According to newly announced information, Hoa Binh Construction (HBC) received a notice from ALB & Partners Law Firm LLC regarding the debt collection results from FLC Group Corporation. As of October 12, the debt collection from FLC has been completed by ALB & Partners.

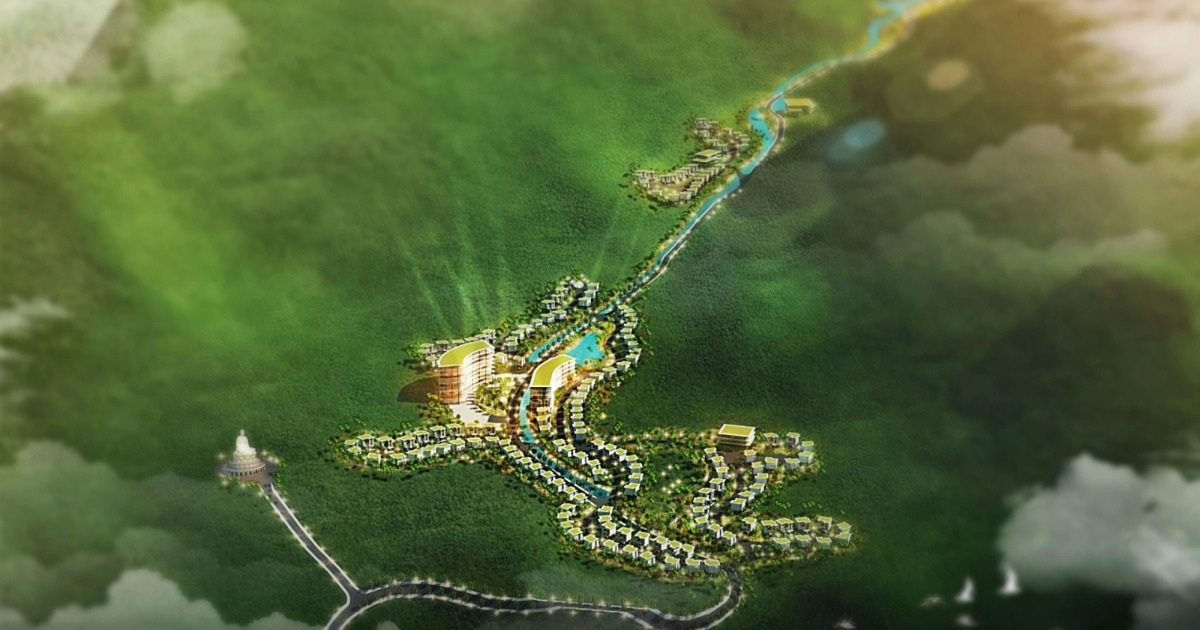

The total debt collected from FLC is over 304 billion VND. Of which, the total amount collected is over 270 billion VND. In addition, FLC transferred to HBC the real estate at the FLC Sam Son eco-tourism urban area project to offset the remaining 34 billion VND debt.

Not only collecting debt from FLC, Hoa Binh Construction also announced the results of debt collection from other partners.

Accordingly, the People's Court of Quy Nhon City, Binh Dinh Province accepted all of HBC's lawsuit requests and forced Vi Khoa Hoc Company Limited to pay HBC more than 100 billion VND.

Previously, HBC received a legally effective judgment from the Vietnam International Arbitration Center (VIAC) Ho Chi Minh City branch. In this notice, the arbitration council accepted HBC's lawsuit request, forcing Urban Development and Construction Corporation to pay HBC nearly VND162 billion within 30 days from the date of the judgment.

HBC Chairman Le Viet Hai once shared that in its business history, there has never been a debt in the financial report that needed to be submitted to the Board of Directors to be erased due to the inability to collect the debt.

After the civil war at the beginning of the year, HBC is facing difficulties. According to the semi-annual audited financial report for 2023, HBC recorded net revenue of VND 3,463 billion, gross profit of VND 187 billion, and after-tax profit loss of VND 713 billion.

Auditor Ernst & Young Vietnam (EY) noted that in addition to accumulated losses, HBC has overdue loans, some of which have been extended by banks.

For the remaining loans that are past due or about to mature, the company is in the process of negotiating with banks to request extensions. These conditions indicate the existence of a material uncertainty that may cast significant doubt about the Group's ability to continue as a going concern.

HBC has just announced the draft submission for the 2nd Extraordinary General Meeting of Shareholders in 2023, scheduled to be held on October 17.

At the meeting, Hoa Binh will present to shareholders a plan to issue a maximum of 220 million shares privately at an offering price decided by the Board of Directors but not lower than VND12,000/share. The amount of money raised, about VND2,640 billion, is expected to be used to supplement business capital and pay off debts.

Closing session on October 13, HBC shares were traded at VND 8,550/share.

Source

Comment (0)