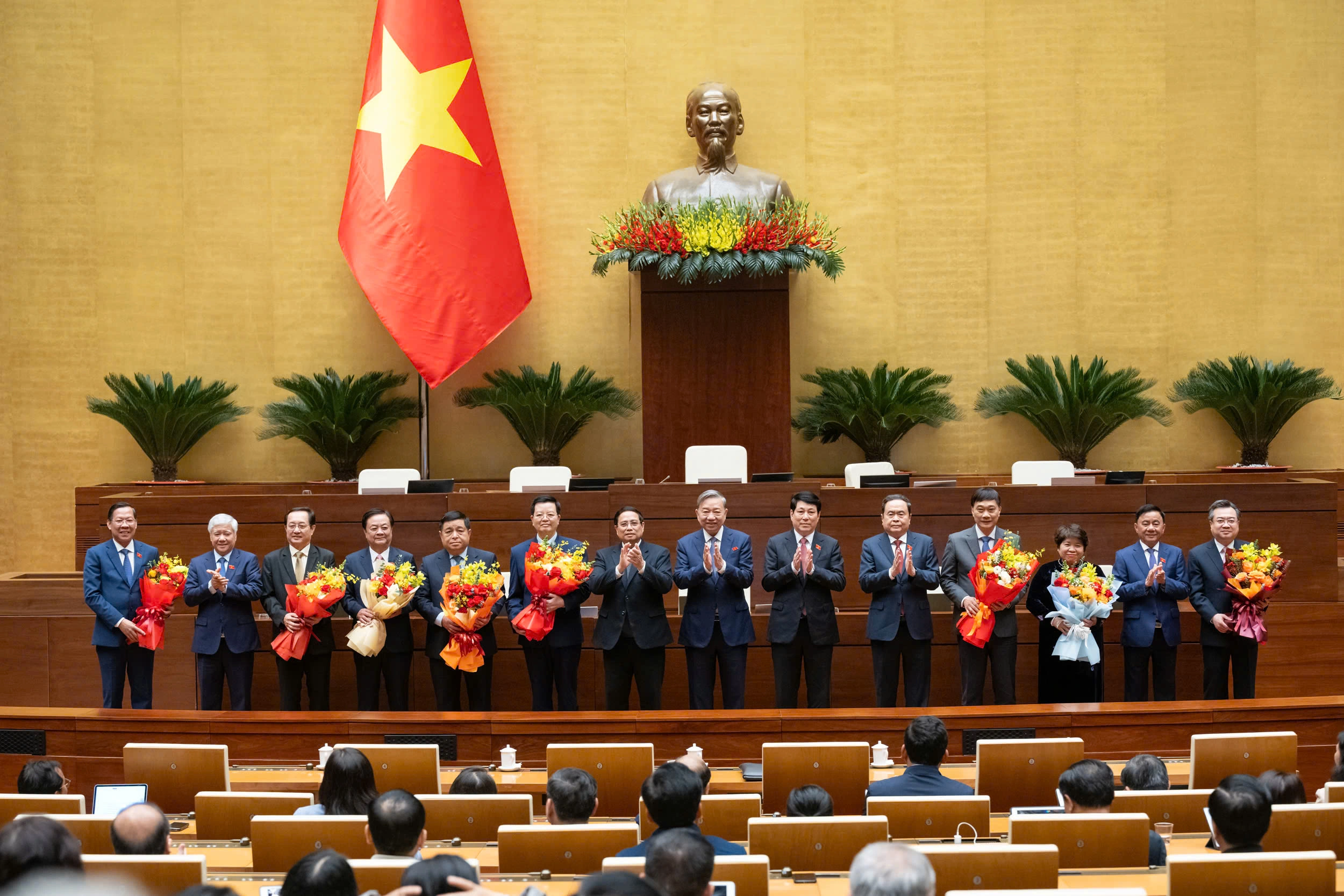

On the morning of December 20, at the Presidential Palace, the Office of the President held a press conference to announce the President's Order promulgating the laws passed by the 15th National Assembly at the 8th Session.

On the morning of December 20, at the Presidential Palace, the Office of the President held a press conference to announce the President's Order promulgating the laws passed by the 15th National Assembly at the 8th Session.

The laws promulgated include: Law on Value Added Tax; Law on amending and supplementing a number of articles of the Law on Securities, Law on Accounting, Law on Independent Auditing, Law on State Budget, Law on Management and Use of Public Assets, Law on Tax Administration, Law on Personal Income Tax, Law on National Reserves, Law on Handling of Administrative Violations; Law on Cultural Heritage; Law on Notarization; Law on Urban and Rural Planning; Law on Trade Unions; Law on Data; Law on Fire Prevention, Fire Fighting and Rescue; Law on Prevention and Combat of Human Trafficking.

Deputy Head of the Office of the President Pham Thanh Ha chaired the press conference.

Apply 5% tax rate to some activities

The Law on Value Added Tax consists of 4 chapters and 18 articles, effective from July 1, 2025.

Notably, regarding the subjects applying the 0% tax rate, the Law supplements regulations that exported goods and services are goods and services directly supplied to organizations and individuals abroad and consumed outside Vietnam or directly supplied to organizations in duty-free zones and consumed in duty-free zones to directly serve export production activities.

Digital information content products provided to foreign parties and with records and documents proving consumption outside Vietnam according to Government regulations are also subject to a 0% tax rate.

The amended law stipulates: Fertilizers, fishing vessels in coastal areas; specialized machinery and equipment serving agricultural production according to Government regulations; traditional and folk performing arts activities are subject to a tax rate of 5%.

The Law amending and supplementing a number of articles of the Securities Law, the Accounting Law, the Independent Audit Law, the State Budget Law, the Law on Management and Use of Public Assets, the Tax Administration Law, the Personal Income Tax Law, the National Reserve Law, and the Law on Handling of Administrative Violations, including 11 articles, takes effect from January 1, 2025.

Some regulations have separate effects such as regulations on: professional securities investors participating in the purchase, transaction, and transfer of individual corporate bonds and equity; independent audit (effective from January 1, 2026); amendments and supplements to the State Budget Law (effective from the 2025 budget year); individual households with business activities on digital platforms (effective from April 1, 2025).

The Law aims to fully institutionalize the policies and orientations of the Party and State; promote growth, control inflation and stabilize the macro-economy; promptly remove difficulties for production and business activities of people and enterprises; and improve the investment and business environment.

At the same time, promote decentralization and delegation of power in the development of mechanisms, policies, laws, planning, inspection and supervision; promote the simplification of administrative procedures and the development of information technology and digital transformation; eliminate the request-grant mechanism; unblock and effectively use all resources for development, taking public investment and State resources as the guide and activating all other legal resources...

Digitizing cultural heritage

The 2024 Law on Cultural Heritage consists of 9 chapters and 95 articles; it has overcome the shortcomings of the current legal system, while adding new regulations to solve problems arising in practice.

One of the important breakthroughs of the Law is to expand the provisions related to promoting the value of cultural heritage, exploiting and using heritage, promoting public-private cooperation and establishing a Cultural Heritage Conservation Fund. This creates a mechanism to attract maximum resources for activities to protect and promote the value of cultural heritage.

At the same time, the Law is also consistent with relevant legal provisions, allowing the implementation of investment projects and socio-economic works in heritage areas. This provision ensures a balance between cultural heritage conservation and socio-economic development, affirming that heritage becomes a special asset and resource in socio-economic development, sustainable tourism and cultural industry in localities.

Another important highlight is that the Law has provisions related to digital transformation, digitization of cultural heritage and promotion of cultural heritage values in the electronic environment.

The Law on Urban and Rural Planning consists of 5 chapters and 59 articles; it covers and specifies 3 basic policy contents.

That is to complete regulations on: urban and rural planning system; establishment, appraisal, approval, review, adjustment of urban and rural planning; selection of planning consultancy organizations, funding sources and other relevant regulations to improve the quality and feasibility of urban and rural planning, the right to access and provide information on urban and rural planning.

The 2024 Notary Law consists of 8 chapters and 76 articles. The Law has a number of new contents related to determining the correct scope of notarization and the authority of notaries, regulations on transactions that must be notarized; amending and supplementing a number of regulations on: notaries, notary practice organizations, notary practice, notary transaction notarization procedures, notary database, notary record storage; new regulations on state management in notarization and administrative procedures in the field of notarization.

The Trade Union Law 2024 consists of 6 chapters and 37 articles. Ensuring trade union finances is one of the notable contents of the Law.

Accordingly, the Law maintains the regulation that agencies, organizations, units, enterprises, cooperatives, and cooperative unions of all economic sectors, regardless of whether a trade union has been established or not, must pay trade union fees equal to 2% of the salary fund, which serves as the basis for compulsory social insurance for employees.

At the same time, the Law supplements regulations on considering exemption, reduction, and suspension of trade union fee payment for enterprises, cooperatives, and cooperative unions when facing difficulties; supplements and clarifies tasks of spending trade union fees; supplements regulations on distributing trade union fees to employee organizations at enterprises.

The above four laws all take effect from July 1, 2025.

Using data effectively

The 2024 Data Law has 5 chapters and 46 articles; creating unity, synchronization, and effective use of data to serve state management and socio-economic development; serving the development of digital government and reforming and reducing administrative procedures; socio-economic development and development of the National Data Center.

One of the important contents of the Data Law is the regulation on the establishment of the National General Database. Accordingly, the National General Database is established to serve the exploitation and common use, meeting the activities of the Party, State agencies, the Vietnam Fatherland Front Committee and socio-political organizations; serving the implementation of administrative procedures, public services, serving the direction and administration of the Government; serving the work of statistics, policy making, planning, socio-economic development strategies, national defense, security, foreign affairs, cryptography, crime prevention and control, handling of law violations; serving the needs of organizations and individuals in exploiting, using and applying data.

The 2024 Law on Fire Prevention, Fire Fighting and Rescue consists of 8 chapters and 55 articles. Notably, regarding fire prevention and fighting inspection, the Law stipulates that heads of establishments, household owners, vehicle owners, and investors must organize their own inspections and promptly detect loopholes and safety risks that can easily cause fires and explosions at establishments, households, and vehicles under their management.

In addition, within the scope of their duties and powers, the People's Committees at the commune level, the police, specialized construction agencies, and inspection agencies shall conduct fire prevention and fighting inspections in accordance with the provisions of law.

The Law has removed fire prevention regulations for 11 types of facilities currently regulated in the current Law on Fire Prevention and Fighting because these facilities already have specialized regulations and standards guiding regulations on fire prevention and fighting safety.

At the same time, the Law has removed regulations on forest fire prevention; fire prevention and fighting inspection; temporary suspension and suspension of operations of establishments, motor vehicles, households and individuals that do not ensure fire prevention and fighting safety to ensure consistency and consistency with the provisions of the Forestry Law, the Inspection Law, and the Law on Handling of Administrative Violations.

Similarly, the Law on Prevention and Combat of Human Trafficking 2024 consists of 8 chapters and 63 articles. The law is designed to improve the law on prevention and combat of human trafficking, create a unified and comprehensive awareness of the work of prevention and combat of human trafficking in the coming time; and enhance the responsibility of individuals, families, agencies, organizations and the whole society in the work of prevention and combat of human trafficking.

At the same time, perfect the legal basis for supporting and protecting the legitimate rights and interests of victims and those in the process of being identified as victims in accordance with the current and future socio-economic situation, contributing to stabilizing the security, order and social safety situation; improving the effectiveness of state management in preventing and combating human trafficking.

The above three laws all take effect from July 1, 2025./.

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

Comment (0)