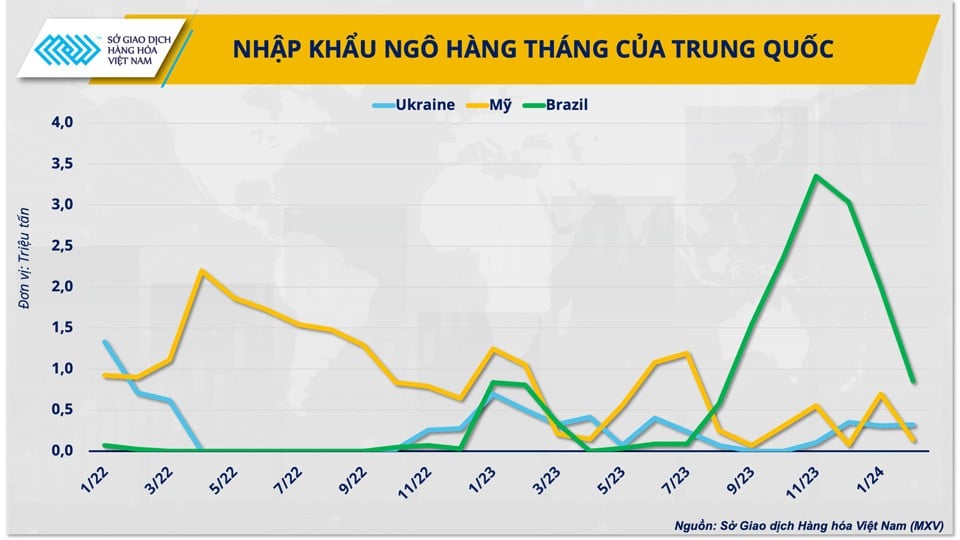

According to the Vietnam Commodity Exchange (MXV), the continuous recovery of corn prices in recent sessions is mainly due to the market's reaction to the news that China has unexpectedly placed a large order from Ukraine. Although there are no exact figures, some European traders estimate that up to 240,000 - 600,000 tons of corn from Ukraine will be exported to this Asian country.

Back in the first half of 2021, when China massively imported tons of US corn, the price of this commodity increased by more than 50%. The question is, is the recent purchase a sign that China's import demand is recovering and a driving force to support corn prices to increase again?

China buys Ukrainian corn, is it unusual?

Before the Black Sea War, China was already Ukraine's largest corn buyer, accounting for about 20% of the country's total corn exports since 2018. On the other hand, Ukraine is also one of China's main corn suppliers, contributing nearly 1/3 of the total corn volume imported into the country.

However, after Russia withdrew from the Black Sea grain deal and the ongoing conflict in the region, Ukraine's important grain export routes were disrupted, directly affecting the country's trade with buyers in Asia.

|

| China's monthly corn imports |

Now, thanks to the success of alternative export routes, cheap corn supplies from Ukraine have returned and are being pushed into the international market. Ukrainian corn prices are among the lowest in the world, much more competitive than supplies from some of the leading producing countries such as the United States and Brazil. The current market environment is helping Ukraine gradually regain its market share in corn exports to China.

According to MXV, this is the reason why China has recently imported a large amount of corn, especially when the country is gradually becoming self-sufficient in domestic supply to reduce its dependence on foreign countries. According to a source of MXV, in the first two months of this year, the total amount of corn imported into the country has decreased by more than 18%, from 5.3 million tons in the same period in 2023.

New US supply needs to be watched closely

Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, commented: “Currently, the global economy is still facing inflation risks, so the factor affecting fluctuations in raw material prices does not come from demand. Instead, information on the production, supply and export situation of the country leading in the world's corn production structure - the US - is what businesses need to pay attention to.”

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

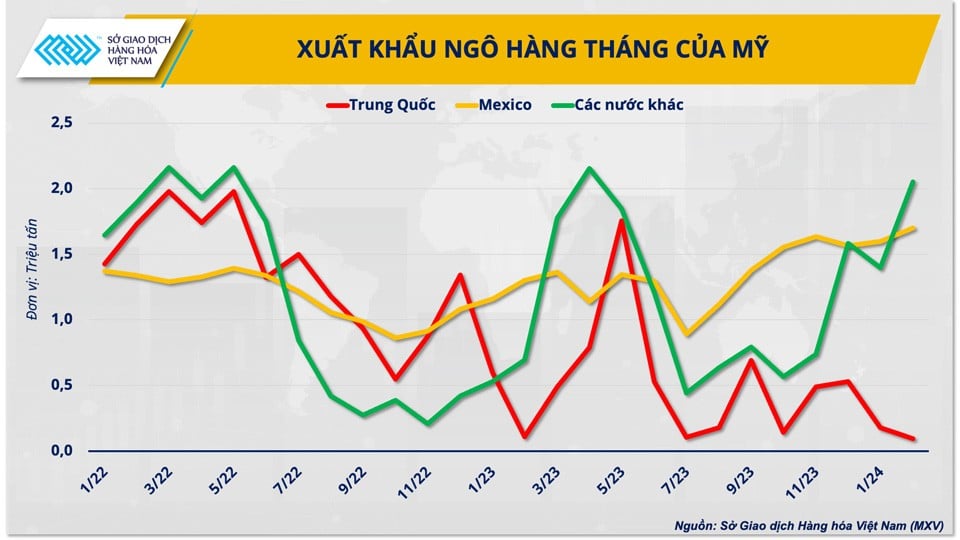

In recent years, the flow of corn trade from the US to major importing countries has changed a lot. Under strong competitive pressure from Brazil - the world's number 1 corn exporter, the US corn market share in the Chinese market has decreased significantly. In 2023, the amount of corn that the US exported to this billion-people country was more than 60% lower, compared to about 16 million tons the previous year.

|

| Monthly US Corn Exports |

However, high demand in Mexico - a traditional US corn import partner - has helped the country's sales remain stable, while gradually reducing its dependence on China. According to data from the US Department of Agriculture (USDA), cumulative US corn sales for the 2023/24 crop year as of February 8 reached 36.2 million tons, up more than 30% over the same period last year. Of which, Mexico accounted for nearly 45% of the US corn import market share, a record high during the same period.

There is no longer much "motivation" for raw material prices to increase.

In addition to exports, major agricultural organizations and news outlets have begun to pay attention and provide forecasts for the crop season that is set to begin planting in April in the U.S. Most notably, the February Agricultural Outlook Forum released the USDA’s first estimates for the country’s new crop year.

The market is watching closely for the forecast of planted acreage, a key metric that will help determine the size of the world’s top producer’s crop. USDA forecasts that US farmers will plant 3.6 million fewer acres of corn than in 2022/23, largely because the soybean-to-corn price ratio reflects more attractive returns from growing the oilseed. While this will result in lower corn production, thanks to a record harvest in late 2023, US ending stocks are still expected to reach their highest level in 60 years.

Mr. Quang Anh said that the corn market will find it difficult to continue to increase as hotly as in the recent period due to the abundant production in the US this year, which will weigh on the price of this raw material. Livestock enterprises need to pay attention to the next forecasts on the new crop area from the Prospective Plantings Report released by the USDA on the night of March 29.

Some experts also believe that spring in the US is likely to come early and corn planting area may be slightly higher than the USDA's initial estimate of 91 million acres. If the US corn crop this year is larger than expected, the prospect of increased supply will further weaken corn prices, thereby allowing Vietnamese importers to take advantage of the opportunity to buy at lower prices.

Source

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)