Apartments continue to lead the market

According to experts, apartments, mainly luxury apartments, will continue to lead the market. New apartment supply will be contributed from the suburbs of Hanoi and Ho Chi Minh City.

Specifically, the Hanoi apartment market has witnessed price increases for 22 consecutive quarters, especially "hot" from the end of 2023 to the end of the third quarter of this year.

Savills' Q3/2024 market report shows that apartment prices in Hanoi continue to increase sharply. Primary prices reached VND69 million/m2, up 6% quarter-on-quarter and 28% year-on-year. This price has exceeded the average price in Ho Chi Minh City.

Cushman & Wakefield predicts that primary apartment prices will continue to rise due to scarce supply. This price increase is also driven by mid-range and high-end supply accounting for 98% of new supply, while affordable apartment supply remains in short supply.

Mr. Le Dinh Chung, General Director of SGO Homes Real Estate Investment and Development Joint Stock Company, predicts that apartment prices will continue to increase, because in the short term, the supply of apartments will not have any major changes.

“ The price of apartments in Hanoi is currently fluctuating between 50 and 100 million VND/m2, apartments priced below 30 million VND/m2 are almost non-existent. This price increase trend will continue in the last months of the year ,” said Mr. Chung.

Most experts believe that apartment prices will hardly decrease in the near future, so this is still a segment that attracts investors' cash flow.

Which real estate segment will attract cash flow at the end of the year? (Photo: Minh Duc).

Land in the suburbs of Hanoi will increase in temperature

The last months of 2024 are also the time when the land segment in the suburbs of Hanoi "heats up". Typically, in some communes in the districts of Dan Phuong, Hoai Duc, Me Linh, Dong Anh ..., the selling price of many plots of land is at 120-160 million VND/m2, an increase of 20-30% compared to the selling price at the beginning of the year. The reason why land prices return to the "throne" is due to the infrastructure and large real estate projects being built and about to be completed in these districts.

According to Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam: “ Land is always the focus of investment when the real estate market is bustling, especially in areas with potential for economic development and convenient traffic infrastructure.

However, in the past 2 years, this segment has gone through a period of stagnation when transactions and interest cooled down. Entering 2024, this segment has improved. Recently, due to the influence of the heat of land auctions in the suburbs of Hanoi, the attractiveness of land has gradually returned .

The specific selling prices of some villa and townhouse projects in Hanoi, recently compiled by the Ministry of Construction, also show a tendency to continue to increase compared to the previous quarter. Most of the newly opened projects in the third quarter of 2024 are in favorable locations, located in areas with strong investment in infrastructure, so the asking prices are relatively high.

Some projects in areas such as Dong Anh and Long Bien (Hanoi) have higher secondary price increases (about 5%) thanks to infrastructure development and products of new projects that are gradually being completed.

Not only land in districts in Hanoi, land in many neighboring provinces is gradually warming up. Mr. Le Dinh Chung, General Director of SGO Homes Real Estate Investment and Development Joint Stock Company analyzed that when Hanoi real estate prices increase, investment demand will not increase sharply in the near future. Currently, customers with 5-10 billion VND in hand have almost no opportunity to invest in the Hanoi market.

According to his observation, from May onwards, the cash flow trend is to "flow" into the suburban provinces of Hanoi such as: Bac Ninh, Bac Giang, Hung Yen, Hai Duong... Regarding the provincial market, Mr. Chung believes that land will recover because this is still the common taste of investors.

" The shift of investment to suburban areas in the second half of 2024 is an inevitable trend due to factors such as prices, legal regulations and infrastructure development. Suburban areas have the potential for more sustainable development thanks to synchronous planning and infrastructure development. This not only helps increase real estate value but also improves the quality of life of residents ," Mr. Chung shared.

Industrial real estate is a bright spot

According to Dat Xanh Real Estate Research Institute, in the third quarter of 2024, the industrial real estate market recorded many positive signals. In the North, the occupancy rate of industrial parks reached 83%, while in the South this figure was 92%. Notably, the trend of mergers and acquisitions (M&A) and shifting capital flows from residential real estate to industrial real estate increased sharply. Some prominent projects to acquire factories and industrial infrastructure with investment capital of hundreds of millions of USD have appeared.

It is expected that in the last quarter of the year, the industrial real estate market in the key economic regions of the North and South will remain a bright spot attracting investment.

Sharing the same view, Mr. Le Dinh Chung also said that the Vietnamese real estate market is gradually recovering, but each segment still faces its own challenges. The industrial real estate segment continues to maintain its heat with a strong number of new projects being implemented, along with increasingly abundant FDI capital flows.

The occupancy rate of industrial parks in operation has continued to increase steadily, reaching about 75%. Of which, the key northern provinces reached 82% and the key southern provinces reached 92%.

However, the occupancy rate in established industrial parks is still difficult to increase due to the "waiting" between supply and demand: Industrial park investors only invest in infrastructure when they have "closed" customers, while investors only want to invest in projects that already have infrastructure.

The big challenge of this segment also comes from the requirement to "green" industrial parks to meet the increasingly high standards of investors and to be in line with the country's sustainable development orientation.

Source

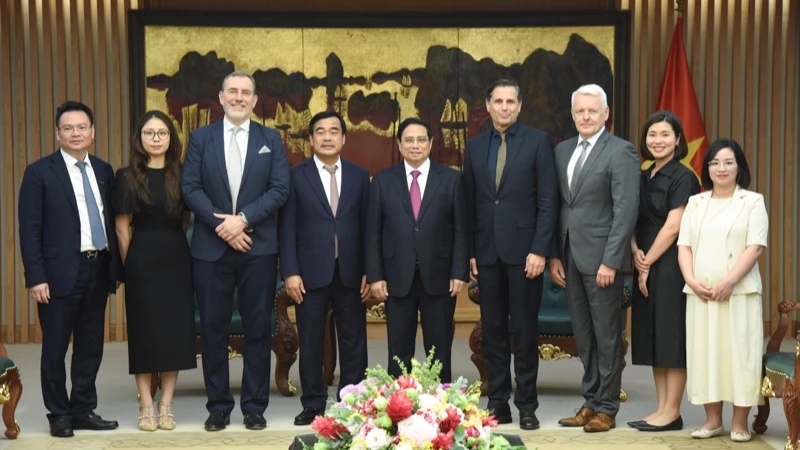

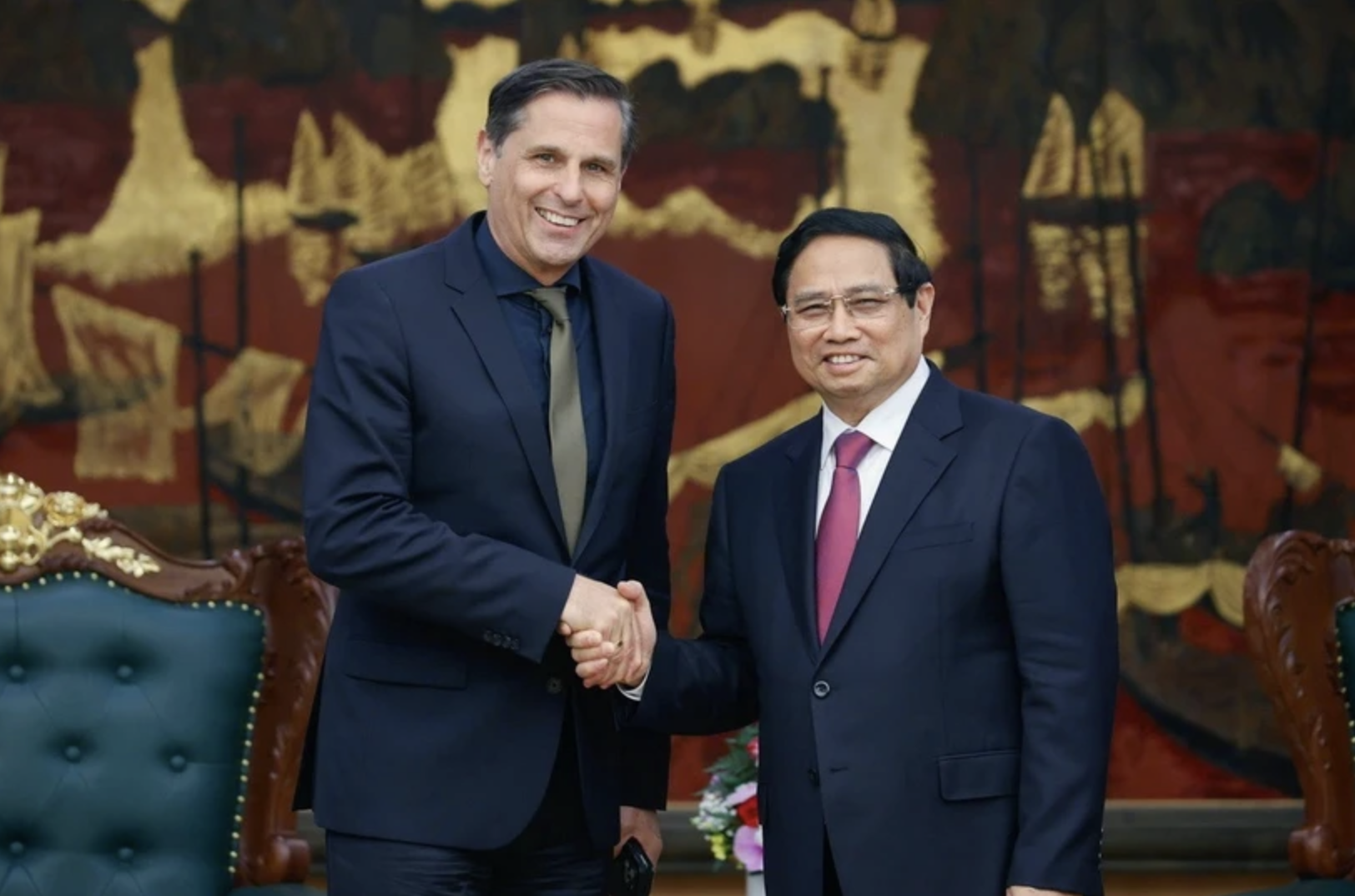

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

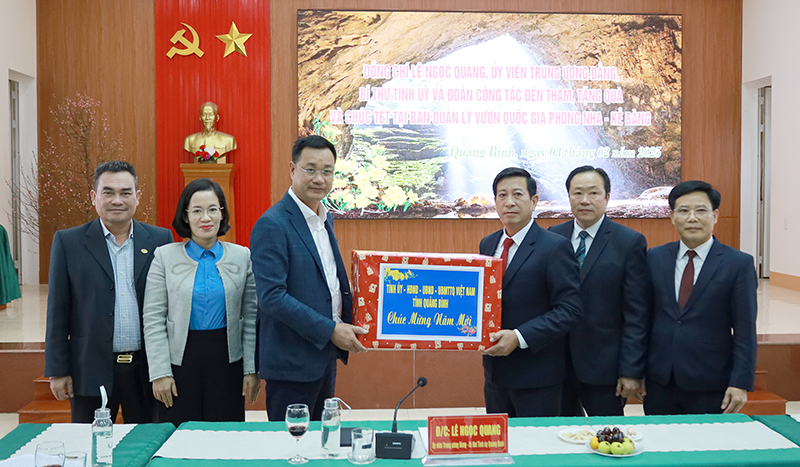

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)