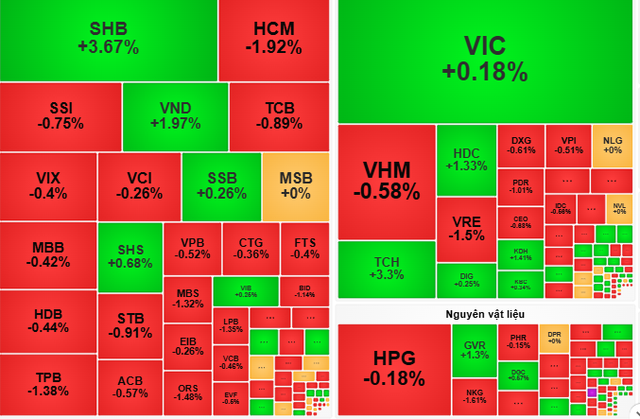

At the end of the session on March 27, the VN-Index decreased by 2.2 points (-0.17%), closing at 1,323.8 points.

Vietnamese stocks recovered when entering the trading session on March 27. However, the recovery was quite modest and the market quickly retreated when approaching the 1,330 point area.

The main trend was fluctuating around the reference level during the session. The pressure to retreat increased in the afternoon session but the number of points decreased only at a low level.

Although red dominated the market, there were still some bright spots when the leading stock group, FPT, along with food and insurance groups, increased in price, helping to limit the decline of the general index.

At the end of the session, the VN-Index decreased by 2.2 points (-0.17%), closing at 1,323.8 points. Liquidity decreased with 564.3 million shares matched on the HOSE floor.

Dragon Capital Securities Company (VDSC) said liquidity weakened significantly compared to the previous session, showing that cash flow is still cautious and stock supply is gradually decreasing, especially selling pressure from foreign investors has decreased significantly.

"It is possible that in the next session (March 28), the market will fall into a state of overselling stocks. Therefore, investors should observe cash flow developments to assess the possibility of stock price recovery" - VDSC forecasts and recommends

VCBS Securities Company advises investors to eliminate stocks under strong selling pressure. Because cash flow is clearly diverging among some individual stocks. Investors can follow the cash flow and consider disbursing and surfing these stocks.

Source: https://nld.com.vn/chung-khoan-ngay-mai-28-3-nha-dau-tu-co-the-di-theo-xu-huong-dong-tien-196250327172605755.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)