Domestic gold price today April 10, 2025

At the time of survey at 4:30 a.m. on April 10, 2025, the domestic gold price had a record increase of 2 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and 1.7 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is at 2.2 million VND/tael.

At the same time, the price of SJC gold bars was listed at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and 1.7 million VND/tael for selling compared to early this morning. The difference between buying and selling prices was at 2.2 million VND/tael.

SJC gold price at Bao Tin Minh Chau Company Limited listed SJC gold bar price at 99.8-101.9 million VND/tael (buy - sell); increased by 2 million VND/tael for buying and increased by 1.7 million VND/tael for selling compared to early morning. The difference between buying and selling price is at 2.1 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and 1.7 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is at 2.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 99.9-102 million VND/tael (buy - sell); an increase of 1.9 million VND/tael for buying and 1.7 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is 2.1 million VND/tael.

The latest gold price list today, April 10, 2025 is as follows:

| Gold price today | April 10, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 99.7 | 101.9 | +2000 | +1700 |

| DOJI Group | 99.7 | 101.9 | +2000 | +1700 |

| Red Eyelashes | 100.2 | 101.9 | +800 | +1500 |

| PNJ | 99.7 | 101.9 | +2000 | +1700 |

| Vietinbank Gold | 101.9 | +1700 | ||

| Bao Tin Minh Chau | 99.8 | 101.9 | +2000 | +1700 |

| Phu Quy | 98.9 | 101.9 | +1200 | +1700 |

| 1. DOJI - Updated: April 10, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 99,700 ▲2000K | 101,900 ▲1700K |

| AVPL/SJC HCM | 99,700 ▲2000K | 101,900 ▲1700K |

| AVPL/SJC DN | 99,700 ▲2000K | 101,900 ▲1700K |

| Raw material 9999 - HN | 99,500 ▲2000K | 101,000 ▲1700K |

| Raw material 999 - HN | 99,400 ▲2000K | 100,900 ▲1700K |

| 2. PNJ - Updated: April 10, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,500 ▲1800K | 101,900 ▲1700K |

| HCMC - SJC | 99,700 ▲2000K | 101,900 ▲1700K |

| Hanoi - PNJ | 99,500 ▲1800K | 101,900 ▲1700K |

| Hanoi - SJC | 99,700 ▲2000K | 101,900 ▲1700K |

| Da Nang - PNJ | 99,500 ▲1800K | 101,900 ▲1700K |

| Da Nang - SJC | 99,700 ▲2000K | 101,900 ▲1700K |

| Western Region - PNJ | 99,500 ▲1800K | 101,900 ▲1700K |

| Western Region - SJC | 99,700 ▲2000K | 101,900 ▲1700K |

| Jewelry gold price - PNJ | 99,500 ▲1800K | 101,900 ▲1700K |

| Jewelry gold price - SJC | 99,700 ▲2000K | 101,900 ▲1700K |

| Jewelry gold price - Southeast | PNJ | 99,500 ▲1800K |

| Jewelry gold price - SJC | 99,700 ▲2000K | 101,900 ▲1700K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,500 ▲1800K |

| Jewelry gold price - Kim Bao Gold 999.9 | 99,500 ▲1800K | 101,900 ▲1700K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 99,500 ▲1800K | 101,900 ▲1700K |

| Jewelry gold price - Jewelry gold 999.9 | 99,300 ▲1700K | 101,800 ▲1700K |

| Jewelry gold price - Jewelry gold 999 | 99,200 ▲1700K | 101,700 ▲1700K |

| Jewelry gold price - Jewelry gold 9920 | 98,590 ▲1690K | 101,090 ▲1690K |

| Jewelry gold price - Jewelry gold 99 | 98,380 ▲1680K | 100,880 ▲1680K |

| Jewelry gold price - 750 gold (18K) | 74,000 ▲1270K | 76,500 ▲1270K |

| Jewelry gold price - 585 gold (14K) | 57,200 ▲990K | 59,700 ▲990K |

| Jewelry gold price - 416 gold (10K) | 40,000 ▲710K | 42,500 ▲710K |

| Jewelry gold price - 916 gold (22K) | 90,850 ▲1560K | 93,350 ▲1560K |

| Jewelry gold price - 610 gold (14.6K) | 59,750 ▲1040K | 62,250 ▲1040K |

| Jewelry gold price - 650 gold (15.6K) | 63,820 ▲1100K | 66,320 ▲1100K |

| Jewelry gold price - 680 gold (16.3K) | 66,870 ▲1150K | 69,370 ▲1150K |

| Jewelry gold price - 375 gold (9K) | 35,830 ▲640K | 38,330 ▲640K |

| Jewelry gold price - 333 gold (8K) | 31,240 ▲560K | 33,740 ▲560K |

| 3. SJC - Updated: 4/10/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 99,700 ▲2000K | 101,900 ▲1700K |

| SJC gold 5 chi | 99,700 ▲2000K | 101,920 ▲1700K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 99,700 ▲2000K | 101,930 ▲1700K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 99,500 ▲1900K | 101,700 ▲1600K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 99,500 ▲1900K | 101,800 ▲1600K |

| Jewelry 99.99% | 99,500 ▲1900K | 101,400 ▲1600K |

| Jewelry 99% | 97,396 ▲1584K | 100,396 ▲1584K |

| Jewelry 68% | 66,108 ▲1088K | 69,108 ▲1088K |

| Jewelry 41.7% | 39,438 ▲667K | 42,438 ▲667K |

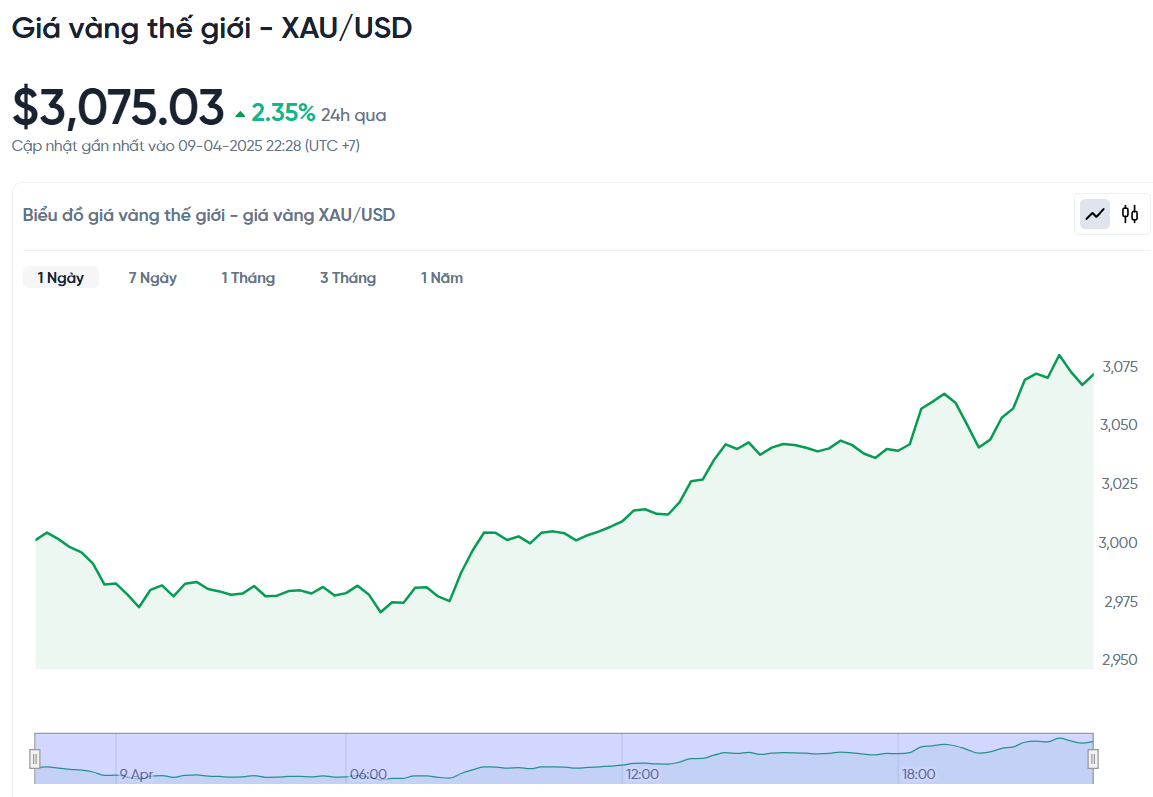

World gold price today April 10, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,075.03 USD/ounce. Today's gold price increased by 70.66 USD/ounce compared to yesterday. Converted according to the USD exchange rate on the free market (26,250 VND/USD), the world gold price is about 98.38 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.52 million VND/tael higher than the international gold price.

Gold prices rose sharply as many investors sought safe havens after US President Donald Trump's retaliatory tariffs took effect. The weakening of the US dollar and expectations that the US Federal Reserve (FED) would cut interest rates also contributed to the increase. US gold futures rose 2.5% to $3,066.20 an ounce.

The US imposition of 104% tariffs on Chinese goods has raised concerns that global trade tensions could escalate and hurt economic growth. In response, China is expected to hold a high-level meeting to discuss how to respond to the situation. In addition, the Chinese central bank has also asked state-owned banks to limit their purchases of US dollars to support the yuan exchange rate.

UBS analyst Giovanni Staunovo said that trade war concerns are weakening the US economic outlook, leading investors to start expecting the Fed to cut interest rates this year. He predicted that gold prices could continue to rise to $3,200 an ounce in the next few months.

Nearly 60% of traders now believe the Fed could start cutting interest rates as early as May. In a low-interest-rate environment, gold – a non-yielding asset – is often the preferred choice of investors.

The market is also awaiting the minutes of the Fed's latest meeting and US consumer price index (CPI) data due on Thursday. According to Giovanni Staunovo, the CPI may no longer be the focus this time, as investors are shifting their attention to the impact of new tariffs on inflation. He said that if the US economy shows clear signs of weakness, the Fed will likely act by cutting interest rates this year.

After falling sharply from a peak of $3,162 an ounce on April 3 to $3,038 on April 5, and even hitting a low of $2,960 on April 7, gold prices have recovered. This increase was mainly due to buying at low prices.

Gold prices are benefiting from the backdrop of global financial market turmoil and escalating geopolitical tensions in Ukraine and the Middle East. Meanwhile, rising inflation is making gold an attractive investment channel, especially in 2025.

Gold Price Forecast

The world gold price is forecast to continue to fluctuate strongly in the coming time, due to the influence of both economic and geopolitical factors. However, the upward or downward trend will depend largely on the development of the trade war between the US and other countries, especially China.

The continued imposition of retaliatory tariffs by various countries is raising concerns in the global market. At the same time, investors are also awaiting a series of important economic data from the US such as the Fed meeting minutes, consumer price index (CPI) and producer price index (PPI). These data will directly affect expectations about interest rate policy, and thereby have a clear impact on gold price movements.

If inflation data shows that inflation remains high or the Fed continues to be cautious about cutting interest rates, gold prices could be pushed below the psychologically important $3,000/ounce level. Conversely, if there are signs that inflation is cooling or the Fed is leaning towards easing monetary policy, gold could rebound and even reach the $3,100/ounce region.

The decline of financial markets such as stocks, cryptocurrencies or oil can also indirectly affect gold. When investors need liquidity, they can sell gold to cover losses in other markets. In addition, profit-taking activities from large investment funds can also create sudden price drops, causing gold prices to fluctuate around $2,960–3,100/ounce in the short term.

The weakening US dollar amid concerns over global trade is providing strong support for gold, said Suki Cooper, an expert at Standard Chartered Bank. She revised her forecast for the average gold price in the second quarter of 2025 to $3,300 an ounce, up from $2,900 previously.

Michael Widmer, a strategist at Bank of America, also gave an optimistic forecast that gold prices could reach $3,063 in 2025 and continue to increase to $3,350 in 2026. He believes that the $3,500/ounce mark is completely achievable within the next two years, but also warns that this is a challenging target, because to maintain the current strong growth momentum requires many factors of prolonged instability.

Although gold prices may occasionally stall, the overall trend is still upward, especially with uncertainties about the global economy and inflation, according to KCM Trade expert Tim Waterer. However, he also noted that gold's rally is being pressured by the fact that the yield on the 10-year US government bond is at its highest level in more than a month, reducing the appeal of gold - a non-yielding asset.

Source: https://baoquangnam.vn/gia-vang-hom-nay-10-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-muc-ky-luc-3152394.html

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

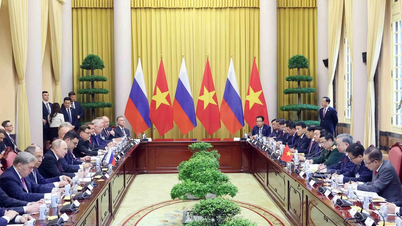

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)