At the close of yesterday's trading session, coffee prices continued to increase from the previous weekend sessions. Of which, Robusta coffee prices increased by 2.74% to 5,143 USD/ton.

According to the Vietnam Commodity Exchange (MXV), the world raw material market was quite quiet on the day the US celebrated Martin Luther King Day, prices of some items were calculated as of 2:30 a.m. this morning Vietnam time. However, buying power was still dominant, so the MXV-Index remained stable at 2,308 points. The metal and industrial raw material markets closed early and were relatively cautious on the day Donald Trump was inaugurated as US President.

|

| MXV-Index |

Metal market fluctuates

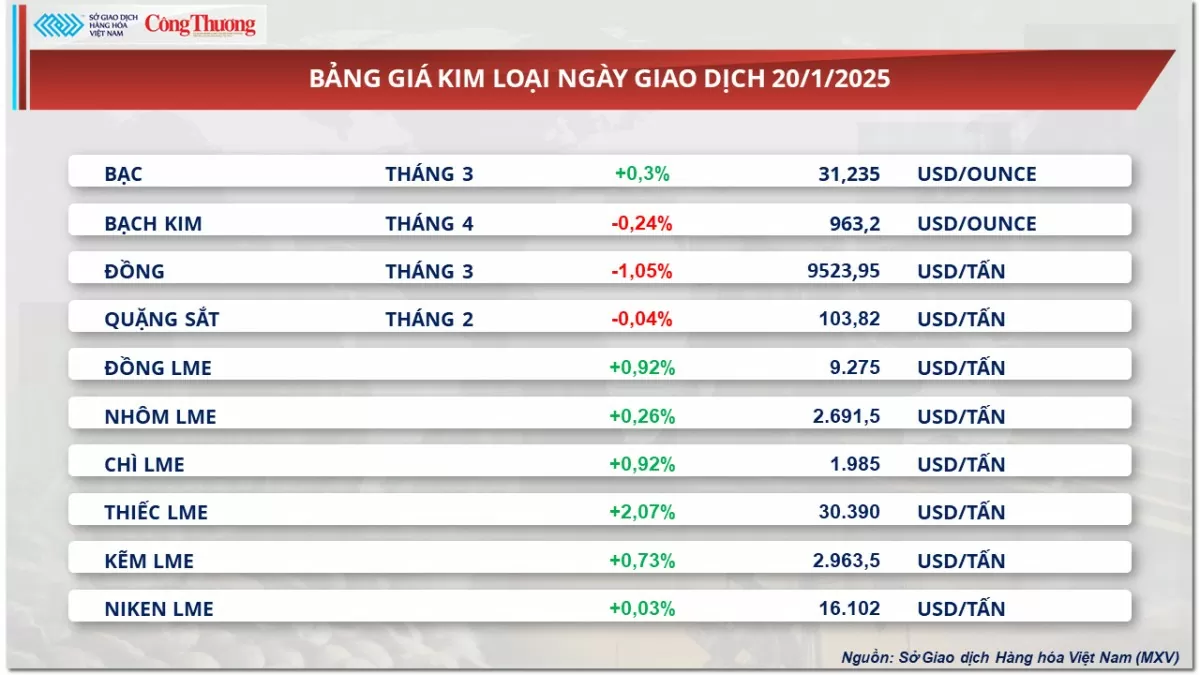

At the end of yesterday's trading session, the metal market was relatively quiet with thin liquidity as the US was on holiday. In particular, for precious metals, silver prices increased by about 0.3% to 31.23 USD/ounce while platinum prices decreased slightly by 0.24% to 963.2 USD/ounce.

|

| Metal price list |

In yesterday's session, the prices of two precious metals fluctuated in opposite directions amid a divergence in fundamental information. On the one hand, precious metal prices were under pressure as geopolitical conflicts cooled down, especially in the Middle East conflict hotspot after Israel and Hamas officially reached a ceasefire agreement in the Gaza Strip after months of fighting. This reduced investment demand for safe havens, thereby putting pressure on silver and platinum prices.

On the other hand, the price of precious metals, a type of safe-haven commodity, received buying pressure due to increased risk aversion after US President Donald Trump officially declared his inauguration early this morning (Vietnam time). In addition, according to forecasts from analysts and industry experts, Mr. Trump is expected to soon issue national energy policies, emphasizing the expansion of oil and gas production, which could reduce energy costs and inflationary pressure, reinforcing expectations that the US Federal Reserve (FED) will continue to lower interest rates this year.

On the base metals side, green remained dominant across the board, with the exception of copper and iron ore. COMEX copper fell more than 1% yesterday after the People’s Bank of China (PBOC) kept its lending rate unchanged for the third straight month in January, despite the country’s pledge to boost consumption.

As for iron ore prices, the market fluctuated but sellers still had the upper hand due to concerns about demand from China. In the week ending January 12, the average price of finished steel products in China continued to decrease slightly, according to the announcement from the Ministry of Commerce of China (MOC). Specifically, from January 6 to January 12, the average price of hot-rolled coil, rebar and steel plate decreased by 1.9%, 1.3% and 1.2% respectively compared to the previous week.

Aluminum prices were supported by the expectation that President Donald Trump’s China tariffs would be delayed. In a statement, Trump said he would issue a comprehensive trade memorandum that would not impose new tariffs on his first day in office. Instead, he would direct federal agencies to review the U.S. trade relationship with China, Canada and Mexico.

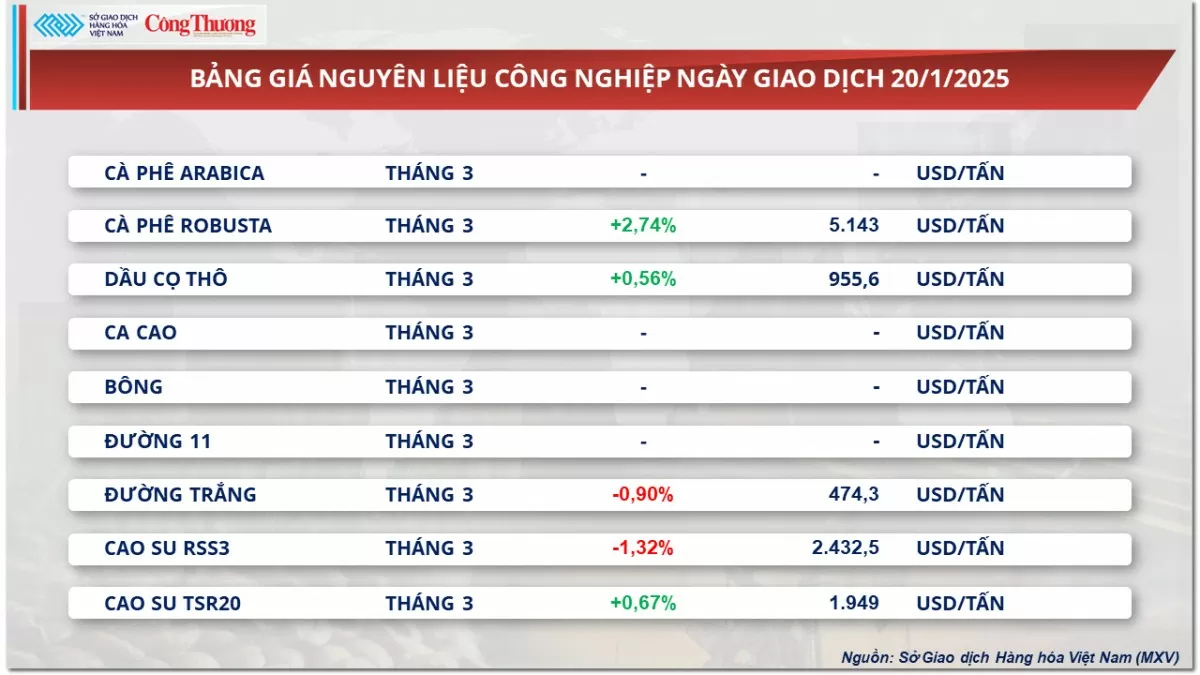

Coffee prices continue to rise

According to MXV, in the first trading session of the week, half of the commodities in the industrial raw materials group were closed for trading, including Arabica coffee, cotton, cocoa and sugar 11. In particular, coffee prices continued to increase from the previous sessions due to the less optimistic supply outlook in Brazil, the world's largest coffee supplier. Closing, Robusta coffee prices increased by 2.74% to 5,143 USD/ton.

|

| Industrial raw material price list |

Brazil’s coffee harvest in 2025 is expected to remain low, marking the fifth consecutive year of below-average production, according to a report released yesterday by investment bank Itau BBA. The bank also said that global coffee prices will remain high and are likely to rise further amid growing global coffee consumption and limited Arabica supplies in 2025 and early 2026.

In addition, the US Department of Agriculture (USDA) has revised down its estimate of Brazil's 2024-2025 coffee harvest to 66.4 million 60-kg bags from 69.9 million bags recorded in the previous report, of which 45.4 million bags are Arabica beans (accounting for 68.38% of total output) and 21 million bags of Robusta coffee (accounting for 31.62%).

In addition, the decrease in the USD/BRL exchange rate, which indirectly affects export activities in Brazil, was also a supporting factor for coffee prices in yesterday's session. The USD is expected to continue to increase strongly after Mr. Donald Trump officially declared his inauguration, which has caused the USD/BRL exchange rate to decrease by 0.64% to 6.03 points. The narrowing exchange rate gap may cause farmers in Brazil to limit coffee sales due to less foreign currency earned, thereby reducing the amount of coffee exported to the world.

Elsewhere, palm oil rose about 0.5% to $955.60 a tonne, largely on technical buying after a series of recent declines. However, prices remained under pressure amid weak demand prospects, especially in India, the world’s largest palm oil importer.

India’s palm oil imports in January 2025 are expected to fall to their lowest in nearly five years as demand slumps and buyers shift to soybean oil from palm oil, officials said. The country imported about 110,000 tonnes of palm oil in the first half of January and imports for the entire month are expected to be around 340,000-370,000 tonnes, the lowest since March 2020, officials estimated.

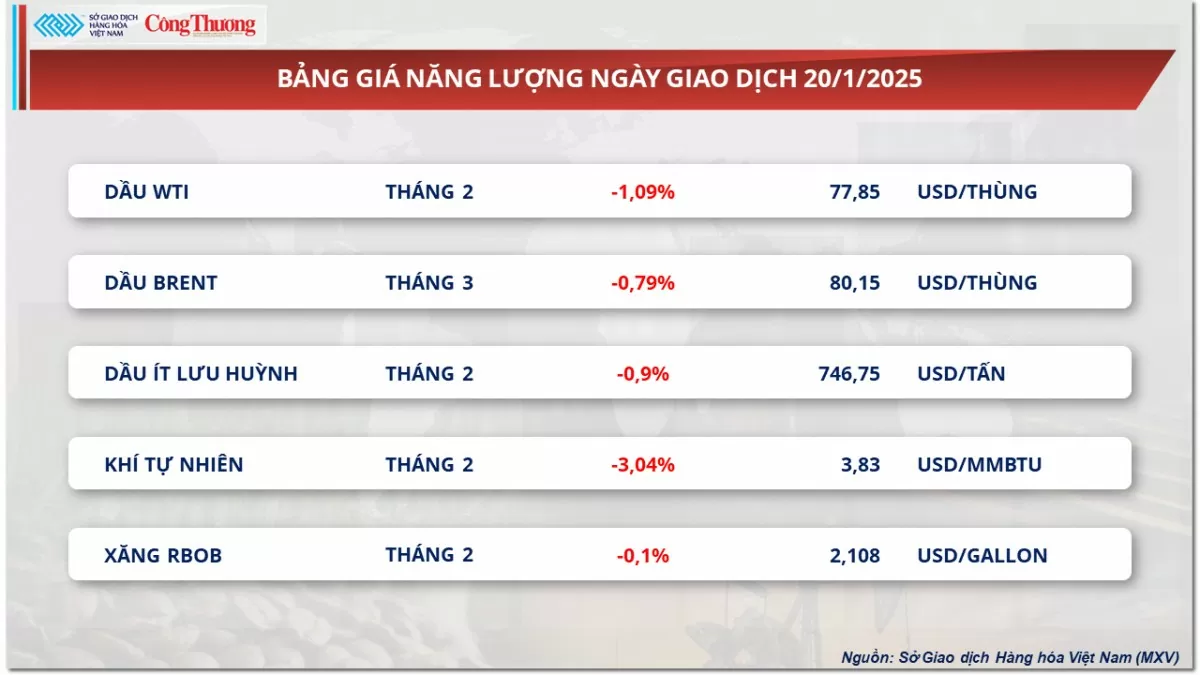

Prices of some other goods

|

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-211-gia-ca-phe-robusta-tang-274-370560.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)