At the close of trading yesterday, world oil prices recovered right before the Christmas holiday, with WTI crude oil ending its three-session decline streak.

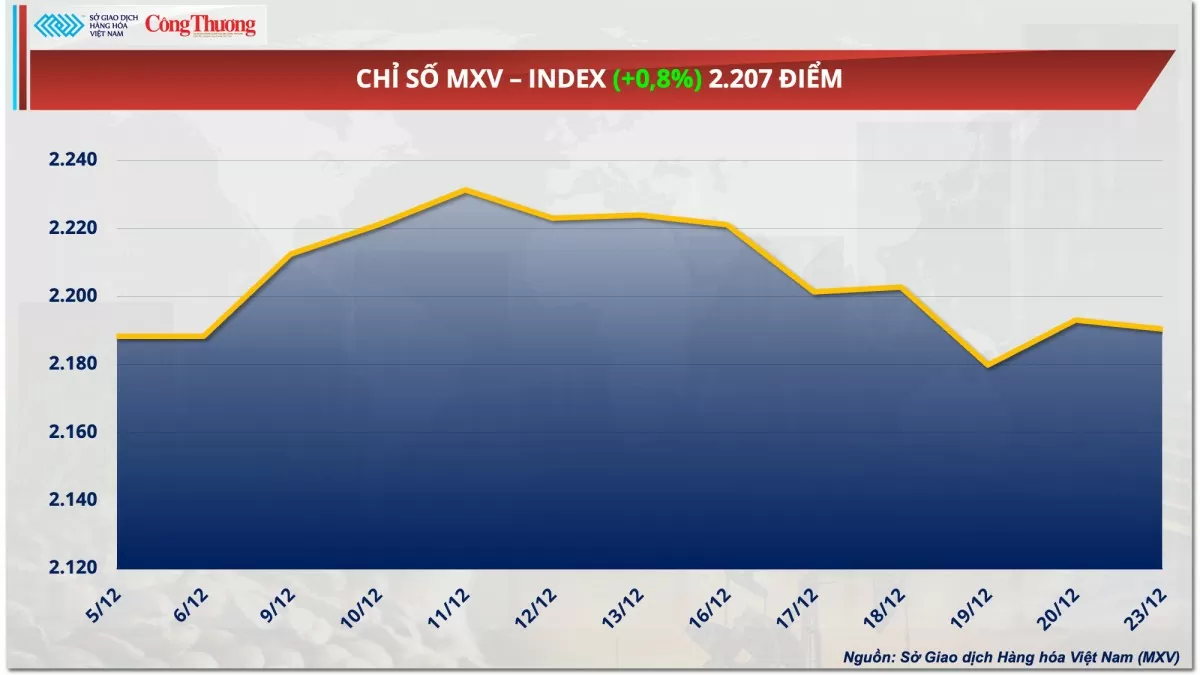

According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material market in yesterday's trading session (December 24). Notably, on the trading price board in the early morning of December 25, all 5 energy products increased in price, leading the trend of the entire market. Meanwhile, the metal market was quite quiet due to the impact of the Christmas holiday, with lower trading volume than previous sessions. At the end of the session, the MXV-Index increased by 0.8% to 2,207 points.

|

| MXV-Index |

Oil prices reverse to recover

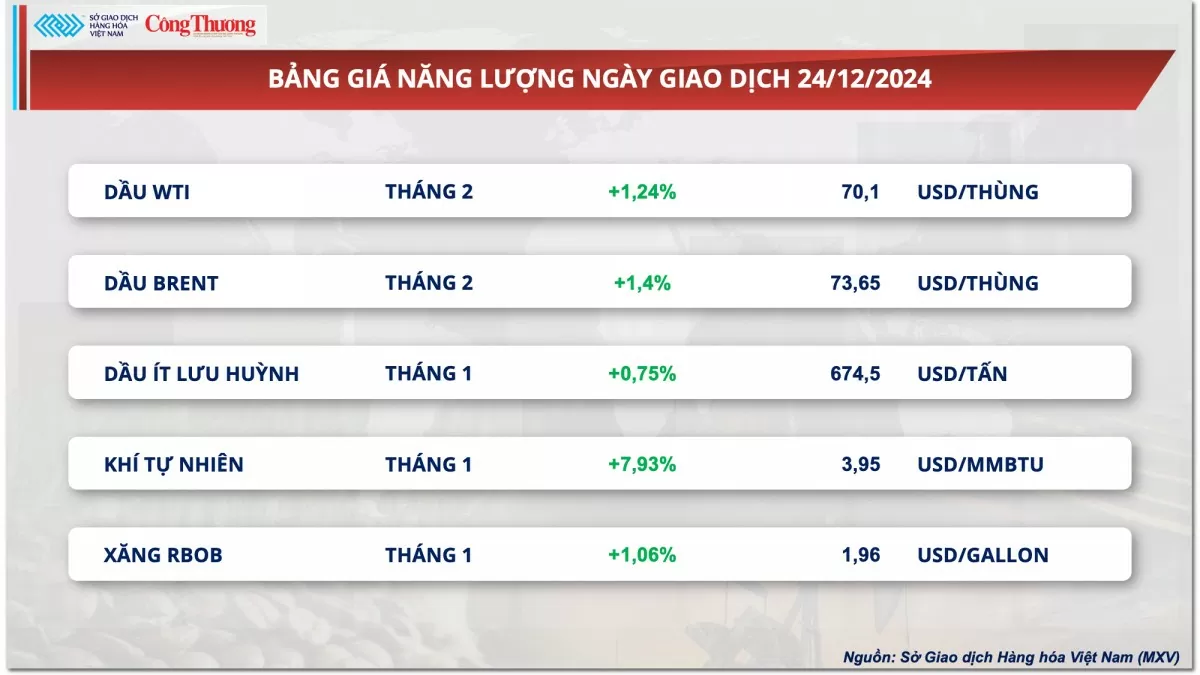

At the close of yesterday's trading session, the energy market was completely covered in green, in which world oil prices recovered right before the Christmas holiday, especially WTI crude oil ended the previous three consecutive sessions of decline. Factors that pushed oil prices back up were forecasts of declining US crude oil and fuel inventories and information about China increasing fiscal stimulus measures to revive the economy through a record bond issuance.

|

| Energy price list |

Yesterday's trading session ended early to allow major exchanges around the world to close for Christmas. At the closing price of around 2:00 a.m. on December 25, Vietnam time, Brent crude oil price increased by 1.4% to 73.65 USD/barrel, while WTI crude oil price also increased by 1.24% to 70.1 USD/barrel.

Oil prices benefited yesterday from a drop in U.S. crude and fuel inventories last week, reflecting rising demand. U.S. commercial crude inventories are estimated to have fallen by 1.9 million barrels in the week ended December 20, according to a Reuters survey. Gasoline and distillate inventories also fell by 1.1 million barrels and 300,000 barrels, respectively. The U.S. Energy Information Administration's (EIA) weekly inventory report was postponed from Wednesday to Friday (December 27) due to the holiday.

In addition, the market welcomed the good news about China's economic stimulus package expected to be launched next year, raising hopes for improved consumption, thereby supporting oil prices in yesterday's trading session. Also according to Reuters, the Chinese government has agreed to issue 3,000 billion yuan (equivalent to 411 billion USD) of special treasury bonds next year. This will be the largest issuance ever and three times the issuance this year as the country increases fiscal stimulus to revive the weakening economy.

The 1.3 trillion yuan will be allocated to subsidizing durable goods, allowing consumers to trade in old cars or appliances and buy new ones at a discount, and supporting large-scale upgrades of enterprise equipment. In addition, the support will be used for national strategic projects, such as building railways, airports, farmland, and strengthening security in key areas.

More than 1 trillion yuan will be invested in new manufacturing, including electric vehicles, robotics, semiconductors, and green energy. The rest of the package will be used to recapitalize the country’s major state-owned banks, which are struggling with shrinking profit margins, weakening profits, and rising bad loans.

Metal market is quiet

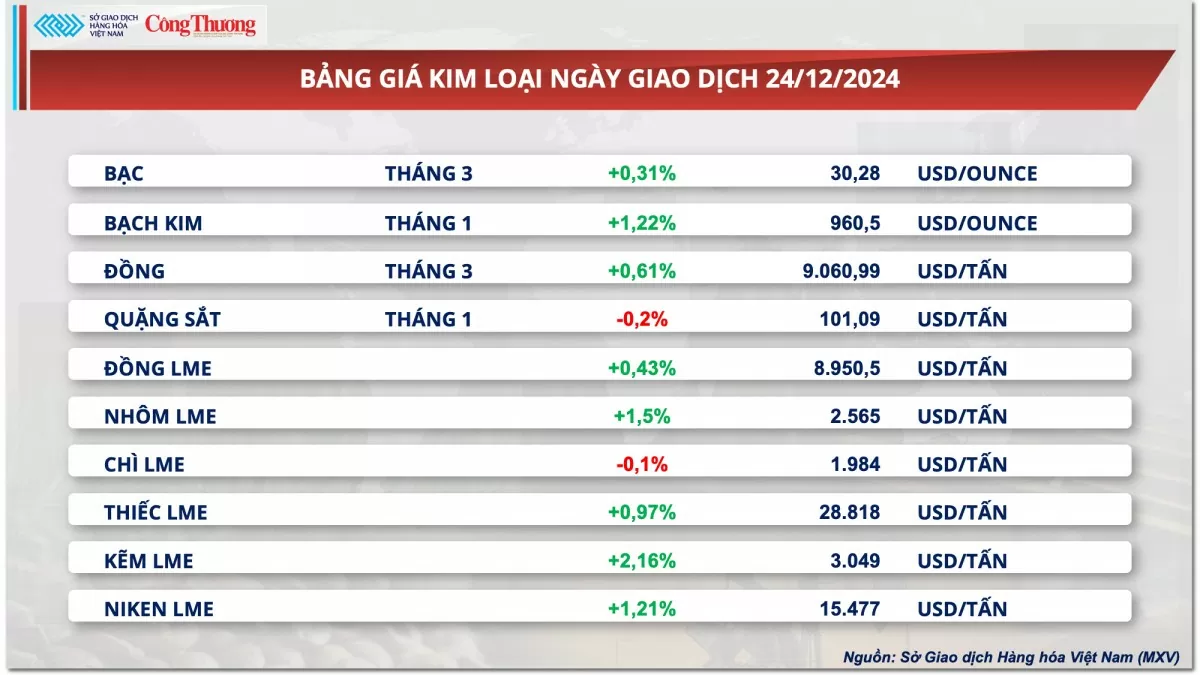

According to MXV, at the end of yesterday's trading session, the metal market was relatively quiet with lower trading volume than previous sessions due to the impact of the Christmas holiday in the US. The market closed early on the holiday, so prices of commodities will be calculated until 2:00 a.m. on December 25, Vietnam time.

|

| Metal price list |

For precious metals, silver prices rose about 0.3% to $30.28 an ounce, while platinum prices also rose more than 1% to $960.5 an ounce. Precious metal prices continued to maintain their upward momentum after important inflation data released late last week showed signs of cooling. Specifically, according to data released by the Bureau of Economic Analysis under the US Department of Commerce, in November, the US's core personal consumption expenditures (PCE) price index, excluding price fluctuations in energy and food, increased by 2.8% year-on-year, 0.1 percentage points lower than forecast. Compared to the previous month, the core PCE index increased by only 0.1% in November, this figure was 0.1 percentage points lower than forecast and cooled down from the 0.3% increase in October. This is also the lowest level in the past 7 months.

The US Federal Reserve’s preferred inflation gauge cooled faster than expected, helping to ease recent concerns that the Fed would delay rate cuts as inflation showed signs of picking up again, and this has helped money gradually return to the precious metals group.

Among base metals, iron ore fell 0.2 percent to $101.09 a tonne despite China signaling fiscal stimulus through a plan to issue 3 trillion yuan in special treasury bonds next year.

Iron ore prices, which are sensitive to China's economic stimulus, fell on Wednesday due to pressure from consumption. China's steel demand is expected to reach 863 million tonnes this year, down 4.4% from a year earlier, according to a report from the China Metallurgical Industry Planning and Research Institute (MPI). Next year, steel consumption will fall another 1.5% to 850 million tonnes. The outlook for falling steel consumption has worsened the outlook for iron ore, a key raw material for steel production, putting pressure on iron ore prices on Thursday.

Furthermore, the latest report from the World Steel Association (World Steel) shows that global steel production fell to 146.8 million tonnes in November, down 3% from the previous month.

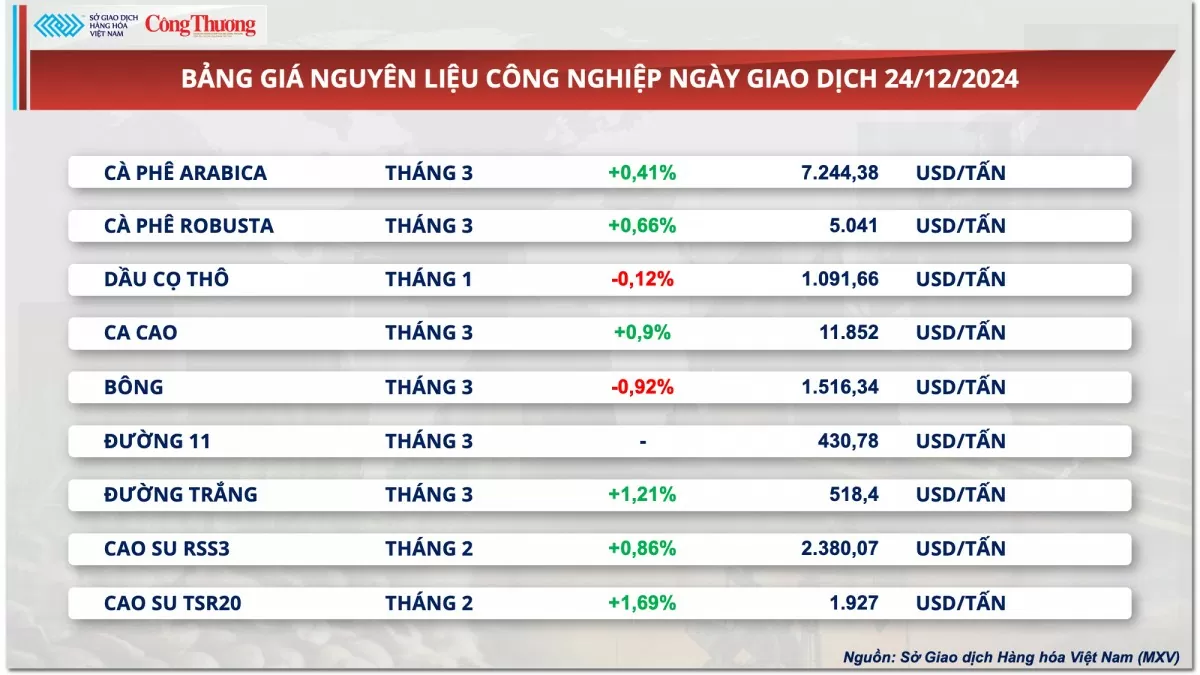

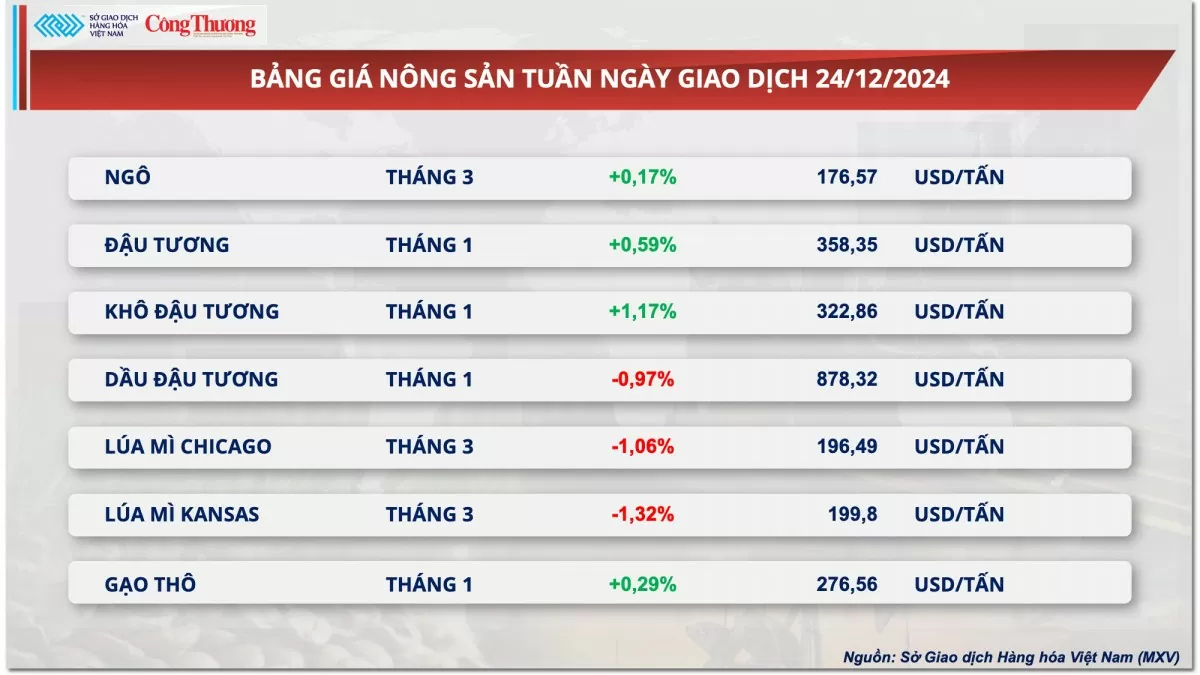

Prices of some other goods

|

| Industrial raw material price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-2512-gia-dau-dao-chieu-hoi-phuc-366076.html

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Vietnamese rescue team shares the loss with people in Myanmar earthquake area](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/ae4b9ffa12e14861b77db38293ba1c1d)

![[Photo] Solemn Hung King's Death Anniversary in France](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/786a6458bc274de5abe24c2ea3587979)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

Comment (0)