FLC Group Joint Stock Company (stock code: FLC) has just sent an unusual announcement to the Hanoi Stock Exchange (HNX) about the delay in paying principal and interest of the bond lot coded FLCH2123003.

Specifically, this batch of FLC bonds was issued on December 28, 2021 and matured on December 28, 2023. The total issuance value is VND 1,150 billion, equivalent to a volume of 115,000 bonds with a face value of VND 10 million.

As of the maturity date (December 28, 2023), FLC has not yet been able to pay off the outstanding debt for this bond lot. After 2 years of mobilization, the company still has 996.86 billion VND of unpaid bond principal, and the estimated late payment interest debt is up to 113.51 billion VND. The total outstanding principal and estimated interest is 1,110.37 billion VND.

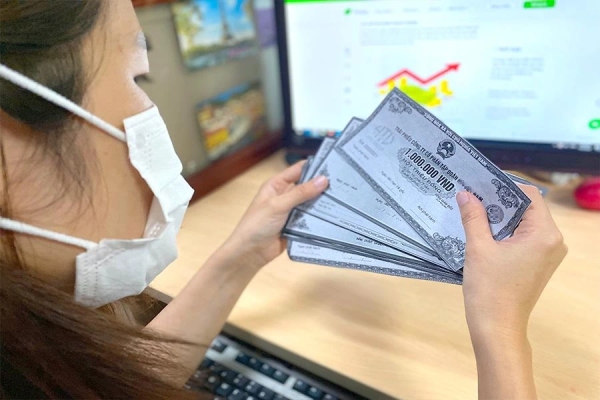

FLC's negotiation to extend payment of overdue bonds with bondholders failed (Illustration: Manh Quan).

FLC said it is in the process of negotiating an extension. If approved by the Bondholders' Conference, the group expects to repay the debt of this bond before December 28, 2025.

Previously, on December 22, 2023, FLC announced the results of consulting bondholders on 4 options for extending this bond code, but none of them were approved.

Specifically, option 1 proposed by FLC is to continue implementing the FLC Hai Ninh 2 resort villa project, using revenue from exploitation and business to repay bond debt. All proceeds from exploitation and real estate business of this project will be transferred to FLC's blocked account to prioritize payment to bondholders.

FLC proposed to extend the bond term by 2 years. The interest rate applied is 13%/year (previously the highest was 11.5%) and all late payment penalties are waived for the principal and interest that have reached maturity. Interest is paid periodically on June 28 and December 28 at 10% of the interest of the payment period, the remaining amount is paid at the end of the period.

Option 2 is that FLC seeks investors to transfer the FLC Hai Ninh 2 project, using all the money transferred to the blocked account, prioritizing disbursement to pay bonds. The time to implement the project transfer plan and the payment time to bondholders depends on the time to find investors to receive the transfer. Conditions on term, interest rate, etc. are similar to option 1.

Option 3 is when the real estate of the FLC Hai Ninh 2 project is eligible to sign a sales contract, FLC will use it to offset the bond payment obligation, giving priority to discount for bondholders compared to regular customers. The bond terms are similar to the above.

Option 4 is in case the above options are not approved by bondholders, FLC will propose another option within 90 days from the date of synthesizing written opinions.

Source

Comment (0)