After more than a year of banning the export of non-basmati white rice, India officially lifted the ban. Immediately, Thai rice prices plummeted to their lowest point of the year, while Vietnamese goods prices remained at the top of the world.

July 2023, India ban on exports of non-basmati white rice. A month later, the country imposed a 20% tariff on parboiled rice exports.

Ban white rice export and the imposition of tariffs on Indian parboiled rice have had a strong impact on the global rice market, pushing this commodity into the second price fever in history. The prices of Vietnamese and Thai rice have simultaneously increased sharply and set new records.

By the end of 2023, Vietnam's rice exports set a historic record, earning nearly 4.68 billion USD. The price of 5% Vietnamese rice exports peaked at 663 USD/ton - the most expensive among the world's largest rice exporting countries.

However, after more than a year, the Directorate General of Foreign Trade - Ministry of Commerce and Industry of India signed a decision to lift the ban on exporting non-basmati white rice from September 28. The condition is that the floor export price of this item is 490 USD/ton.

For many years, India has been the world’s number one rice exporter, accounting for 40% of the global market share. Therefore, experts say that India’s “opening of warehouses” to sell goods will affect the global rice trade, including major exporting countries such as Thailand, Vietnam, Pakistan, etc.

In fact, India’s move to lift the ban was rumored earlier. Rice prices in the world market have also gradually cooled down.

According to data from the Vietnam Food Association (VFA), in the trading session on September 27 (before India lifted the export ban), the export price of 5% broken rice from Vietnam was at 562 USD/ton, the same type from Thailand was at 567 USD/ton, and Pakistani rice was priced at 532 USD/ton.

As of October 1, Thai rice price Lan rice fell sharply to 540 USD/ton - the lowest level in the past 14 months; Pakistani rice also fell to 517 USD/ton. Meanwhile, Vietnamese rice fell slightly to 557 USD/ton. At the current price, Vietnamese rice is still the most expensive among the top major exporting countries in the world.

Mr. Do Ha Nam - Vice President of VFA said that for many months now, the association has been considering that India could lift the ban on rice exports at any time. According to VFA's assessment, Indian rice is mainly low-grade, sold to Africa, while many fragrant rice products of Vietnam only have Thailand as a competitor.

According to businesses, in the past 9 months, Vietnam has exported more than 7 million tons of rice. The amount of goods for export from now until the end of the year is not much, especially a very large rice area in the North has just been damaged by storms and floods. Meanwhile, the demand for imported rice from the Philippines and Indonesia... is still very large.

Therefore, in the short term, Vietnamese rice prices will not be affected too much when India "opens its warehouse" to sell again.

In the long term, we have to wait for India’s export moves. Vietnamese businesses are also monitoring the market and calculating inventory to balance with export orders that need to be paid in the last months of this year.

Mr. Nguyen Nhu Cuong - Director of the Department of Crop Production (Ministry of Agriculture and Rural Development) said that the ministry will coordinate with the Ministry of Industry and Trade to comprehensively assess the impact of India's rice export management policy. According to him, the world's rice demand remains high, and India's rice exports are concentrated in different segments than Vietnamese rice, so the impact is not significant.

He emphasized that before India issued the export ban, Vietnam produced more than 43 million tons of rice per year and exported about 7-7.5 million tons of rice, without causing surplus or affecting domestic demand. Therefore, next year, the rice planting plan will remain stable at over 7 million hectares, with an output of about 43 million tons.

The Director of the Department of Crop Production affirmed that the development perspective of the Vietnamese rice industry is not to follow the market, but to focus on improving quality and promoting the implementation of the Project of 1 million hectares of high-quality, low-emission rice associated with green growth in the Mekong Delta by 2030 to raise the level of Vietnamese rice, while serving the strategy of green growth and sustainable development.

According to statistics, Vietnam exported more than 7 million tons of rice, earning 4.37 billion USD in just 9 months of 2024. Compared to the same period last year, the volume of exported rice increased by 9.2%, while the value increased sharply by 23.5%. The average export price of Vietnamese rice in the first 9 months of this year was 624 USD/ton, up 13.1% over the same period last year.

Source

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

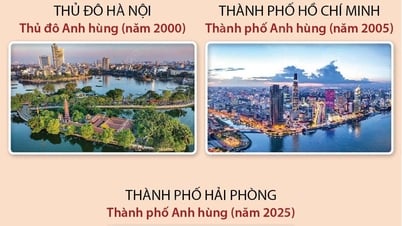

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)