Closing yesterday's trading session, cocoa prices increased sharply by nearly 7%, setting a new historical peak.

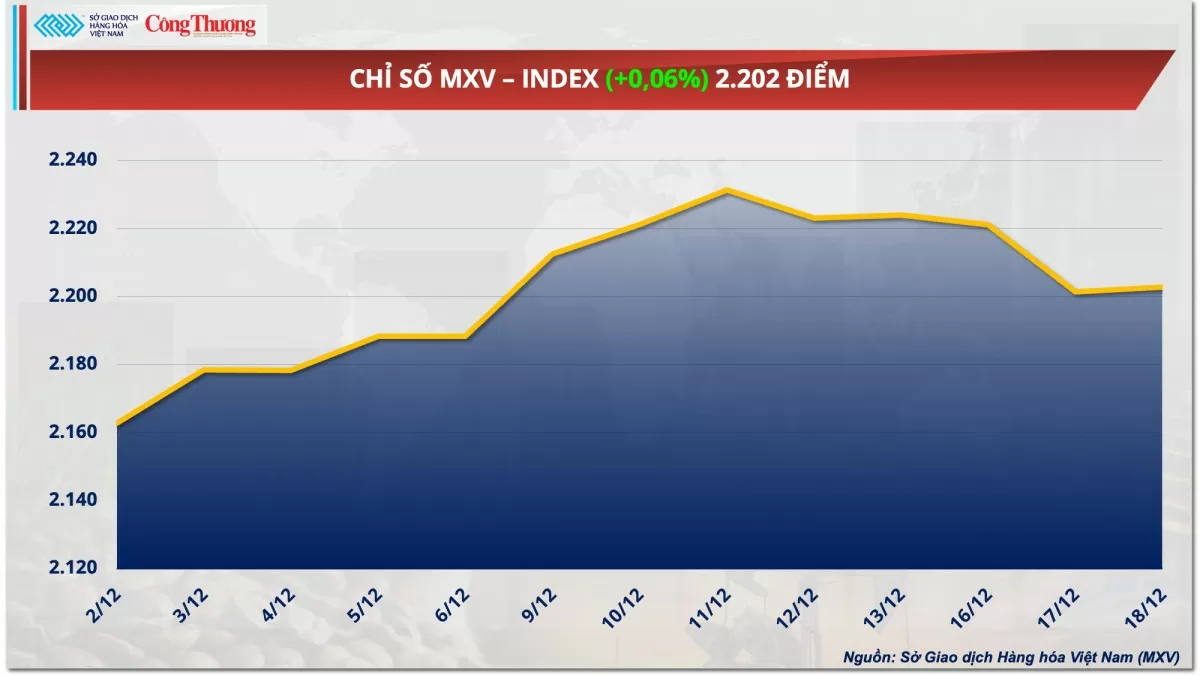

According to the Vietnam Commodity Exchange (MXV), the world raw material market was divided in yesterday's trading session (December 18). Notably, the industrial raw material group led the overall market growth, notably cocoa with prices soaring nearly 7%, setting a new historical peak. In addition, the energy group also prospered with prices of 4 out of 5 commodities increasing simultaneously. At the close, buying power dominated, pulling the MXV-Index up slightly by 0.06% to 2,202 points.

|

| MXV-Index |

Selling pressure dominates the industrial raw materials market

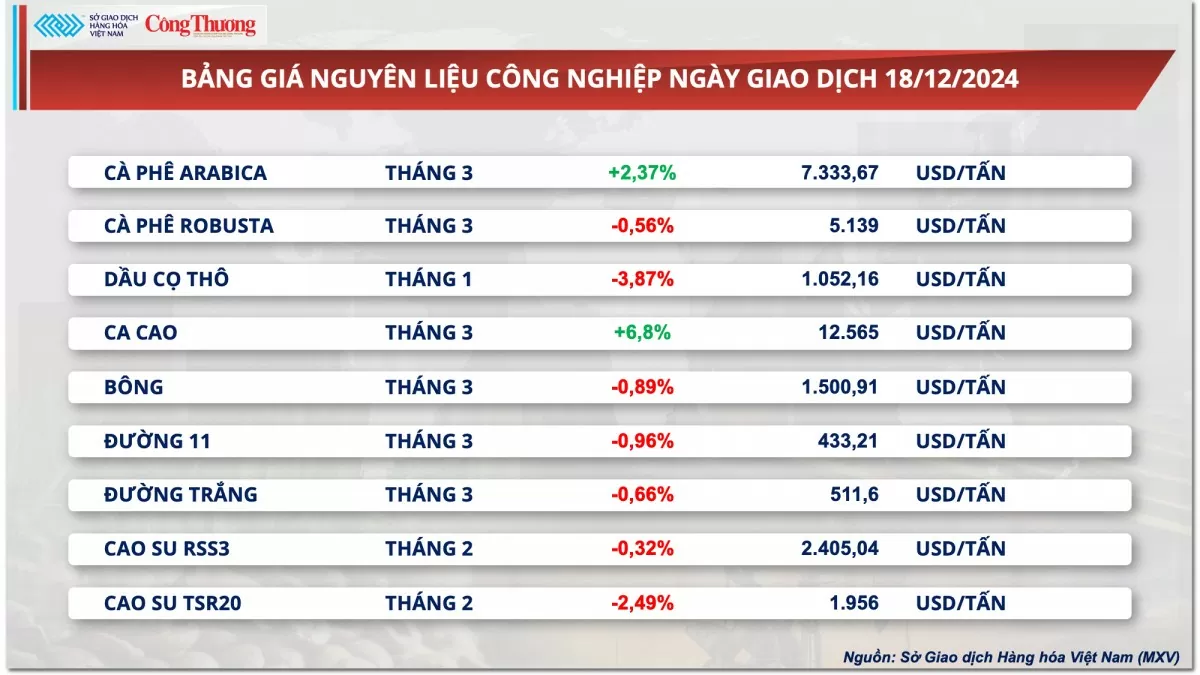

Closing yesterday's trading session, red dominated the price list of industrial raw materials. Contrary to the general trend of the group, the focus of attention was on cocoa when the price of this commodity increased sharply by nearly 7%, setting a new historical peak. The main reason for the continued high price of cocoa is that the production area, which supplies about 3/4 of the world's output, West Africa, has been facing unfavorable weather conditions and supply has become scarce. In addition, speculators increased purchases at the end of the year, making the situation even more tense.

|

| Industrial raw material price list |

In Ivory Coast, farmers in most cocoa growing regions are concerned that lack of rain and hot weather have hampered the development of the main crop (October to March). This year, the dry monsoon season started earlier than usual, starting in November, making concerns about drought reducing production more acute.

Previously, both cooperatives, buyers and purchasing agents said that most of the main harvest had been completed by November and the shortage was expected to last until February or March. Meanwhile, multinational exporters are concerned about the risk of contract defaults as they estimate that supply from farmers will not be enough to meet demand, or even decrease in the coming months due to crop failures.

In terms of export volumes, consultancy StoneX estimates that cocoa arrivals in the 2024-2025 crop year in Ivory Coast will increase by more than 30% compared to the same period last season, but will decrease by 10% to 28% compared to the same period in the previous four seasons. This, along with poor production in Ghana, the world's second-largest cocoa grower in recent seasons, has pushed inventories on the ICE-US Exchange down to more than 1.4 million bags, an all-time low.

The prices of the two coffee commodities diverged in response to the conflicting fundamental information. Specifically, the price of Arabica coffee increased by 2.37% while the price of Robusta coffee decreased by 0.56% compared to the reference price.

Concerns about a lack of rain in Brazil are driving up prices. The Somar Meteorological Agency said that Minas Gerais, Brazil’s largest Arabica-growing state, received just 35.2 mm of rain last week, 65% of the historical average. This means Brazil’s main coffee-growing region has been experiencing consistently low rainfall since April, which could hamper the development of the 2025-26 crop, leading to a poor supply outlook.

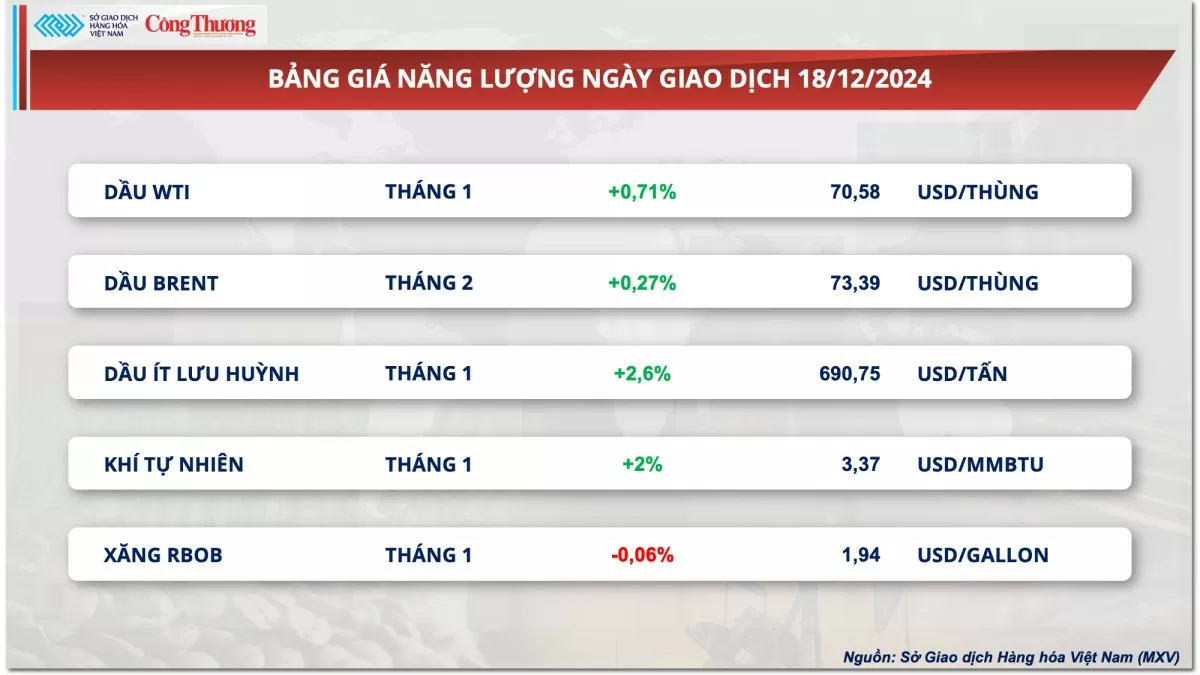

Energy markets react mixedly to the Fed's decision

Crude oil prices fluctuated yesterday, as the market reacted in mixed ways to the US Federal Reserve's interest rate adjustment decision and US crude oil inventory data.

|

| Energy price list |

WTI crude oil price increased 0.71% to 70.58 USD/barrel, while Brent crude oil price increased 0.27% to 73.39 USD/barrel.

In its weekly oil and gas report, the U.S. Energy Information Administration (EIA) said commercial crude oil inventories in the country fell by 934,000 barrels compared to the previous week to nearly 421 million barrels. The inventory decrease reported by the EIA was smaller than the 4.7 million barrel decrease announced by the American Petroleum Institute a day earlier, as well as the 1.6 million barrel decrease expected by analysts. However, this information also had a "bullish" impact on oil prices yesterday.

Kazakhstan’s delay in increasing production also contributed to supporting oil prices. Specifically, Kazakhstan said that it would comply with the quota set by OPEC+ and shelved plans to increase oil production by 190,000 barrels/day in 2025.

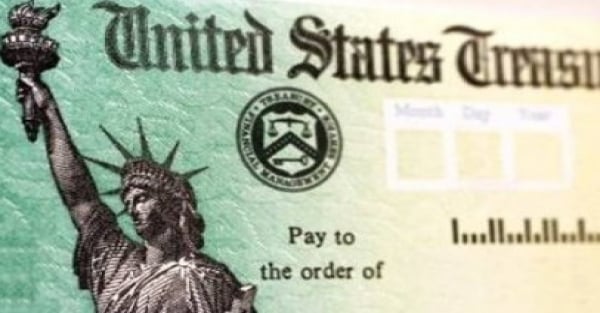

At its December policy meeting, the Fed cut interest rates by 25 basis points to a range of 4.25% to 4.5%, in line with market expectations. However, the Fed also signaled that it would slow the pace of rate cuts in 2025, after the US unemployment rate remained relatively stable and inflation did not improve much recently. Fed policymakers forecast only two 25 basis point rate cuts next year. The Fed's decision sent the US dollar soaring to its highest level since late 2022, making crude oil more expensive for international buyers and hindering price increases.

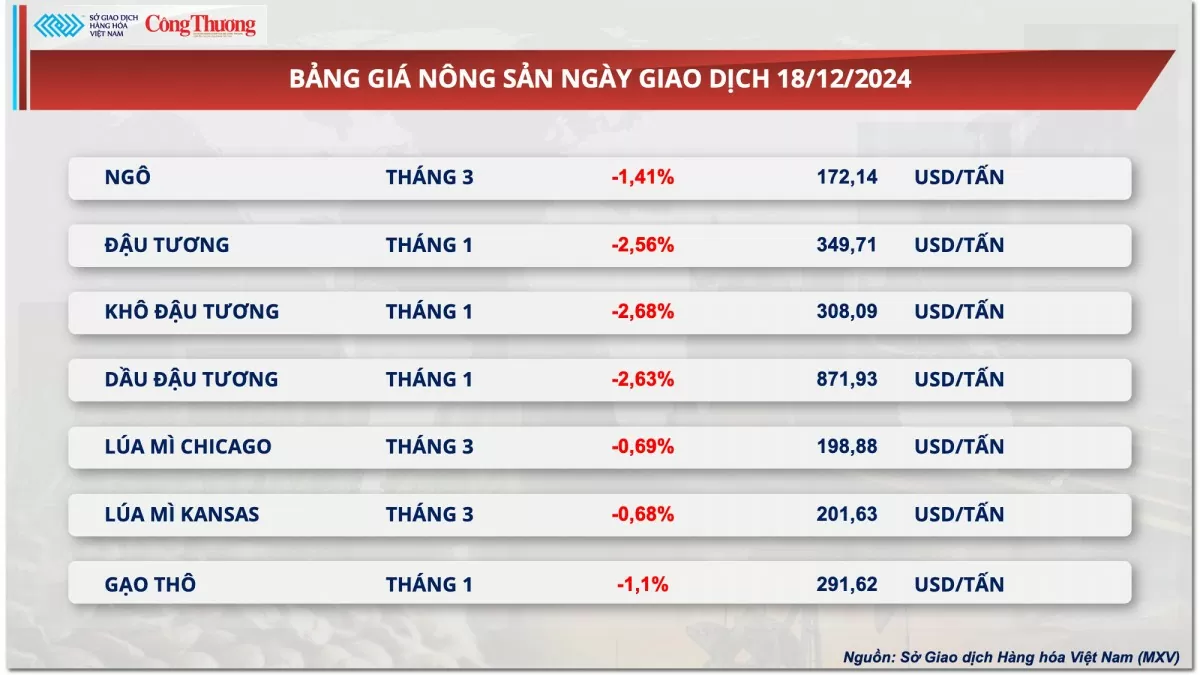

Prices of some other goods

|

| Agricultural product price list |

|

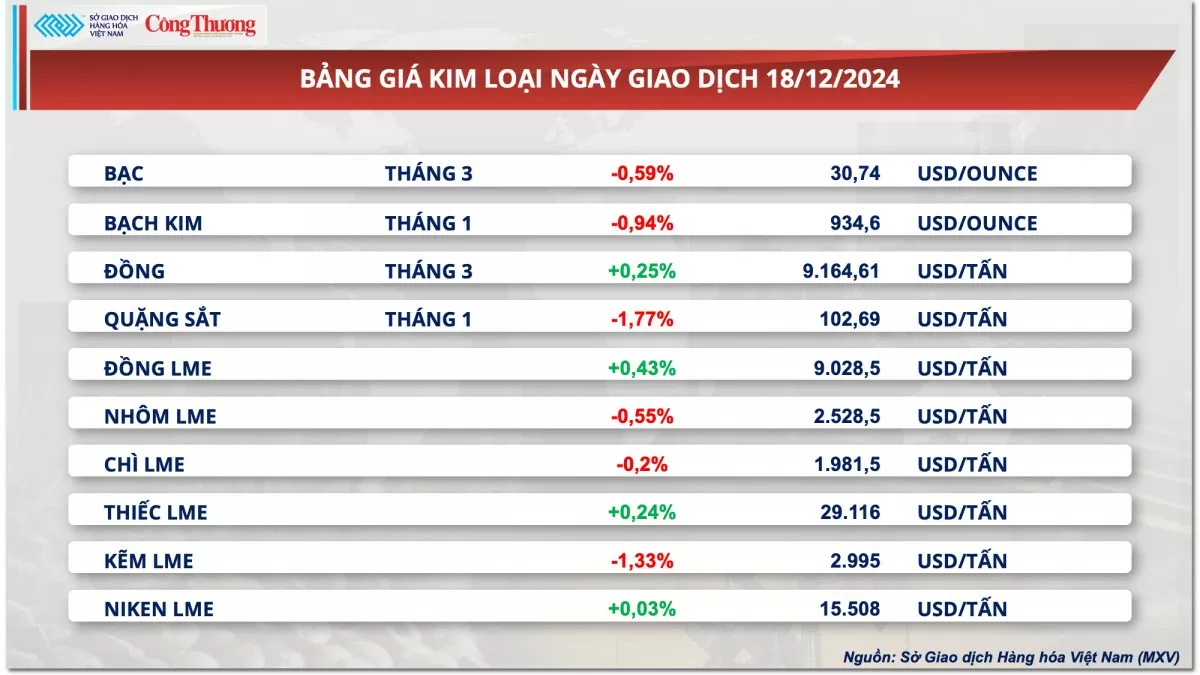

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-1912-gia-ca-cao-lap-dinh-lich-su-moi-365020.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)