Advances in artificial intelligence (AI) are fueling a data center investment frenzy in Asia, leading to record-breaking lending.

|

| The surge in demand for data center capacity is attracting the attention of a growing number of investors across the Asia-Pacific. (Source: Vietnamnet) |

Asia is becoming a hot spot for data centers, with demand expected to grow about 32% annually through 2028, far outpacing the 18% growth expected in the US, according to data from real estate services firm Cushman and Wakefield.

The surge in demand for data center capacity has attracted the interest of a growing number of investors across the Asia-Pacific, said Yemi Tepe, a lawyer at Morrison Foerster Law Firm.

Among the financing, Bridge Data Centers - a company owned by Bain Capital - received a $2.8 billion loan for its operations in Malaysia.

Meanwhile, DayOne (formerly GDS International) raised $3.4 billion in debt on the market.

Several other potential deals in Asia-Pacific are also in the pipeline.

A Singapore-based subsidiary of Australia's Firmus Technologies is seeking a $120 million private loan.

India's Yotta Data Services Pvt. is also in talks with private equity funds to raise about $500 million for its data center campuses.

Amid escalating tensions between the US and China, multinational technology corporations are diversifying their investments outside of China, redirecting hundreds of billions of dollars of investment into cities in Southeast Asia, helping to reshape local economies in these countries.

The Malaysian state of Johor, which borders Singapore, is the main beneficiary of this investment flow, with about 30 data center projects completed or under construction and another 20 awaiting approval.

Thailand also approved investment applications worth $5.9 billion last week, including three projects focused on the sector.

However, the data center industry is facing uncertainty as the US prepares to impose more tariffs and raises the risk of a wider trade war.

Potential targets include countries that supply the data center industry — mostly in Asia — as well as some of the key components the industry relies on, such as semiconductors. Projects could also be delayed if supply chains are disrupted.

Geopolitical risks could lead to higher financing costs, reduced investor confidence and increased credit risks for financiers, Tepe said.

As a result, investors may demand higher risk premiums or opt to divest from projects involving Chinese entities, potentially slowing the growth of the Southeast Asian data center market.

Source: https://baoquocte.vn/chau-a-dang-tro-thanh-mot-diem-nong-ve-trung-tam-du-lieu-308688.html

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

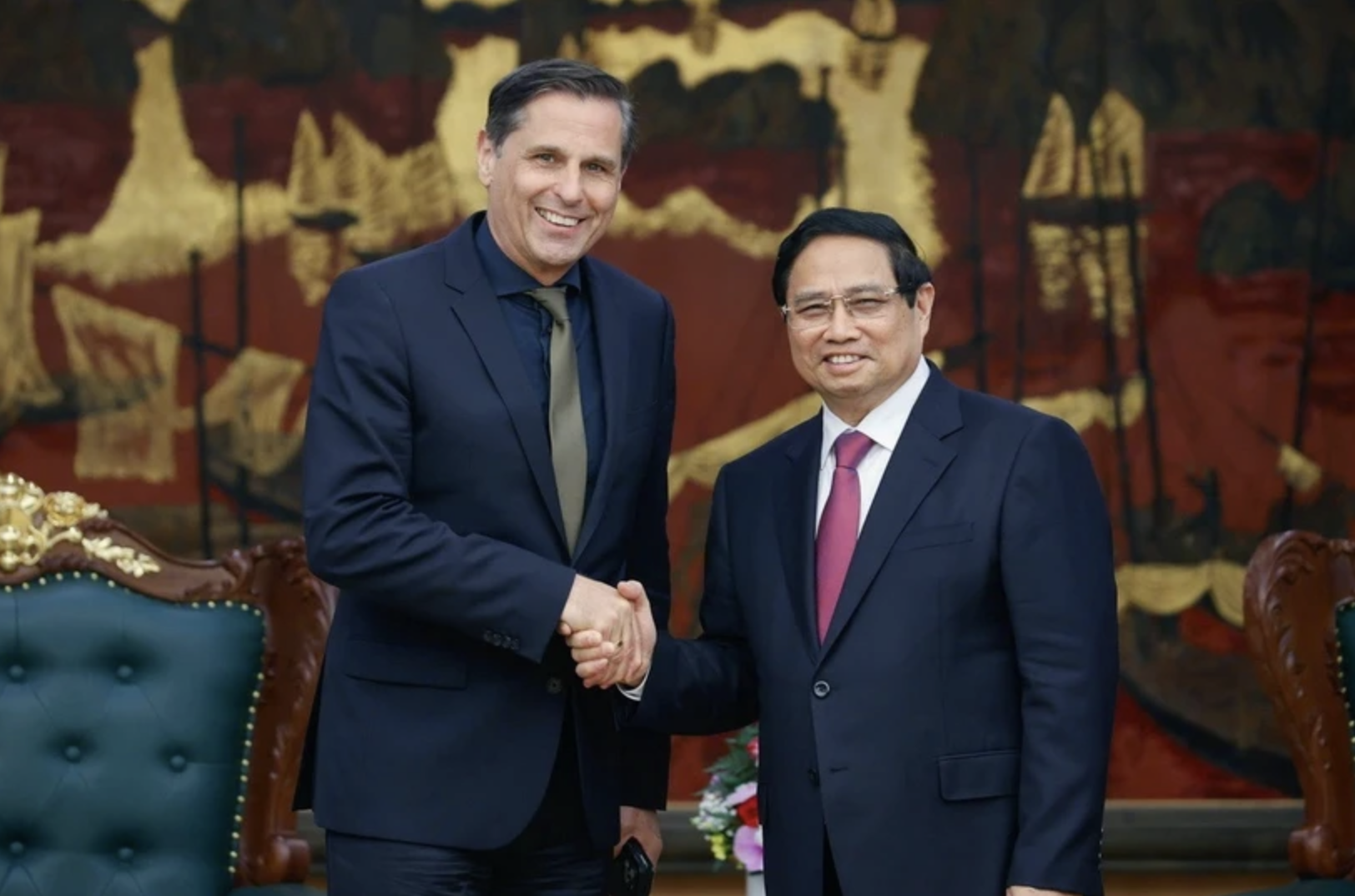

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)