At the end of the session on May 30, the VN-Index closed at 1,266 points, down 6 points.

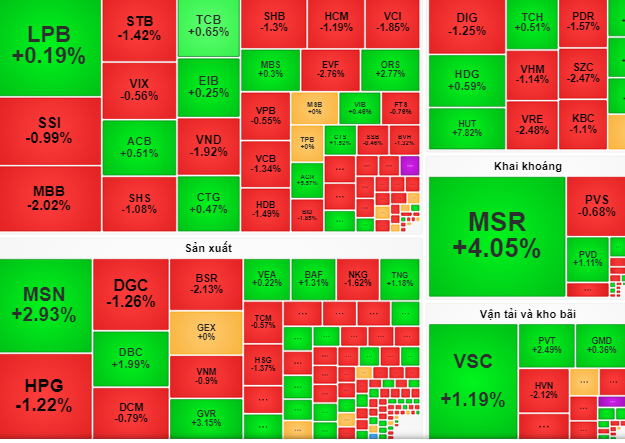

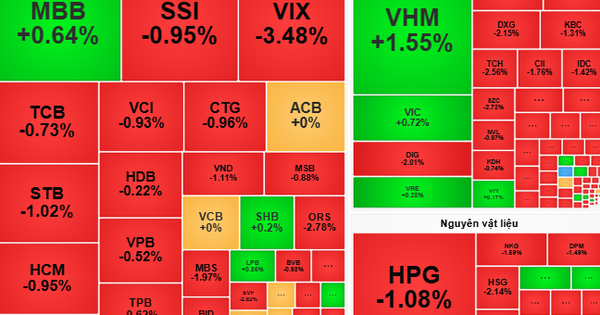

Selling pressure appeared right at the beginning of the session, causing red stocks to cover almost the entire market throughout the morning session. Of the 30 large stocks, only 2 increased in price: CTG and MSN. The group of small and medium stocks also had red colors as investors sold to preserve profits.

Selling liquidity continued to increase sharply in the early afternoon session, causing the HoSE to lose 20 points at times. However, near the end of the session, buying power suddenly increased, helping the general indices narrow the decline. Many stocks increased in price again, such as GVR up 3.1%, PVT up 2.4%, DBC up 1.9%.

This session, foreign investors continued to sell strongly with a total value of 1,351 billion VND. They focused on selling stocks VRE, MBB, VND...

At the end of the session, the VN-Index closed at 1,266 points, down 6 points, equivalent to 0.5%.

With the above developments, some securities companies predict that the VN-Index will fluctuate within a range of 20 points in the 1260 - 1280 area. The market will have alternating sessions of increase and decrease in points in the upcoming sessions.

"Investors should continue to eliminate stocks that have fallen deeply in price, hold stocks that recovered in the session of May 30 at 50-60% of the portfolio and should not borrow money from securities companies to buy stocks (margin stocks) at this time" - VCBS Securities Company recommends.

Meanwhile, Dragon Capital Securities Company (VDSC) warned that the stock selling pressure is still strong, negatively affecting the market in the coming time.

Source: https://nld.com.vn/chung-khoan-ngay-mai-31-5-gia-co-phieu-co-the-hoi-phuc-196240530173256787.htm

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Capital's youth enthusiastically practice firefighting and water rescue skills](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3f8481675271488abc7b9422a9357ada)

![[Photo] Ho Chi Minh City speeds up sidewalk repair work before April 30 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/17f78833a36f4ba5a9bae215703da710)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Steering Committee on Regional and International Financial Centers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/47dc687989d4479d95a1dce4466edd32)

Comment (0)