Recently, SMBC Vietnam Prosperity Bank Finance Company Limited (FE Credit) has periodically announced information about its financial situation on the Hanoi Stock Exchange (HNX).

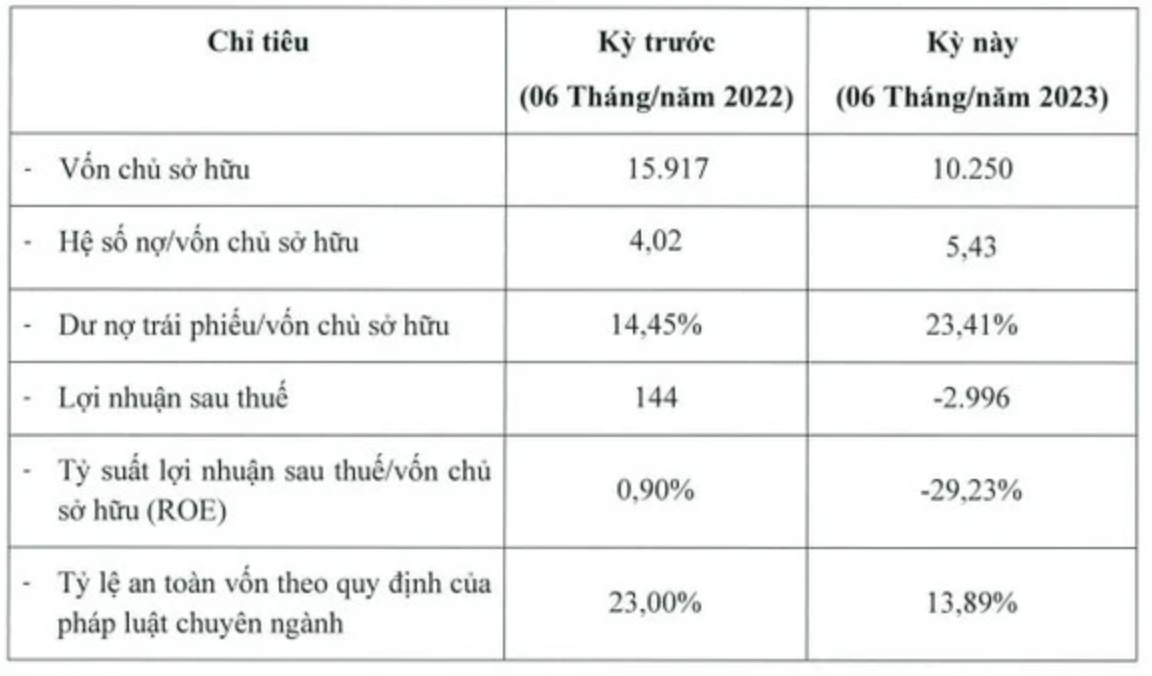

Accordingly, in the first 6 months of 2023, the company recorded a loss of VND 2,996 billion, while in the same period it made a profit of VND 144 billion. This figure exceeds the company's total loss in the whole year of 2022, which was VND 2,376 billion.

The loss dragged FE Credit's equity this period down to VND10,250 billion, from VND13,240 billion at the beginning of the year, and down 35% compared to the same period. The company's return on equity (ROE) also decreased from 0.9% to -29.23%.

The debt/equity ratio is 5.43 times; however, the company's bond debt/equity increased from 14.45% to 23.41%. Thus, by the end of the second quarter of 2023, FE Credit's bond debt and payable debt increased sharply, reaching VND 2,400 billion and VND 55,658 billion, respectively.

In addition, FE Credit's capital adequacy ratio as prescribed by specialized laws has decreased from 23% in the first 6 months of last year to 13.89%.

According to FE Credit's board of directors, the reason for the loss was due to unfavorable economic conditions that continued to negatively affect the low-income group, which is FE Credit's main customer base.

FE Credit's financial information for the first half of 2023 (unit: billion VND) (Source: HNX).

FE Credit, formerly the consumer credit division of Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HoSE: VPB), is currently the leading consumer finance company in Vietnam with a dominant market share.

This company used to be the "golden goose" of VPBank, contributing 40-50% of the parent bank's profits for many years. During its heyday, FE Credit reported a profit of more than VND3,700 billion.

According to the VNDirect Securities analysis team, FE Credit's 2022 business results are below expectations due to a jump in bad debt. FE Credit switched from pre-tax profit of VND610 billion in 2021 to a loss of VND3,000 billion in 2022.

VNDirect estimates that FE Credit's outstanding loans decreased by 2.7% year-on-year or increased by 3.4% when calculating the VND4,570 billion loan that FE Credit sold to its parent bank.

Total operating income increased slightly by 1.5% YoY to VND16,700 billion. However, operating expenses and provisions increased significantly by 28% and 23%, respectively, causing FE Credit to shift from a pre-tax profit of VND610 billion in 2021 to a loss of VND3,000 billion in 2022. The bad debt ratio jumped from 13.6% at the end of 2021 to 20.4% at the end of 2022.

VPBank's Board of Directors also stated that 2023 will continue to be a difficult year for FECredit, especially in the first 6 months of the year. The bank expects FE Credit's operations to gradually stabilize and become profitable in the third and fourth quarters of 2023. The overall loan growth rate will slow down, but focusing on customers will be less risky .

Source

![[Photo] Brazilian President visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/723eb19195014084bcdfa365be166928)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

Comment (0)