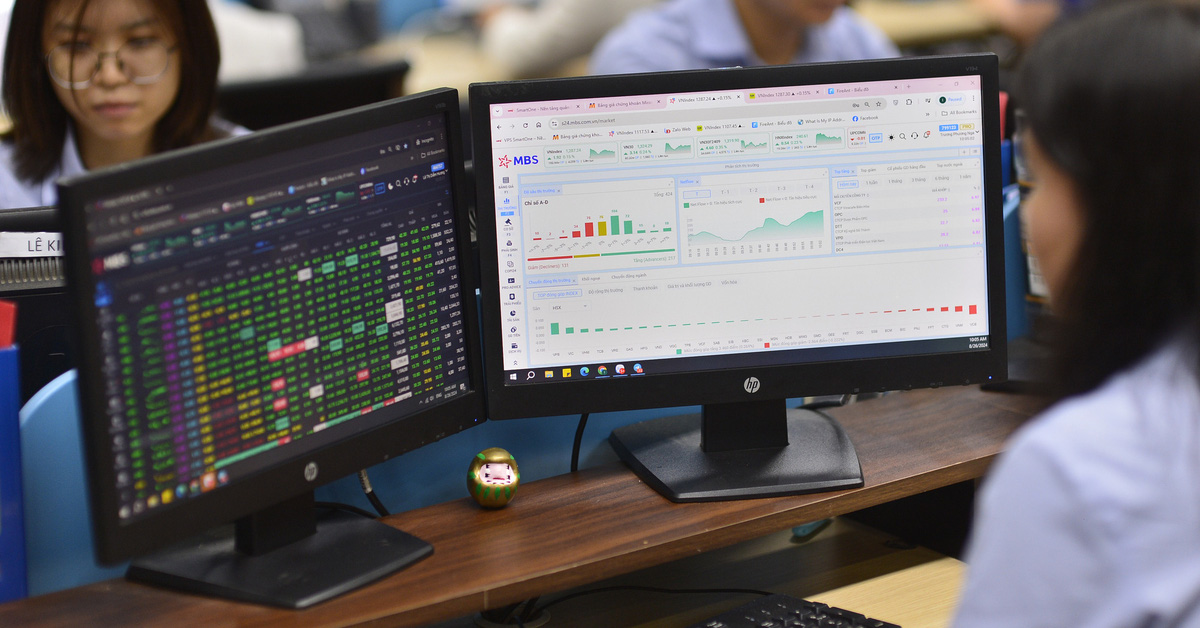

Investment Comments

Shinhan Securities (SSV) : During the trading session on March 4, there were times when the market increased by more than 10 points, but at the close, it recorded a slight increase of 3 points. This shows that the selling pressure is always present and ready to take profits when the stock price reaches a high level.

In the short term, the market is still maintaining an uptrend with increasing volume. Technical indicators such as MACD and RSI remain positive.

Vietcombank Securities (VCBS) : The main trend of the market will still be an uptrend and will gradually move towards the 1,300 point area. On the hourly chart, there is a high probability that the market will experience a short-term correction in the medium-term uptrend.

VCBS recommends that investors continue to implement the T+ swing trading strategy when the market fluctuates during the session. With the current market situation, investors should consider realizing profits during the uptrends during the session and take advantage of the market fluctuations to disburse at better prices.

Beta Securities : From a technical perspective, in terms of trend, VN-Index is maintaining a positive trend as the index lines are all above important average lines. However, the RSI indicator is still in the overbought zone, indicating that profit-taking pressure is still high, which could lead to fluctuations/corrections in the short term.

VN-Index has had 3 trading sessions testing and standing firmly above the strong resistance level of 1,250 points, which increases the possibility that VN-Index will head towards a new resistance zone at 1,280 - 1,300 points, cash flow is still tending to shift from large to medium and small capitalization segments.

In the current period, short-term risks are increasing, as the market is in a rather "hot" state, so short-term investors should be cautious and limit transactions as well as chasing purchases. With a medium and long-term vision, investors should wait for the market to enter a short-term correction to consider disbursing to increase buying positions for stocks with strong growth potential.

Stock news

- Japanese stocks continue to hit new highs after breaking a 34-year record, surpassing the 40,000 mark. Japan's Nikkei Stock Average (Nikkei 225) surpassed the 40,000 mark on Monday - marking a new milestone after first breaking a 34-year record in February.

- US public debt increases by 1,000 billion USD every 100 days, the global "debt bomb" +1.60 is unprecedented. Data from the US Treasury Department shows that the country's public debt officially surpassed the 34,000 billion USD mark on January 4, after briefly reaching this mark on December 29 last year.

Previously, the world's largest economy's huge public debt exceeded 33,000 billion USD on September 15, 2023, and exceeded 32,000 billion USD on June 15, 2023. Thus, it can be seen that the growth rate of US public debt is getting faster. Before reaching the 32,000 billion USD mark, this debt took 8 months to increase by a thousand billion USD from the 31,000 billion USD mark .

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)