Closing last week's trading session, Arabica coffee prices decreased by 1.24% while Robusta coffee prices edged up 0.30% compared to the reference.

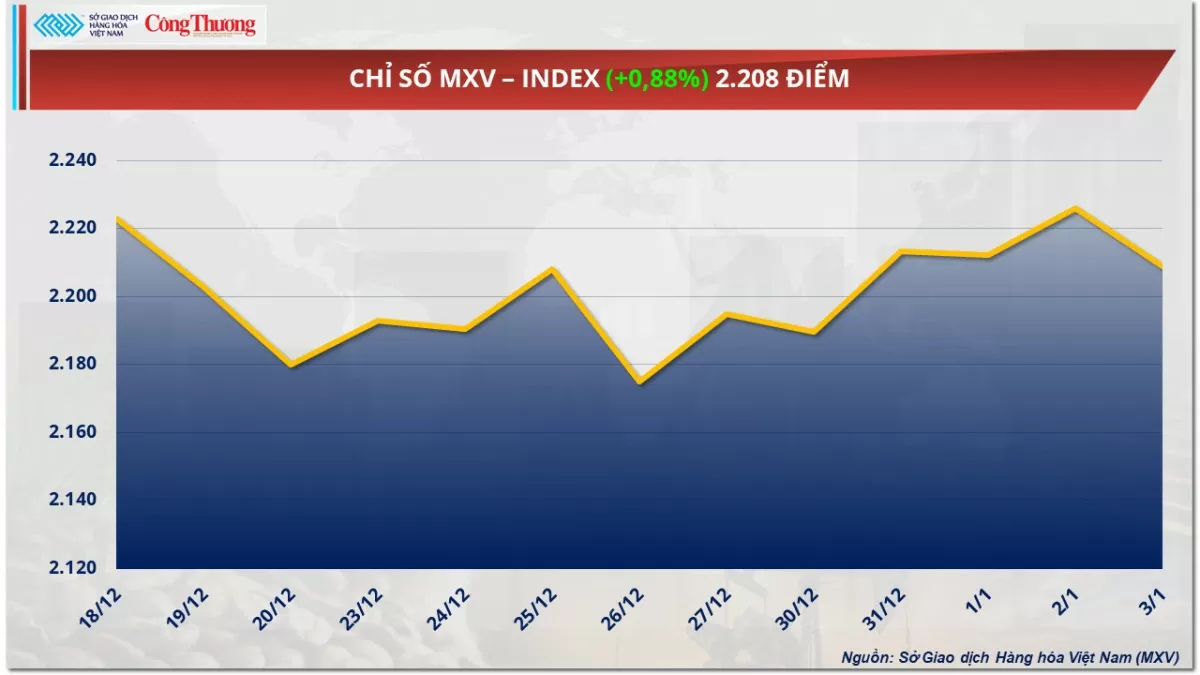

According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material price list in the first trading week of the new year (December 30, 2024 - January 5, 2025), pushing the MXV-Index up 0.88% to 2,208 points. Notably, the energy group led the increase of the entire market with 4 out of 5 commodities increasing sharply in price. Of which, crude oil prices recorded the 5th consecutive increase, reaching the highest level in nearly three months. In a synchronous manner, prices of many industrial raw materials increased simultaneously, notably cocoa with 11%.

|

| MXV-Index |

World crude oil prices hit highest level since mid-October

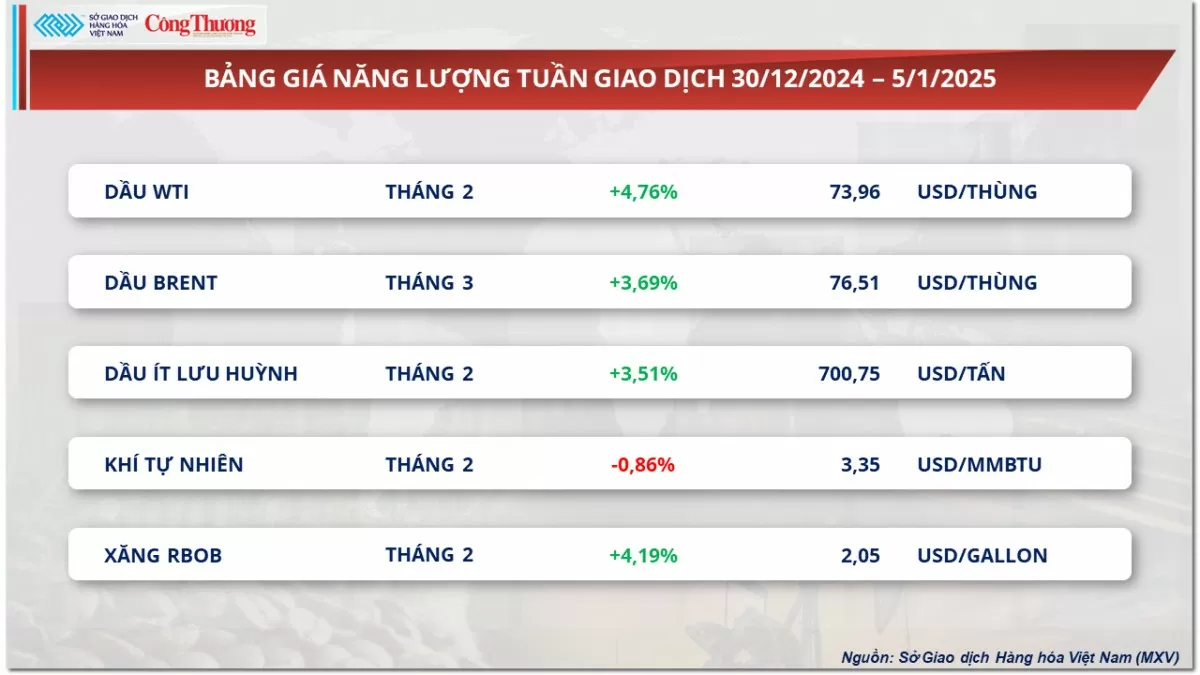

At the end of the first trading week of the new year, the energy group led the market's growth with 4 out of 5 commodities increasing sharply in price, of which world oil prices jumped nearly 5%. The main reason came from positive economic signals in China and increased demand for fuel storage for the winter.

|

| Energy price list |

At the end of the trading week, Brent crude oil prices increased by 3.7% to 76.5 USD/barrel, recording the highest level since mid-October. Meanwhile, WTI crude oil prices also increased by 4.8% to nearly 74 USD/barrel.

Last week, in addition to Chinese President Xi Jinping's pledge to adopt more proactive policies to boost economic growth in the new year, positive economic data from China also helped raise market expectations for improved crude oil demand, thereby supporting the price increase last week. According to the National Bureau of Statistics of China (NBS), in December, the country's manufacturing purchasing managers' index (PMI) recorded the third consecutive month above 50 points, while the non-manufacturing PMI also jumped to its highest level since March 2024.

In an effort to stimulate consumption and support the slowing economy, China has increased salaries for millions of civil servants for the first time in nearly a decade, expected to inject an additional $12 billion to $20 billion into the economy. In addition, the Chinese government will boost funding through the issuance of special treasury bonds in 2025 to boost business investment and consumption, a government official confirmed on Friday. Specifically, a series of projects this year worth 100 billion yuan, equivalent to nearly $14 billion, have been approved by the government.

In the US, commercial crude inventories fell by 1.2 million barrels in the week ending December 27, while crude oil production increased by 41,000 barrels per day and distillate and gasoline inventories added by 6.4 million barrels and 7.7 million barrels, respectively. In the context of the US National Weather Service forecasting colder weather in the East and Midwest, the above data shows increased fuel storage for winter heating, thereby supporting oil prices to rise last week.

In addition, according to data from the US Department of Labor at the end of December 2024, the number of initial unemployment claims in the country in the week ending December 27 decreased by 9,000 to 211,000, marking the lowest level in the past 8 months. The relatively positive health of the US labor market raised hopes of increased consumption and economic activity, thereby boosting oil demand and strengthening the upward momentum of prices this week.

On the other hand, the Dollar Index rose 0.88% to nearly 109 points last week, continuing to hover around its highest level since November 2022. The rising value of the greenback makes crude oil more expensive for importers using other currencies, raising concerns about weakening demand, thereby putting pressure on prices.

Industrial raw materials market is divided and volatile.

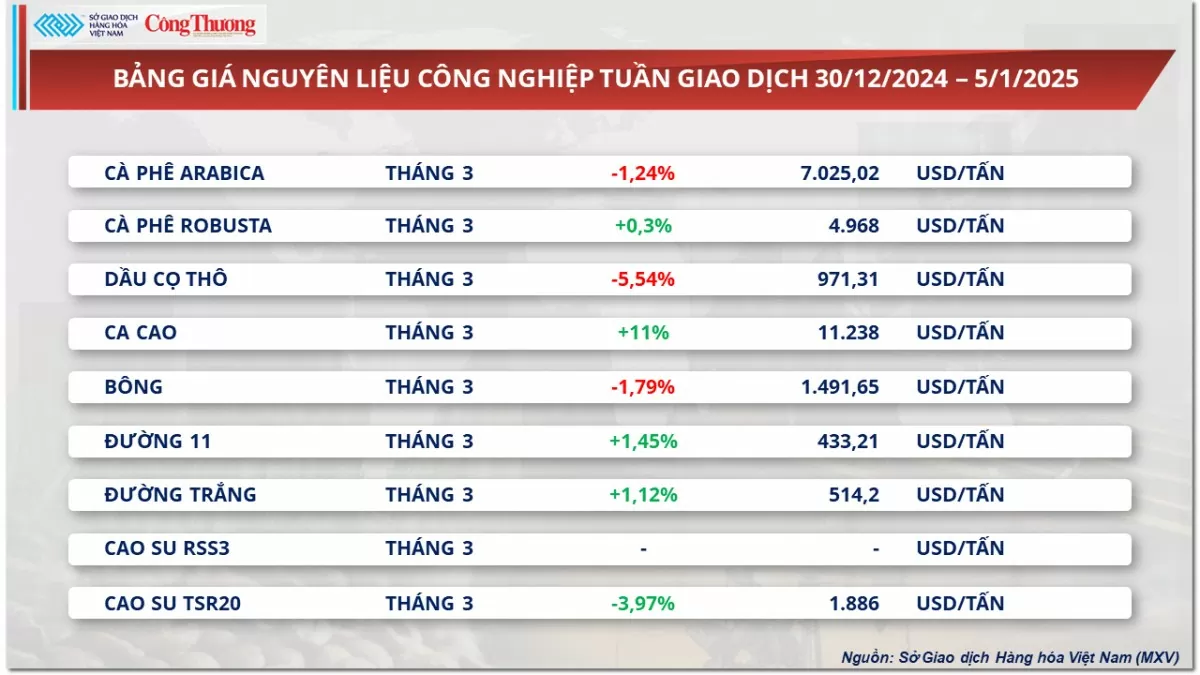

According to MXV, at the end of the first trading week of the new year, the price list of industrial raw materials recorded a difference between green and red. However, cocoa attracted attention when it returned to lead the group's increase after a deep adjustment in the previous week. Specifically, the cocoa contract price for March 2025 closed the week at 11,238 USD/ton, up 11% compared to the reference. The main reason for the return of cocoa prices still comes from concerns about the possibility that Ivory Coast will not be able to ensure supply for export in the first months of 2025.

|

| Industrial raw material price list |

Farmers in Ivory Coast, the world’s largest producer and exporter of cocoa, say prolonged dry weather could reduce the quality of beans and lead to a shortage in supplies in the coming months. Farmers there say cocoa production is expected to remain stable in January, but will start to decline in February.

Meanwhile, exports are still up year-on-year, but there is pressure on securing supplies for exports in the coming months as production is expected to decline. Cocoa exporters in Ivory Coast estimated that cocoa arrivals in the country from October 1 to December 29 reached 1.05 million tonnes, up more than 27% year-on-year. However, the increase was mainly due to exports. Moreover, this week’s increase was down 2.7 percentage points from the increase in the week to December 22.

On the other hand, the prices of two coffee commodities continued to fluctuate in a week of tug-of-war. Specifically, the price of Arabica coffee decreased by 1.24% while the price of Robusta coffee increased slightly by 0.30% compared to the reference price. The market continued to receive conflicting fundamental information, causing prices to fluctuate.

Last week, the lack of rain in Brazil's main coffee growing region improved, helping the market ease negative expectations for coffee production in the 2025-2026 crop year. The Somar Meteorological Agency reported that rainfall in Minas Gerais, Brazil's largest Arabica coffee-producing state, reached 102.8 mm last week, 82% higher than the historical average.

Meanwhile, prolonged rains in the Central Highlands are slowing down farmers’ coffee harvest. According to Reuters, due to the rains, about 20-30% of Vietnam’s coffee output has yet to be harvested.

In addition, the Indonesian government announced that the country exported 22,881 tons of Sumatra Robusta coffee beans in November, down 28.4% from the previous month but up sharply 76.51% compared to the same period last year.

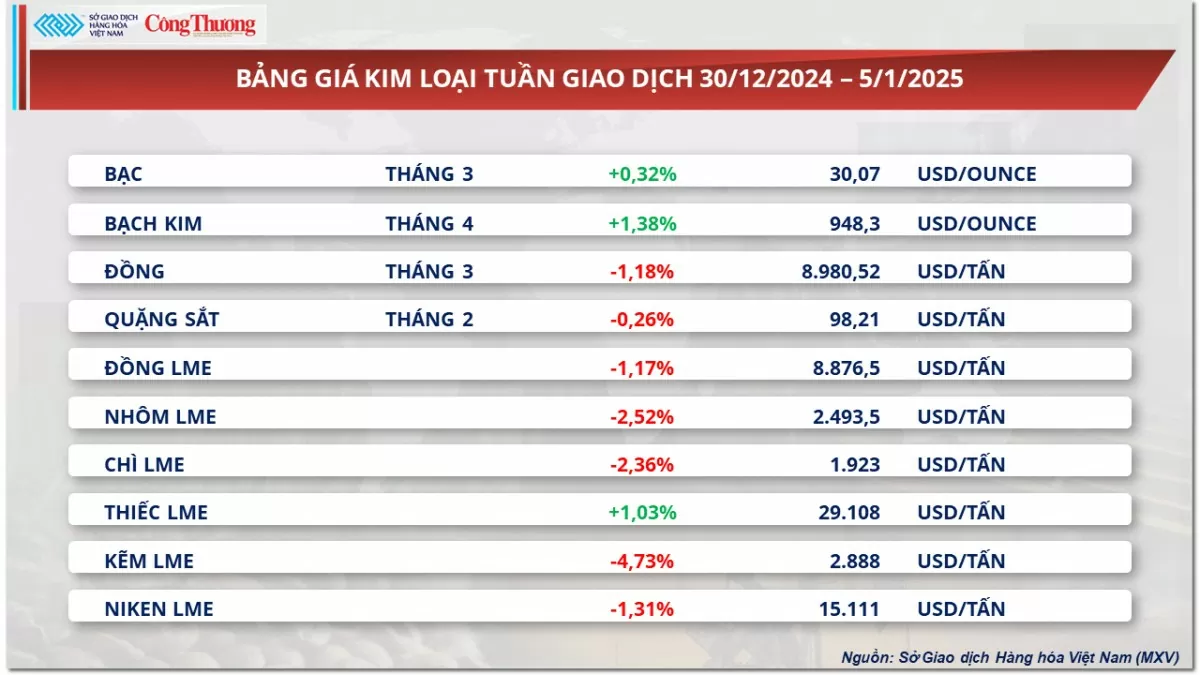

Prices of some other goods

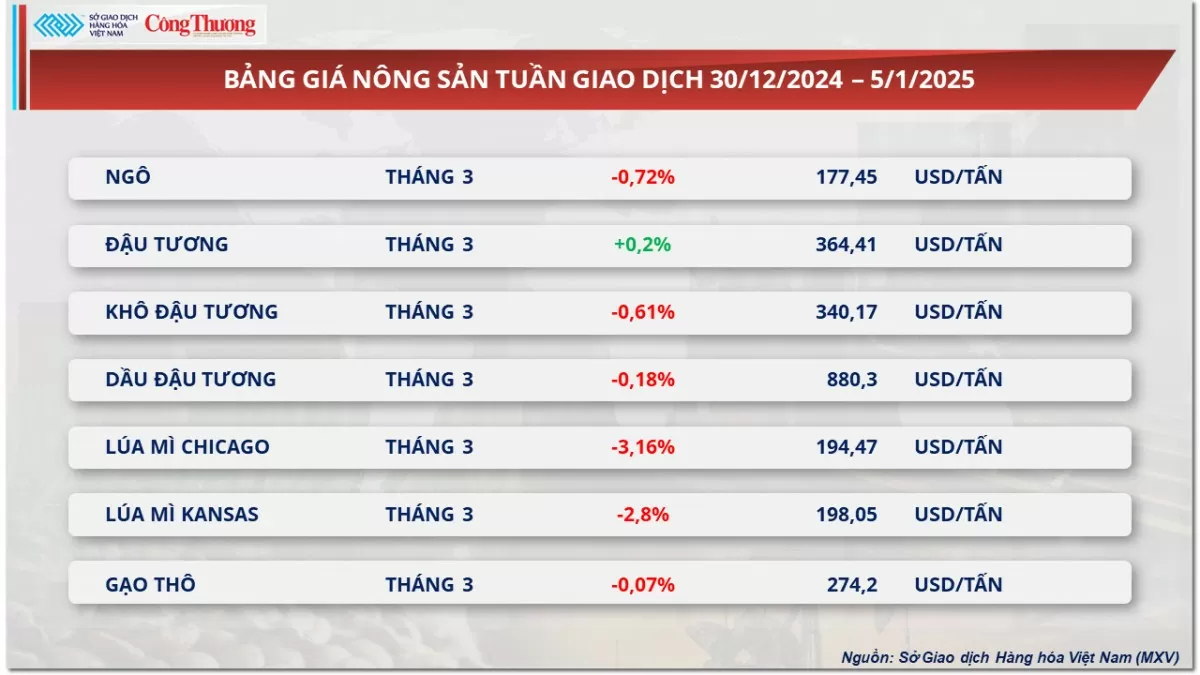

|

| Agricultural product price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-61-gia-ca-phe-bien-dong-368111.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)