A series of 7 consecutive sessions without decrease brought the stock price of Hoa Sen Group Joint Stock Company (Code: HSG) from 21,500 VND to 24,000 VND, establishing the peak since April 2022 until now.

Shares of Hoa Sen Group Joint Stock Company (stock code: HSG) closed the first trading session this week at VND24,000, up 2.13% compared to the reference price and extending the streak of 7 consecutive sessions without decreasing. This is the highest price range of this stock in the past 26 months, since April 2022.

Compared to the price range at the beginning of the year, HSG's market price has increased by 10%. With nearly 616 million listed shares, the market capitalization of this enterprise has also increased to 14,783 billion VND.

Not only did HSG's market price fluctuate strongly, its liquidity also improved significantly in the first session of the week. This code recorded more than 17.4 million shares successfully transferred, equivalent to a transaction value of VND413 billion, nearly double that of the last session of the week.

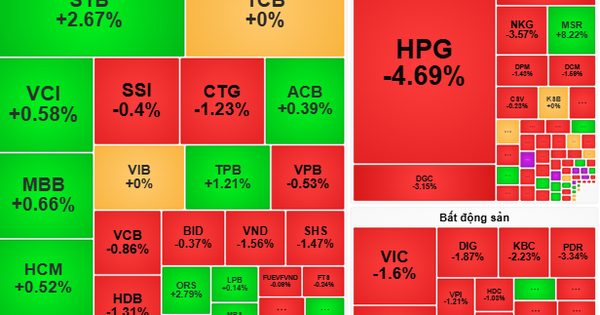

HSG's increase was consistent with the performance of many other steel stocks. Typically, NKG also increased by more than 3% in the session on June 10 to reach VND26,500, while TLH increased by 1.1% to VND8,000. Meanwhile, the leading stock in the industry, HPG, reversed from decreasing to increasing before narrowing the range and closing at the reference price of VND29,300.

|

| HSG price and liquidity chart from 2022 to present. |

In an analysis report a month ago, BSC Securities Company maintained its recommendation to buy HSG with a fair value of VND28,350 for the end of this year and early next year. According to this analysis group, the current period is a relatively reasonable time to buy HSG shares because the worst period of the steel industry has passed and the company owns a good inventory management strategy as well as the leading market share in galvanized steel.

According to a new analysis report published a week ago, a group of experts from KB Securities Vietnam Company recommended investors buy HSG shares with a target price of VND27,400, corresponding to an expected profit margin of 23% compared to the closing price on June 3.

According to KB Vietnam, HSG will benefit the most in the event that anti-dumping measures on galvanized steel imported from China and South Korea are applied thanks to its No. 1 and No. 2 market shares in galvanized steel (28.4%) and steel pipes (12.4%). In addition, domestic consumption is showing signs of recovery as galvanized steel and steel pipes increased by 29% and 28% respectively compared to the previous month. Domestic consumption is expected to recover strongly in the second half of this year thanks to the gradual recovery of the civil real estate sector, followed by newly implemented projects that will stimulate domestic steel demand.

Regarding business activities, in the second quarter of the 2023-2024 fiscal year (from January 1, 2024 to March 31, 2024), Hoa Sen recorded revenue of VND 9,248 billion and after-tax profit of nearly VND 319 billion, up 32.5% and 27.3% respectively over the same period. In the first 6 months of the fiscal year, the company recorded revenue of more than VND 18,321 billion, up 23%. After-tax profit had a big change when the same period last year's loss of VND 424 billion turned into a profit of VND 422 billion.

In the 2023-2024 fiscal year, Hoa Sen plans to do business with two scenarios. Specifically, scenario 1 targets a sales output of 1,625 thousand tons, up 13.3% over the same period. Revenue is expected to be 34,000 billion VND, up 7.4% over the same period, and after-tax profit is expected to be 400 billion VND, up more than 12 times over the previous fiscal year.

Scenario 2 targets an estimated total output of 1,730 thousand tons, up 20.7% year-on-year. Revenue is expected to reach VND36,000 billion, up nearly 14%, and after-tax profit is expected to reach VND500 billion, up more than 15 times compared to the previous fiscal year.

Source: https://baodautu.vn/co-phieu-cong-ty-co-phan-tap-doan-hoa-sen-lap-dinh-2-nam-d217335.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)